Protect and grow your stock portfolio in as little as 10 minutes a day

VectorVest analyzes 18,000+ stocks daily and gives a simple buy, sell, or hold rating on each, enabling anyone to make consistent, reliable profits from the stock market.

For a limited time, try VectorVest for 30-days for only $9.95 Cancel anytime.

“I originally got this app as a “2nd opinion” brokerage app to determine if Robinhood’s stock ratings were viable or not.”I’ve made +27% in the past 4 months.

I have been using VestorVest for a number of years and am averaging 30% annual returns. VectorVest is instrumental in my success.

I’ve been with VectorVest +10 years and took their course that covers Spread Trading. The next 12 months I pocketed over $110,000 trading SPX only while risking only $20K at any one time.

No guesswork. No gut feelings. Buy & sell at exactly the right time with the world’s most advanced market timing signals.

You can’t predict the market, but our cutting-edge market-timing signals and proprietary VST™ ratings (Value-Safety-Timing) ratings let you capitalize on upswings and steer clear of downturns. Our educational resources ensure you never stop enhancing your trading skills and understanding of the markets.

Advanced Market Timing

Buy and sell at the right time with our advanced market-timing algorithm and real-time alerts.

Buy, Sell & Hold Signals

Clear buy, sell and hold signals that tell you exactly what stocks to buy, what to sell and when.

Daily Stock Picks

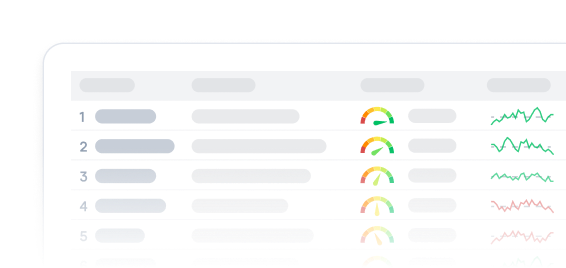

Plus explore VST™ ranked stocks in a variety of sectors with our pre-built screeners and watchlists.

Fundamental & Technical Analysis

Combines technical and fundamental analysis, distilled down to an easy-to-understand VST™ rating.

Proven Performance

We’ve outperformed the S&P500 by over 2000% for 20+ years. Verify every call we’ve made directly in our platform.

Preserve Your Wealth

Our VST™ ratings and recommended stop prices help you avoid losses and preserve your profits.

Suits All Market Conditions

Our market timing indicators help you navigate volatile market conditions, and avoid or short downturns.

All Investing Strategies

Ideal for long-term traders, those in or near retirement, as well as short-term and day traders.

New & Seasoned Investors

Ideal for novice investors, but with limitless opportunities for seasoned investors or those developing their skills.

+2,139%

+209%

We’ve consistently outperformed the S&P500, achieving a 20% average annual return for two decades

And not only the S&P500, we’ve beaten every major stock market index. Don’t just take our word for it—verify this yourself during your trial by backtesting every recommendation we’ve made.

Manage and grow your portfolio in as little as 10 minutes a day. with our proprietary VST™ ratings.

Our exclusive VST™ (Value-Safety-Timing) ratings distill hundreds of data points into clear buy, sell, or hold recommendations for every stock. This makes trading impossibly simple, ideal if you’re new to investing or learning to manage your own portfolio.

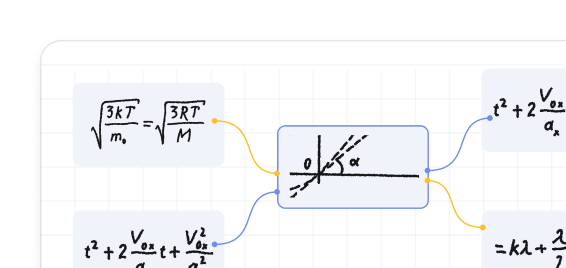

Here’s how it works:

If you’re a seasoned investor, or developing your skills:

VectorVest offers limitless opportunities for learning, growth, and portfolio management through deep data, insights, and educational resources.

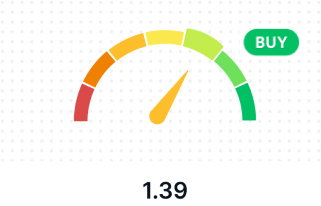

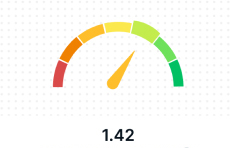

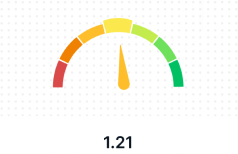

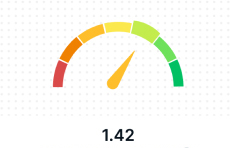

Our VST™ rating (from 0 to 2)

OVERALL

RELATIVE VALUE

RELATIVE SAFETY

RELATIVE TIMING

Excellent set of tools… I consistently beat all my professionally managed accounts. Really can’t imagine not having them part of my daily routine.

Using the VectorVest tools I made over $32,000 in less than two weeks on one trade. Subscribing to VectorVest is the smartest investment decision that I have made.

With this tool I can check any stock and make the right call most of the time. It has simplified things for me. My portfolio is going gang busters.

You can’t predict the market, but you can ride the rallies and dodge the downturns.

While it’s impossible to predict the market, VectorVest alerts you to swings so quickly you’ll feel like you’re peering into the future. The chart below shows our buy and sell signals at major market turns dating back to 2000.

Mar 20, 2000 – Sell Recommendation

NASDAQ surged 400% in 5 years but crashed 78% from its peak in Oct 2002. VectorVest advised subscribers to exit the market on Mar 20, 2020, securing gains and outperforming buy-and-hold by over 226%.

Mar 17, 2003 – Buy Recommendation

The Dotcom bubble bursting led to a several year bear market. VectorVest made a buy recommendation as momentum shifted and the market rally began.

Nov 2, 2007 – Sell Recommendation

VectorVest advised investors to move to cash on Nov 11, 2007 or to begin shorting the market. Average 19% gains by mid-summer of 2008.

Mar 9, 2009 – Buy Recommendation

VectorVest sees the shift in momentum after the mortgage meltdown and makes a Buy recommendation at the start of one of the longest bull runs in market history.

Feb 21, 2020 – Sell Recommendation

Coronavirus shutdowns erased nearly 11,000 points (roughly 37%) from the DJIA. While nobody could predict the shutdowns to occur VectorVest advised investors to tighten stops and take profits on Feb 21, 2020.

Mar 25, 2020 – Buy Recommendation

VectorVest identified upward momentum and advised investors to buy stocks long, setting subscribers up for one of the fastest market recoveries in history.

Nov 22, 2021 – Sell Recommendation

Record-high inflation and increasing interest rates triggered a stock market decline. VectorVest’s Nov 21, 2021, advice to shift to cash shielded its subscribers from the impact, and those who utilized its shorting tactics made gains of up to 93% in just six months.

I’ve more than doubled my Options account as of August 2021; over 100% gain. HIGHLY recommend VectorVest. Customer service is outstanding. Seminars and software, OUTSTANDING.

I have a strong and positive view of VectorVest. Joined after the crash of 2020. Long story short, I made enough money in June to December 2020 using VV to pay off a large mortgage.

I have had very good success with VectorVest. I’ve made 50-60% returns annually for the last 6 years with their systems. All I can say, if you follow them to a T you will succeed.