|

Traders and investors are always searching for the Perfect Indicator. You know, the Holy Grail that never loses. How do I know? Well, I am one of those people. Sorry, but it doesn’t exist. All I will say is there are technical indicators that can give you a “Trader’s Edge.” They are mostly trend-following indicators based on price action. If you don’t understand the basics of them, you may be missing an opportunity to improve your “hit rate” and make more money. Of the widely available indicators, my favorites are Moving Averages, Support and Resistance, MACD, Stochastics, and RSI. I have rule-based strategies built around each one of them. There is, however, one near-perfect indicator that I use with virtually all of my setups. I recommend it to every trader, especially those who are new to technical analysis and those who don’t have a clear, consistent, and repeatable setup that makes them money more often than not. The indicator is VectorVest’s Relative Timing or RT. VectorVest Founder Dr. Bart DiLiddo has written several Essays about it over the years, and I have written a few myself. RT is excellent on its own, but more and more I like the 40-day Moving Average of RT, especially in the volatile markets we’re seeing so far this year. It’s an essential part of the Midas Touch Graph layout, but let me explain how you can use it to gain an edge and get into trades precisely when the upside momentum is increasing. |

|

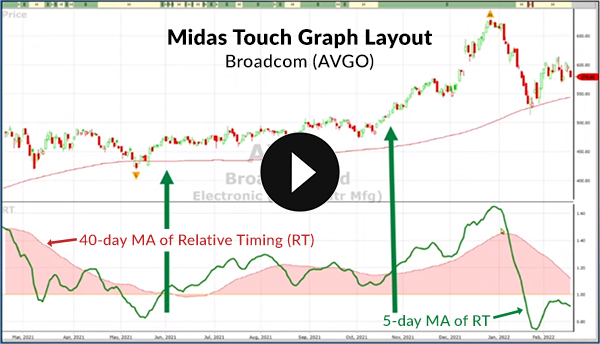

The rules of Market Timing apply. When it is go-time, select the Midas Touch from Graph Layouts in the Graph Control Panel. The 40-day MA of RT will appear on the sub-graph. Display the Price and leave the MA of the Stop Price on the graph. Next, add the 5-day MA of RT to the sub-graph. It is a smoother proxy for the RT. Lastly, make sure the Recommendation, ‘B,’ ‘S,’ ‘H,’ REC ribbon is running across the top of the graph.

Click here to Try VectorVest Risk-Free for 30 Days! Or call 1-888-658-7638

That’s it. Once you start looking for this pattern, it will literally jump off the page for you. It will tell you three things:

Please click here to watch a short video where I will show you the setup and what to look for. Let’s test it out with a couple of well-known stocks. TORONTO DOMINION BANK (TD). The 40-day MA of RT stopped falling and flattened out in mid-September 2021. The 5-day MA of RT crossed the 40-day MA of RT on September 28th. On October 8th, TD got a ‘B’ REC, so you could have purchased it at the next trading day’s open for about $86.28 per share. You might have sold around January 21, 2022, when both the 5 and 40-day MA of RT started hitting lower highs. Price was about $100 per share for a stress-free gain of about 16%.

|

|

|

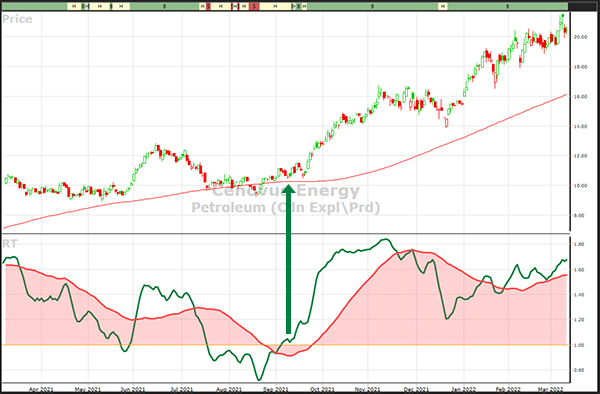

CENOVUS ENERGY (CVE). Cenovus is the top VST stock as of Monday, February 14th, 2022. Before then, the 5-MA of RT crossed above the 40-MA of RT on September 2nd, 2021. When a new Buy signal came on September 13th, the 40-MA of RT was still below 1.00, but had flattened out and was ready for liftoff. The next day’s opening price was $11.25 per share. By November 30th, both the 5 and 40-day MA of RT were losing momentum, a perfect time to Sell all or at least half of your position. Price was around $15.30 per share, a gain of about 40%. After a brief pullback, Price and the 5-day MA of RT resumed their march higher. In fact, the stock rallied another 40%. |

|

|

The beautiful thing about these setups is that they occur frequently, and they are easy to identify. So, here is my challenge. Set up your graph in 1-year daily mode as described above. Study the top 100 VST or RS (Relative Safety) ranked stocks from the Stock Viewer. Put your Date Line cursor at the setup of the 5 and 40-MA of RT as noted in Rules 1 and 2. If there isn’t already a Buy REC, advance to the nearest signal. Note the possible entry price and then ask yourself, “Did I have a chance to make some money?” Note how many times out of 100 you said, “Yes, I would have made money.” Now you have an idea of what is THE NEAR PERFECT INDICATOR. |

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $9.95 (usually up to $139/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment