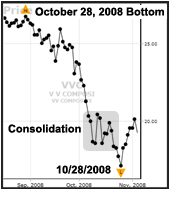

The Price of the VectorVest Composite hit an intraday low of $24.54 per share on August 9, 2011, down $5.64 or 18.7% from the post recovery intraday high of $30.18 touched on May 2, 2011. This was the most severe drawdown since the market bottom of March 2009. Strange as it may seem, the current market bottom is not reminiscent of the March 2009 bottom, but to that of October 28, 2008.

The October 28, 2008 bottom occurred during the most severe financial crisis of our time. It followed a series of brutal down days in September and early October and a brief consolidation period in mid-October. It was during this consolidation period that I wrote a series of essays that are apropos to our current situation, i.e., stock prices have been beaten down and it's a good time to think about buying some great stocks you always wanted to own.

The October 28, 2008 bottom occurred during the most severe financial crisis of our time. It followed a series of brutal down days in September and early October and a brief consolidation period in mid-October. It was during this consolidation period that I wrote a series of essays that are apropos to our current situation, i.e., stock prices have been beaten down and it's a good time to think about buying some great stocks you always wanted to own.

My essay of October 10, 2008 was entitled, "The Silver Lining." It said that if you preserve your capital during a market downturn, you could benefit by buying great stocks at bargain prices. Here's an excerpt from that essay: "Your top priority right now must be to preserve capital. If you haven't already sold your stocks and gone into cash by this time, I don't think you should do it now. But you should learn how to protect your portfolio. Please see my June 29, 2007 essay on Portfolio Protection. Learn how to use Option Collars. If you do, you'll have the money to buy stocks when this bear market ends, producing bargain prices. This is the silver lining. So survive now and be ready to look for The Silver Lining."

My essay of October 17, 2008 was entitled, "Time to Buy." It was motivated by the classic signs of a bottom, i.e., volatile up and down days with the RT hitting higher lows. Coincidentally, the New York Times published an Op-Ed piece by Mr. Warren Buffett entitled, "Buy Stocks. Cash is Trash." Here's an excerpt from my essay: "His optimism is based upon the credo to be fearful when others are greedy and greedy when others are fearful. He also said that cash is a terrible long-term asset...it pays virtually nothing and is certain to depreciate in value. Wisely, Mr. Buffett made no claims regarding what the market would do today, tomorrow or three years from now. He's just buying value for the long-term. Smart guy he is, indeed."

My essay of October 24, 2008 was entitled, "Blue Chip Bargains." The purpose of this essay was to illustrate how you could use VectorVest to find the kind of stocks Mr. Buffett would choose to buy. I created a search called, "Best of the Biggies," then used Portfolio Manager to create a 100-stock portfolio with no more than two stocks from the same Industry Group. I named the portfolio "Blue Chip Bargains" and suggested that it be used as a shopping list.

Here's what I said: "I would be in no hurry to buy these stocks right now. I'd wait at least until the Price of the VectorVest Composite goes up for two consecutive weeks; then I would begin to nibble at the list and I would buy Leaps instead of stocks unless I wanted the cash from dividends and I'd sell Covered Calls against my positions to reduce cost and risk. That's what I would do with these Blue Chip Bargains." We illustrated this technique in a "Strategy of the Week" presentation dated December 12, 2008.

So here we are, not quite three years later, living through another scary financial situation with a stock market that has been beaten to a pulp. Is it time to buy stocks? Nobody knows for sure, but we do know that some very good stocks are now much lower in price than they were a few months ago. We also know that you can begin to nibble at solid stocks like those found by the "Best of the Biggies" search.

Even if you had purchased all 100 stocks as of the close of 10/24/08, you would be making money on 84 of them today with a gain of 60.7% vs. 48.6% for the VVC. The average loss on the 16 losers was 3.95%. Your gain could have been much greater with less risk had you used the technique illustrated in the 12/12/08 "Strategy of the Week" presentation. It seems to me that once again, Opportunity is A'Knockin.

Sign up today and you can immediately use VectorVest's impressive analytical tools to protect and grow your profits.