The discount retailer Five Below (FIVE) opened Thursday morning with a nice jump after the company issues a positive earnings report with an even better outlook.

So far this morning, the stock is up 15% – but should you follow the trend and buy now, or have you missed your window? You’ll find a clear answer to your next move with this stock in a moment. First, let’s unpack the earnings release.

In reality, the third quarter for Five Below was a step backward from the path they were on previously – as both EPS and revenue fell slightly. However, they still beat analyst expectations. This has caused the strong price trend we’ve seen this morning.

The retailer brought in revenue of $645.03 million for the quarter, up 6.2% year over year. This came in well over Wall Street’s estimate of $614.03 million. And, diluted EPS of 29 cents/share also beat the anticipated EPS of 15 cents/share that analysts were expecting. Despite the fact that the company’s EPS in the third quarter last year was much higher at 43 cents/share, this is positive news in the current macroeconomic climate.

And, the CEO of Five Below Joel Anderson chimed in to echo this sentiment. He says that amid challenging conditions, the company was able to beat its own guidance through disciplined expense management, improvements in ticket & transaction metrics, and adherence to the company’s long-term triple-double vision.

Looking ahead to the future, the company has issued a strong Q4 outlook – as they are already on track to beat their own internal expectations. Even in this dynamic, ever-changing environment, Anderson and other executives feel confident in their resiliency. As such, the full-year revenue forecast has been raised right to $3 billion – with a profit forecast between $2.97 and $3.02 per share.

All of this news has investors adding Five Below to their portfolios – and maybe you’re wondering if you should do the same. Is there an opportunity for you here with this stock? And if so – what exactly is the opportunity? You don’t have to play the guessing game or let emotion influence your decision-making – the VectorVest stock analysis tool has identified three key metrics you need to see…

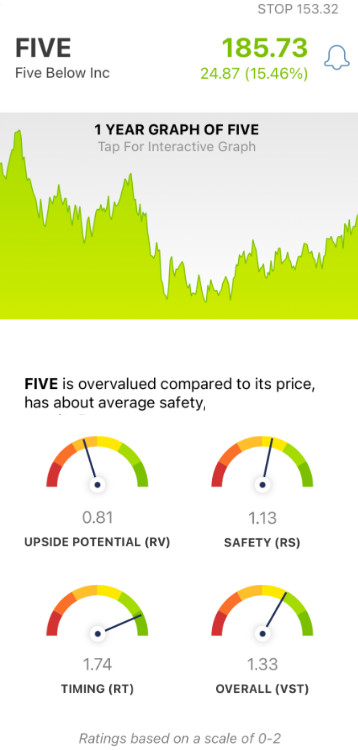

Despite Poor Upside Potential, FIVE Stock Has Good Safety & Excellent Timing

VectorVest allows you to effortlessly uncover and assess opportunities in the stock market through three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). And, interpreting these ratings is as straightforward as it gets. They sit on a scale of 0.00-2.00 – with 1.00 being the average. Anything over the average indicates overperformance and vice versa.

But, the best part of having the VectorVest system in your arsenal is that based on these ratings, you’re provided a clear buy, sell, or hold recommendation for any given stock, at any given time. This will provide you with much-needed confidence to execute your strategy. As for FIVE, here’s the current situation:

- Poor Upside Potential: The RV rating analyzes a stock’s long-term price appreciation potential forecasted 3 years out. And despite the impressive earnings report released today, VectorVest deems the upside potential for FIVE to be poor – with an RV rating of just 0.81. This is coupled with the fact the stock is overvalued at its current price. The current value is just $86.11 according to VectorVest.

- Good Safety: An indicator of risk, the RS rating assesses a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for FIVE, the RS rating of 1.13 is good.

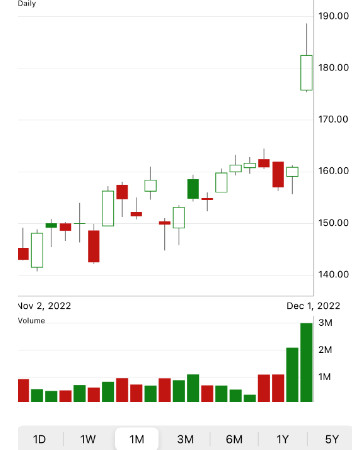

- Excellent Timing: As you can see by looking at the price movement today, FIVE has excellent timing – and the RT rating of 1.74 reflects that. This is calculated by looking at the direction, dynamics, and magnitude of a stock’s price movement. The rating is updated based on changes day over day, week over week, quarter over quarter, and year over year.

All things considered, FIVE has a very good VST rating of 1.33. But does that necessarily mean the stock is a buy right now? And if so, how will you know when it’s time to sell? With VectorVest, you can create a game plan that minimizes risk while maximizing profit potential. For a clear answer on your next move with FIVE, get a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for FIVE, it is overvalued with poor upside potential but has good safety & excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment