Dot-com Bubble

The Epitome of FOMO

Between January 1995 and the peak in March 2000, the NASDAQ rose 582% only to fall 78% from its peak by October 2002, giving up much of its meteoric gains.

VectorVest market timing warned subscribers to get out of the market beginning March 17, 2000; “I believe that the rally is exhausted. Downside risk outweighs upside potential. Prudent Investors should protect profits and take defensive actions such as buying Puts. Consider any rallies as opportunities to sell stocks at higher prices.”

On 3/20/2000, VectorVest published a Confirmed Down, “It certainly looks like the severe correction we had anticipated has arrived. Prudent Investors should not buy any stocks at this time and should continue to take action to protect profits. Aggressive Investors and Traders should play the market with a bias to the downside.”

The market didn’t turn around until 2003, with the onset of the Iraq War in March.

On 3/21/2003, VectorVest signaled a Confirmed Up with the guidance, “it is OK for Prudent Investors to buy stocks, but don’t bet the farm at this time. Aggressive Investors and Traders should play the market to the upside.”

The Great Recession

Global Financial Crisis

On 11/1/2007, VectorVest issued a Confirmed Down, “Stock prices fell sharply today as investors began to fear the end of interest rate decreases along with a slower economy. This is not a good recipe for driving stock prices higher.”

On the following day, 11/2/2007, VectorVest published its weekly essay titled “Contra ETFs”. The Special Presentation video that night was “How to Make Money Using Contra ETFs.”

As the market rallied in the spring of 2008, VectorVest signaled a Confirmed Up on 4/3/2008. This trend continued until VectorVest published another Confirmed Down on 6/11/2008, “Stock prices sank as oil prices soared today and the C/Dn signal arrived exactly as expected. Prudent Investors should protect profits and not buy stocks at this time. Aggressive Investors and Traders should play the market to the downside.”

The following Friday, 6/13/2008 VectorVest published, …there’s plenty of evidence that a sustainable downtrend is underway. So don’t be taken in by sucker’s rallies. We are playing the market to the downside with long positions from the “Buying Contra ETF’s Strategy.” By the July 4th Holiday that summer, Buying Contra ETFs was up 19% with 5 out of 5 winners.

Many investors lost their shirts during this critical time in recent market history.

…and VectorVest Nailed It!

On 3/6/2009, VectorVest’s essay was titled “Itching to Rally”, which included, “Investors are dying to buy stocks and any scrap of good news, true or not, will serve the purpose. This market is Itching to Rally.”

The following Monday, 3/9/2009, VectorVest alerted subscribers to be alert for an explosive rally and highlighted 5 bottom-fishing strategies, including “Jail Break”.

On Tuesday, 3/10/2009, VectorVest subscribers were prepared to enter the market with one of the 5 top-performing bottom-fishing strategies. They got the explosive rally they were looking for.

All 5 recommended strategies produced explosive results. In just two months, they averaged a 252% return, with Jail Break returning 332%!

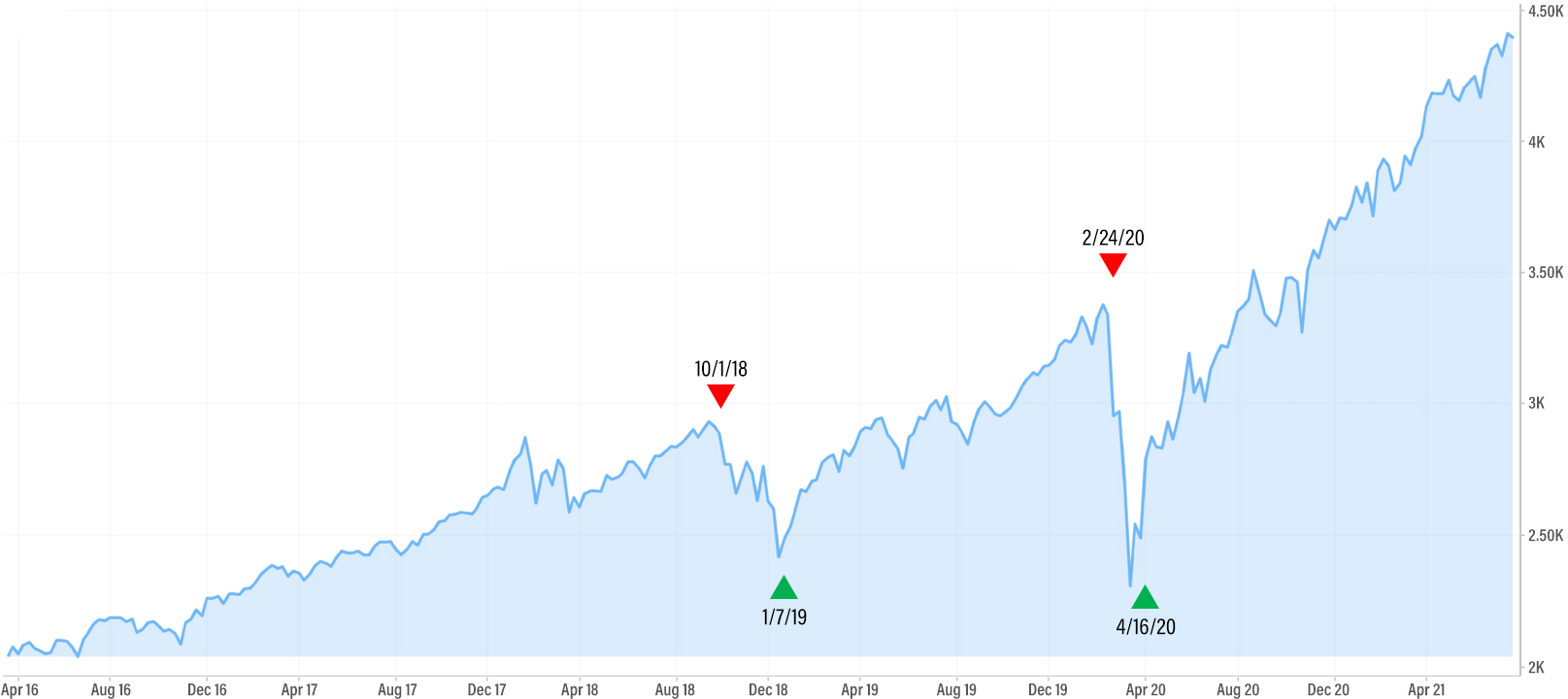

The Coronavirus Crash

Global Pandemic

The Coronavirus Crash wiped nearly 11,000 points off the Dow, or 37%! As early as January 17, 2020 VectorVest was already warning that the Market Timing Indicators were signaling an overbought market.

On February 14, 2020, VectorVest published “our Market Timing Indicators are at lower levels today than they were during the January high, this bearish divergence suggests that downside risk outweighs upside potential.”

On February 21, 2020, VectorVest reported, “Aggressive Investors and Traders should play the market with a bias to the downside.”

The Daily Market Video that evening confirmed… “we are seeing a breakdown of the MTI… sound the alarm. Now is the time to tighten stops and protect profits. The Primary Wave is down, an important signal is being generated here.”

On February 24, 2020, VectorVest relayed “We do not advocate buying any stocks at this time. The underlying trend of the market is now down. All three of our market timing indicators are now below the level of 1.00 showing weakness in the market.”

The market video that evening reported “The DEW “Goldilocks” timing system signaled a down signal today. Each of our hot stocks today were Contra ETFs and were up an average of 11% today.”

Only VectorVest provides this critical combination of services—a Market Timing System with a 30-year track record followed by expert video guidance every evening that prepares you for market plunges like the Coronavirus Crash.

Zero Percent Interest Rates and a $700 billion round of quantitative easing.

The market bottomed on March 23, 2020. Two days later, on March 25, 2020, VectorVest published “The primary trend of the market is Up. Prudent Investors may buy stocks long only if the market is rising.” The market video reported “There are some hefty gains in our 5-Day Derby Winners, with Bottoms Up gaining 88.79% over the last 5 days. A lot of us are anxious to get back into trading. For those who are very aggressive, they may start stepping in, buying good quality stocks at a good price. For those less aggressive, wait for our first Green Light.”

On March 26, 2020, VectorVest investors got that Green Light with “Prudent Investors may buy stocks long if the market is rising. Aggressive Investors and Traders should play the market with a bias to the upside.”

On April 6, 2020, the bullish message continued with “the five searches with the highest 1-Day percent price gains are all bullish”, averaging an 18% gain. The market video that evening followed with “The DEW is our “goldilocks” timing model, just right for many. We got an up call on today’s data. We had been outside of normal pricing behavior, and we normally see a rapid snap back from these extreme levels. It’s time to start ‘nibbling’ at stocks should the market continue higher tomorrow.”