Everyone’s favorite social media service for finding inspiration just got an upgrade from Goldman Sachs. One analyst there believes that the company’s stock is on the brink of a big surge. In fact, Eric Sheridan of Goldman Sachs is expecting as much as a 25% price spike in the near term. As a result, he’s moved his price target up from $24 to $31.

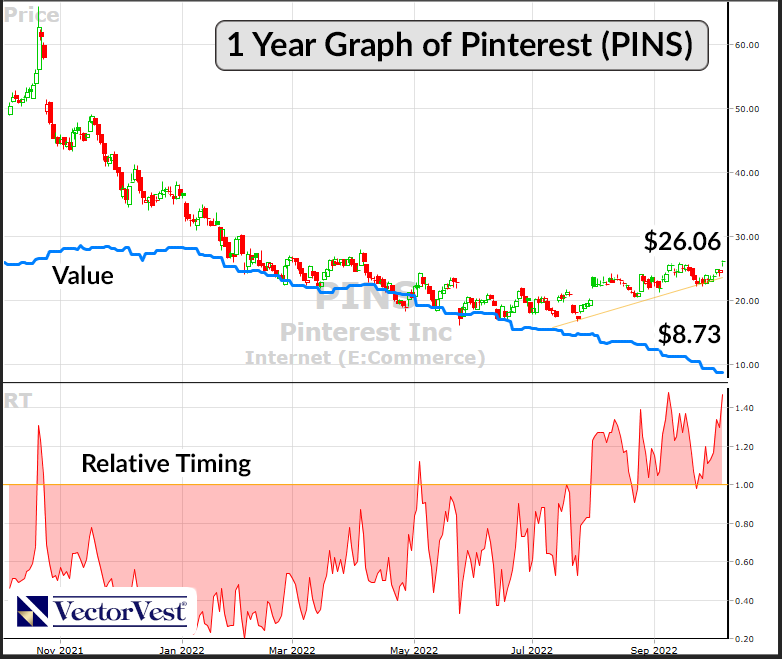

If you’ve been keeping track of Pinterest news, you know that there has been a ton of volatility in the stock’s price in 2022. The company started the year off with a steady decline until the stock price bottomed out at around $17/share in the summer months. At that point, Pinterest was experiencing some big changes. Their co-founder and CEO stepped down, replaced by a former Google executive. Then, after one investment firm (Elliot Management) took a large stake in Pinterest, the acquisition rumors began.

While there have been no concrete reports as to the validity of these rumors, the hype alone led to a rally for Pinterest’s stock. In the past 3 months, they’re up 32%. Then, early this week, Piper Sandler analyst Thomas Champion provided a slightly optimistic upgrade raising his price target up $1. And with the latest upgrade from Sheridan, the company has experienced a strong week with a 12% gain. Today, prices have surged 5% already. Why are these analysts excited about Pinterest, though?

Despite a poor digital advertising landscape at Pinterest (and online as a whole), analysts believe that the potential for this company is still strong. They are positioned to leverage a few different secular growth themes – from improving their creator economy to improving their ad sales, and even looking abroad at international monetization. And, they’ve rated PINS a “buy” accordingly.

But what does VectorVest’s stock forecasting tools show for this stock? After all, this system is the most simple, effortless way to get a clear buy, sell, or hold recommendation for any given stock at any given time. You can tune out the noise and put emotion to the side by letting VectorVest influence your decision-making instead. Let’s take a look at three important aspects of PINS stock you need to know before making your next move.

Despite Poor Upside Potential and Safety, the Time is Right for PINS

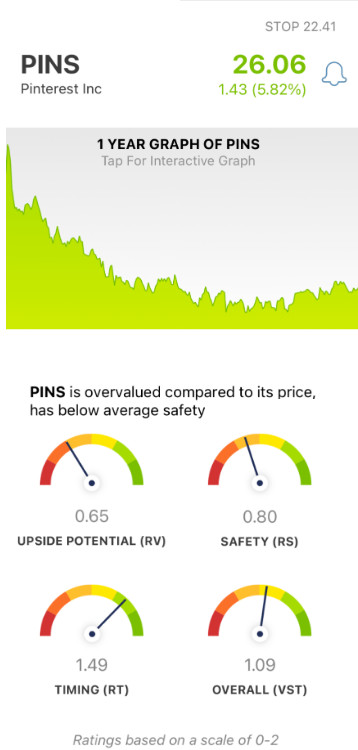

The VectorVest system provides you with everything you need to know about a stock based on three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Put on an easy-to-understand scale of 0.00-2.00, you can pick stocks with the highest ratings to win more trades. It’s that easy. And, together, these ratings contribute to the overall VST rating a stock is given and dictates whether it’s rated as a buy, sell, or hold – so you don’t have to play the guessing game. Here’s the current situation with PINS:

- Poor Upside Potential: While analysts have a positive outlook on the long-term price appreciation potential for PINS, VectorVest does not. The RV rating of 0.65 is poor. This is coupled with the fact that VectorVest deems PINS to be far overvalued – with a current value of just $8.73

- Poor Safety:Relative safety is an indicator of risk. It looks at the consistency & predictability of a company’s financial performance, debt-to-equity ratio, and business longevity. All this considered, VectorVest deems PINS to have poor safety with an RS rating of just 0.80 on a scale of 0.00-2.00

- Excellent Timing:There’s something to be said about market sentiment and the role it plays in influencing the stock price. Right now, PINS has excellent timing with a relative timing rating of 1.49. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. As more and more investors flock to buy PINS after the recent analyst upgrades, this price trend should continue

Together, these three ratings work out to an overall VST rating of 1.09 – which is fair on a scale of 0.00-2.00. While the upside potential and safety for PINS are poor, the stock has a positive price trend with the wind in its sails. Should you buy the trend? Or, is it too early – and should you wait for further validation? To get a clear answer on your next move with PINS, analyze stock free here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for PINS, it is overvalued with poor upside potential and safety – but the timing is excellent right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment