Companies situated in the travel industry have had a rough few years now as a result of the pandemic. And it’s not just airlines that are suffering – manufacturers like Boeing are feeling the effects themselves. Since the company’s stock experienced a 62% drop back in 2020, it struggled to regain its footing. This year alone Boeing is down 42%. So – why does one analyst assume a 90% price gain is coming?

Colin Scarola of CFRA – a large investment firm – believes much of the price woes Boeing’s stock has faced have been the result of fear. From pandemic fears in the past few years to recession fears in the present day – and fear around Boeing’s debt, too.

There’s no question that Boeing is drowning in debt. $5.4 billion is a lot of debt for a company that did just $3 billion in profit last year. Nevertheless, Scarola believes that Boeing could easily pay off their debt with free cash flow. There is no need for the company to even consider refinancing its debt at a higher rate.

Another reason Boeing stock has continued to tumble is the delay of the company’s new 737 MAX 10 in getting FAA approval. It’s unlikely that they’ll meet the December deadline to gain approval, at which point the company will have to revamp the plane in accordance with modern cockpit-alternating requirements. This would further delay the planes from getting to market – and experts expect that this won’t happen any sooner than the summer of 2023.

Say what you will about analysts – and their motives for releasing these types of outlooks – but Scarola does bring some fair points to the table. He references a few data points for Boeing’s plane delivery capabilities per month – both in current circumstances and in a recession. If his projections are correct in this regard, Boeing will be able to climb out of this hole they’re in sooner rather than later. But a 90% gain seems a bit optimistic in any set of circumstances.

So – what does all of this mean for investors? Should you buy what Scarola’s selling? After all, the current price point of $129.99/share could be a good value buy should Boeing return to its pre-pandemic range of over $340/share. Or, is the timing still not right for Boeing? You don’t have to play any guessing games or let emotion influence your decision – we can take an unbiased look at what your next move should be through the VectorVest stock analysis software.

3 Things This Analyst May Have Overlooked According to VectorVest

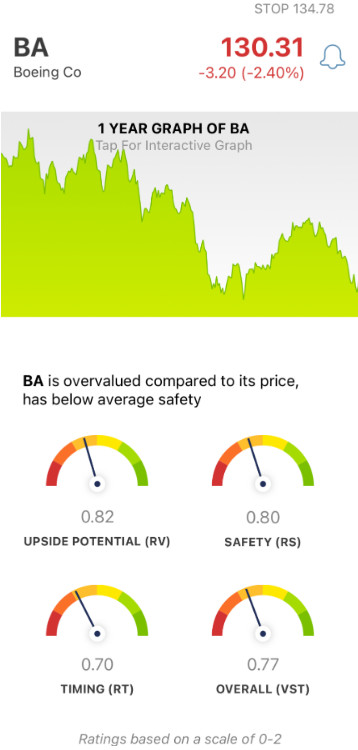

The VectorVest system simplifies stock analysis and grants you invaluable insights into any given stock, at any given time. You can gain a clear buy, sell, or hold recommendation based on three easy-to-understanding ratings, which sit on a scale of 0.00-2.00. These are relative value (RV), relative safety (RS), and relative timing (RT). Together, these make up the overall VST rating for a stock – which also sits on a scale of 0.00-2.00. The higher the figure, the better. And unfortunately for Boeing, there’s not a lot to be excited about right now:

- Poor Upside Potential: the RV rating takes a look at the long-term price appreciation potential for a company – up to three years out. As for Boeing, the RV rating of 0.82 is poor. Moreover, the stock is way overvalued even at this low price of around $120. VectorVest calculates the current value to be $49/share.

- Poor Safety: an indicator of risk, the RS rating takes into account the consistency and predictability of a company’s financial performance. It also factors in business longevity and debt-to-equity ratio. And in looking at Boeing, VectorVest shows a poor RS rating of 0.80.

- Poor Timing: to top it all off, Boeing has a negative price trend pushing the stock down further and further with a poor RT rating of 0.70. This rating is based on the direction, dynamics, and magnitude of a stock’s price trajectory. It’s analyzed day-to-day, week-to-week, quarter-to-quarter, and year-to-year. It doesn’t appear that the 90% price correction that Scarola is projecting is coming any time soon.

In the end, Boeing has a poor VST rating of 0.77. The woes the company has been facing won’t end in the short term – that’s for sure. So – is now actually the time to buy shares of this stock? To get a clear answer on what your next move with Boeing should be, analyze stock free here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for BA, it is overvalued with poor upside potential, poor safety, and poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment