by Leslie N. Masonson, MBA

Over the years, investors searching for dividends only had a few choices such as mutual funds and individual securities. With the advent of ETFs and their tremendous growth over the past 30 years, investors now have another alternative that may be the best of all. ETFs provide investors with a diversified and cost-effective approach to gain exposure to a portfolio of income-generating assets. In this article, I will explore the benefits of using ETFs for income, and highlight a selection of high-quality dividend-paying ETFs.

According to ETFAction.com, there are 199 ETFs that offer dividends with a total asset base of $397.7 billion and an average expense ratio of 0.55%. There are many choices among these ETFs, whether they be U.S. or globally focused, sector-focused (e.g., energy), corporate or preferred shares, leveraged, dividend Dogs, broad-market, industry-focused (e.g., real estate).

Other factors to consider, as in any ETF, is the reputation of the issuer, assets under management (AUM), annual expense ratio, number of holdings, average daily volume, current yield, growth in yield over its history, active vs. passive management, whether open-ended or an exchange traded note, as well as actual performance over its life-time.

High quality dividend-paying ETFs contain companies with growing dividends, providing investors with a reliable and increasing income stream. Compared to actively managed mutual funds, ETFs generally have lower expense ratios, providing investors with higher returns. Companies with excellent fundamentals and a history of stable and growing earnings should have no problem supporting their dividends

Be aware that these ETFs are sensitive to interest rate changes which impact their attractiveness relative to fixed-income investments such as money market mutual funds, CDs, municipal bonds, collateralized mortgage obligations, and others. Keep in mind that similar to stocks, ETFs are subject to market fluctuations and risk, and past performance may not indicative of future results.

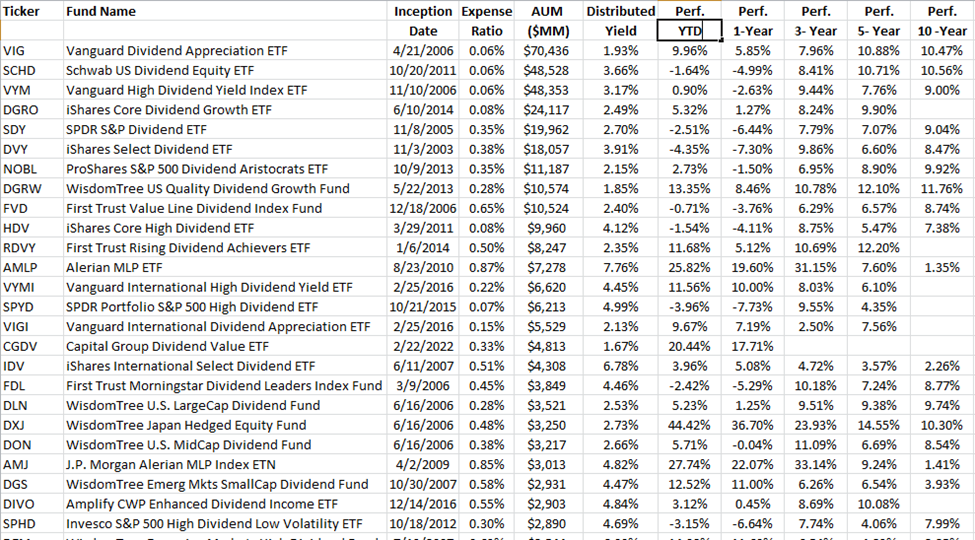

The data for December 1, 2023 shown above provides the top 25 dividend-focused ETFs based on AUM, and was obtained from ETFAction.com. Clearly, there are many choices. But the three ten-year winners were VIG, SCHD, and DGRW with total performance of 10.5%, 10.6%, and 11.8%, respectively.

Moreover, their 5-year performance mirrors the ten-year. The one-year performance had more variability with VIG at 9.96%, SCHD at a negative 1.64%, and DGRW at 13.35%. Obviously, SCHD’s poor performance should be checked out if that is one ETF you are considering.

Both VIG and SCHD had the largest AUM of the category with $70.4 billion and $48.5 billion respectively, as well as the lowest expense ratios at 0.06%, while DGRW’s was 0.28% which eats into its yield. Other top performers over multiple time periods include RDVY, DXJ, AMJ, and TDIV.

As with any investment strategy, careful consideration, and ongoing monitoring are essential to harness the full potential of ETFs for income generation. As always, Investors should conduct thorough research and due diligence on the ETF sponsor’s website by looking at the fact sheet, prospectuses, as well as considering all the key factors that were mentioned earlier. Also, definitely look at the portfolio holdings and number of holdings and their weighting to determine if they are as conservative as you may be. What you don’t want are negative performance surprises. I didn’t check out why SCHD has a negative return, but you should if you are considering it.

In conclusion, dividend-paying ETFs offer investors a combination of stock market exposure and a solid income stream with less volatility than just a handful of dividend paying stocks. While investing always involves risks, high-quality dividend-paying ETFs from well-known providers like Vanguard, Schwab, Wisdom Tree, and First Trust provide investors with a steady income stream along with diversification and cost efficiency.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment