by Leslie N. Masonson, MBA

About 15 years ago, forward-thinking institutions and pension funds were exploring groundbreaking, long-term strategies to enhance their global returns. They delved into ETF thematic investing and some firms dove in head first to capture assets from interested investors. The world of Exchange-Traded Funds (ETFs) investing is no stranger to the allure of new categories to grow assets under management (AUM) in a very competitive field

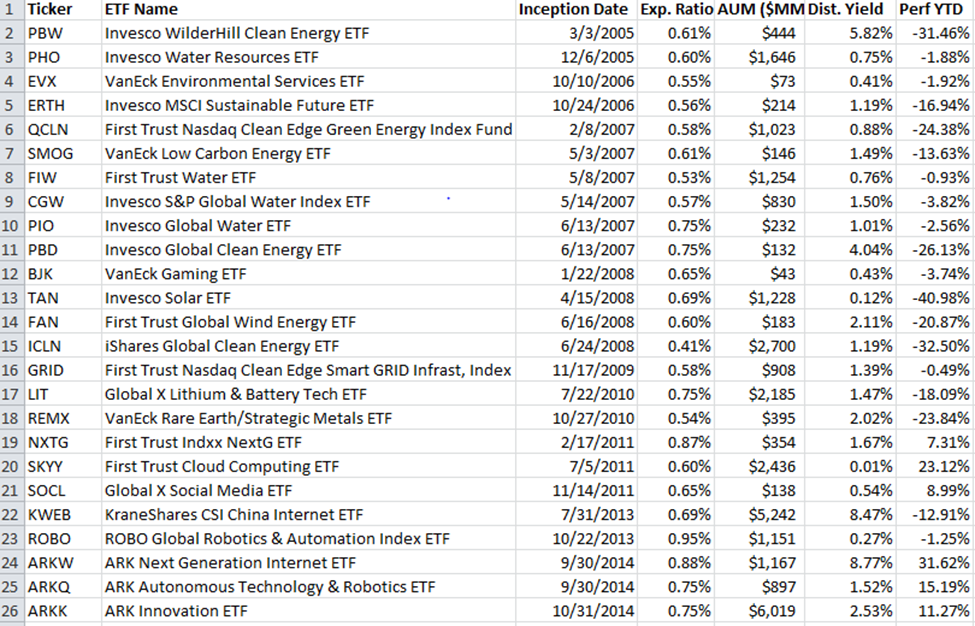

Thematic or theme-based ETFs is now a burgeoning category. These ETFs first emerged in 2005 and 2006, then reaching 30 by mid-2017. From then on, the number of ETFs mushroomed to its current level of 246 valued at $62.4 billion, as of October 27, 2023 with an average expense ratio of 0.61%. There are currently 70 sponsoring firms in this space with the top asset gathers including ARK Investment Management LLC, First Trust, Global X, Invesco, and iShares. The table below highlight the top 25 thematic ETFs by inception date:

.

Clearly, some of the ETFs have failed to build their AUM such as EVX, BJK, and SOCL while a few have exceeded the $1 billion mark including PHO, QCLN, FIW,TAN,ICLN,LIT, SKYY, KWEB, ROBO, ARKW, and ARKK. Year-to-date performance has been weak with twenty-six6 losers, and only four winners, not a great showing.

If these ETFs were ranked by AUM instead of inception date, the cut-off of the number 25th ranked ETF would have been $561 million. So all the ETFs mentioned above in the $1 billion+ club plus ARKQ and CGW and GRID would have been listed.

Consider thematic ETFs as those with a forward-looking twist. They aim to capture alpha from sustainability, evolving consumer, industrial revolution, disruptive technology, health innovation, fintech, environmental shifts, clean energy, robotics, demographic changes, cybersecurity, or other nascent fields.

The ARK thematic ETFs saw the initial brunt of the action with four ETFs coming to market in 2014, and then four more came to market in future years. ARK total ETF assets account for $10.7 billion of the thematic total or 17.1%. And of course their spectacular average 200% performance in the two years ending February 12, 2021, and CEO Cathie Wood’s media coverage was the story of the day. Not so much in thereafter when they all cratered and lost 75-85% in the next 21 months, and then being in a trading range ever since.

The recent surge in thematic growth occurred starting in 2019 and continued through June 2023. The only problem with all these new ETFs is that their AUM numbers are weak; with many less than $50 million which means their life may be short as they aren’t profitable enough to stay in business, and that usually means having at least $100 million in AUM. Moreover, most have low daily trading volume and bid-to-ask spreads that are more than $0.01 which is not great for traders. Also, these newer ETFs with average annual expense ratios between 0.40% to 0.80% are more expensive than typical index ETFs which are not directly comparable, but offer a benchmark type number. Therefore, at this point the thematic ETF category is oversaturated and any new ETFs to this space will not be able to compete against the bid handful of winners, thus far.

Only ETF sponsors that curate a solid roster of high-quality, innovative companies within a unique thematic wrapper will attract the lion’s share of any new business. Those offering a meager slice of their chosen universe will vanish after a year or two, or find themselves acquired. The key for sponsors is to present unique themes that mirror sustainable, global business trends. Predicting which themes will yield the greatest returns in the future is a formidable challenge, and difficult to assess in real-time.

Some new ETFs may evolve into superstar performers in the years ahead as technology continues to change the world – think transistors, radio, TV, landline telephone, Internet, smart phone, Artificial Intelligence, etc. The question is which new technology will break out of the pack and generate billions of dollars in revenue.

Investors and traders interested in the thematic space can build a watchlist of a dozen ETFs of interest. As with any novel investment niche, due diligence is crucial. Investors and traders should allocate only a small portion of their assets to this area until it proves its mettle. And of course, the judicious use of technical indicators like support & resistance, moving averages, RSI, MACD, and volume can aid in timing ETF purchases and sales. As everything else in life, timing is critical to your investment success and is the most important factor in investing and trading according to VectorVest.

The next article (Part 2) will focus on the performance of thematic ETFs to give you a head start in creating your watchlist. In the meantime, check out some of the major sponsor websites, and explore the ETF screener to see which thematic ETFs are nearing the top rankings, then check out their charts for suitable candidates for review.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment