Nobody Analyzes Stocks Like VectorVest

VectorVest issued a SELL rating for AMZN on 1/20/22

at $3,033.35, with a Value of only $1,359.13 per share.

As of April 29, 2022, Amazon (AMZN) has plummeted from $3,033.25 to $2,483.00 since VectorVest’s SELL rating on January 20, 2022. That’s an 18% loss in just over 3 months!

|

How does VectorVest do it?

- VectorVest calculates an exclusive Stop-Price for each stock, every day. It’s your line in the sand.

- VectorVest provides a Buy, Sell, or Hold rating to every stock, every day.

- When a stock drops below the stop-price, it receives a sell rating.

- NO HUNCHES, NO OPINIONS…

Another warning sign.

VectorVest calculates the value of every stock, every day. When the price is significantly higher than the value, there is an increased likelihood that the stock could crash during a market correction.

In the case of Amazon, VectorVest’s calculated value was $1,359.13 on January 20, 2022. Remember, AMZN closed at $3,033.25 that day, so it was extremely overvalued. Value is computed from forecasted earnings per share, forecasted earnings growth, profitability, interest, and inflation rates.

Pro tip: Buy safe, undervalued stocks that are rising in price, in a rising market.

WITH VECTORVEST’S STOCK RATINGS AND BREAKTHROUGH MARKET GUIDANCE, YOU DON’T HAVE TO SUFFER THROUGH PAINFUL MARKET SELL-OFFS

In November 2021, I knew to sell almost all of my stocks right before the crash.

And this wasn’t lucky timing. I actually received advance notice that the crash was coming.

You see, I have what you’d probably call an unfair advantage when it comes to investing.

No, I don’t use a money manager or anything like that. Like many investors, I manage my own portfolio.

But thanks to VectorVest, the crazy market activity we’re seeing right now doesn’t even cause me to lose a minute of sleep. VectorVest guides me every step of the way.

|

Spotting trends has never been easier! VectorVest’s powerful market timing system tells you exactly when it’s safe to buy stocks, and when to take your profits off the table.

As early as November 5, 2021, VectorVest’s Market Timing Indicators were signaling an overbought market.

On November 12, 2021, VectorVest published, “while the Price of the VectorVest Composite (VVC) moved higher, our market timing indicators did not. This Bearish divergence suggests that downside risk outweighs upside potential.”

On November 19, 2021, VectorVest published, “Inflation and interest-rate fears took hold this week and the Price of the VectorVest Composite (VVC) fell $1.07 per share…, if the market continues to move lower, we could receive a Confirmed Down (C/Dn) situation as early as this Monday.”

VectorVest went on to say: “You do not want to ignore the next Confirmed Down signal… Now is not the time to be complacent. Take Action, and reduce your exposure. Tighten up your stop criteria. Protect Profits. The Confirmed Down is an alarm.”

On November 22, 2021, VectorVest published, “We have a Confirmed Down situation.” That’s the red down arrow you see on the chart above, labeled CONFIRMED MARKET DOWN.

This signal alone could have saved you thousands in your portfolio.

Seeing is believing, so try VectorVest Risk-Free for 30 days, only $9.95

|

|

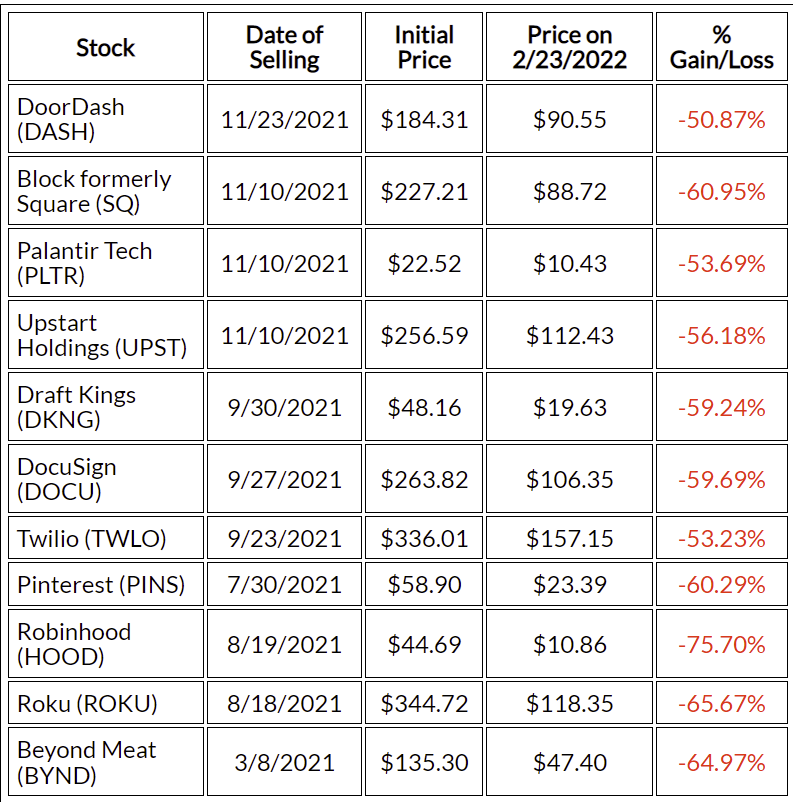

Large losses can be devastating…

With VectorVest, you can avoid losses like these. The Amazon Sell Rating and sell-off that followed was not a fluke… this happens over and over again.

VectorVest issued a sell rating before these stocks dropped. This type of guidance allows you to lock in profits and minimize losses, so you have more money to invest when the market turns back up.

|

Taking the emotion out of investing.

With VectorVest, you’ll always know at a glance whether to buy, sell, or hold any investment. VectorVest takes the guesswork out of investing!

Seeing is believing, so try VectorVest Risk-Free for 30 days, only $9.95!

With this Special Trial Offer, you’ll get this Double Bonus:

- A FREE copy of the classic book – Strategies & Common Sense, 2022 edition— a $24.95 value

- Chapter 13 is all about stop-prices. It details how they help you control losses and protect profits.

- Successful Investor Quick Start Video Course – a $95 value

|

Or call 1-888-658-7638

You will also receive:

- 30 days of full access to VectorVest 7

- The 4.6 star-rated VectorVest Mobile App — a $19.99 value

- Hot Stock Picks in our Daily Color Guard Video

- FREE, friendly support from our NC staff

- Convenient on-demand learning center — VectorVest University

- FREE Getting Started Coaching Session — a $95 value

- 100% Money-Back Guarantee

So, there’s nothing holding you back!

Get started today!

|

|

|

Leave A Comment