Financial Nakedness – Part 1

In the latest episode of Fantastic Female Fridays, I interviewed Carol Glynn of Conscious Finance Coaching. It’s a company based in Dubai that Carol spearheads intending to help her clients (who are primarily women) overcome challenges to achieve their financial dreams. She calls the work that she does “financial nakedness” as when you’re working with a money coach, they see everything!

Here are some things we can all learn from Carol:

Clarity Sheets

Carol says that she doesn’t refer to budgets in the way we might traditionally call them but instead as “clarity sheets”. Their purpose is to highlight what people spend, in comparison to what they earn, not intending to squeeze out the enjoyment of their money but to see if that spreadsheet is representative of their value.

Here at VectorVest, I think that our Watchlists offer great clarity too. They point out the long-term price appreciation potential of a company (i.e. Relative Value), the consistency and predictability of financial performance (i.e. Relative Safety), and the direction, magnitude, and dynamics of a stock price (i.e. Relative Timing). They enable people to weed out those stocks that don’t offer value to investors and take the pulse of a whole list of stocks at a glance.

A Fear of Investing is a Fear of the Unknown

Carol talked about how we view savings versus investing. Saving is secure, stable, and constant. We know the result. However, in the case of investing, we don’t know what’s going to happen nor when. Of course, investors are rewarded through higher returns for taking that risk but that doesn’t mean that new investors may be wary. Specifically, when she is dealing with this, Carol walks through why somebody might want to invest, their risk appetite, demystifies the jargon, helps them find out the cost, and then make a decision.

One of the best ways that I think people use the VectorVest system to help them with the fear of the unknown is the Quicktest tool. If I can examine the performance of a group of stocks that an indicator helped me to buy quickly, that gives me a window into the past. For example, one of the most popular Quicktests we run is the Birthday Game – pick the date of your birthday some year over five years ago, rank the whole database by Relative Safety, and quick test it today. We’ve run this test thousands of times and it can be so interesting to see how this indicator with its “set and forget” approach can work so well.

Financial Nakedness – Part 2

In the latest episode of Fantastic Female Fridays, I interviewed Carol Glynn of Conscious Finance Coaching. It’s a company based in Dubai that Carol spearheads intending to help her clients (who are primarily women) overcome challenges to achieve their financial dreams. She calls the work that she does “financial nakedness” as when you’re working with a money coach, they see everything! In the last post, I reflected on how Carol refers to “Clarity Sheets” as distinct to budgets and that she talks about how fear of investing is a fear of the unknown. Here are two more of the key points we discussed during the conversation.

Everybody thinks Others are Born with the Playbook

Carol mentioned that lots of people come to her finance coaching business riddled with negative emotions. They might be shame, guilt, intimidation, overwhelm, and others. Lots of people assume that others know exactly what they’re doing. However, the reality is that financial literacy isn’t genetically inherited! Everybody needs to learn from the beginning and has different reasons for doing so.

At VectorVest, I think that the support offered by the wider, global team enables everybody’s education to be tailored. From my point of view, during our European Q&A sessions, we look at the main financial markets’ news and economic trends on several Sunday nights throughout the year so that you can qualify the news into objective analysis using the program. The recent two-day session that we held on YouTube was the ideal way for anybody to start learning about the stock market and advance in your area of most interest. Of course, there are a plethora of courses tailored to options, technical analysis, Retirement planning and so much more too. All of us here at VectorVest started from zero, so you’re in good company!

What is Your Willpower Telling You?

Willpower is an interesting idea. Many connotate it with grit and the ability to stick “it” out, whereby “it” refers to something difficult with a view to arriving at a virtuous outcome. It’s worthwhile thinking about why that might be. Carol gives us great ways to optimize your willpower by being kind to yourself. Think back to why you want what you’re working towards so that you can power through. Remove the “should” and “should not” from your lexicon so that there is only room for the why you genuinely want what you’re striving towards. Celebrate the milestones with rewards.

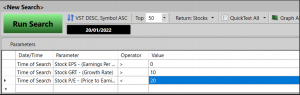

Do you find that you need willpower when it comes to investing? Do you find it frustrating to analyze stock after stock, graph after graph? I’m a gratefully busy person with lots going on and that’s the way I like it too! However, I still want to make smart decisions when it comes to the markets and one of my favorite parts of the VectorVest program is Unisearch because l can direct the system to bring me exactly what I’m looking for. I was talking to a new group of young investors during the week and I asked them for suggestions of stocks that were profitable, growing their earnings by over 10% per annum AND the share price is just twenty times earnings. It’s quite the task! They were googling all sorts, checking their phones, and looking up various apps. After some time elapsed, I opened up VectorVest and built the following search:

EPS > 0

GRT > 10

PE < 20

On the day I ran the search in VectorVest Europe, I could find lots of stocks! Hapag Lloyd was top of the list. NN Group in Amsterdam was one of the results. Eramet and Derichebourg, both in Paris, formed part of the top five. It took seconds to cut through this task.

Financial Nakedness – Part 3

In the latest episode of Fantastic Female Fridays, I interviewed Carol Glynn of Conscious Finance Coaching. It’s a company based in Dubai that Carol spearheads to help her clients (who are primarily women) overcome challenges to achieve their financial dreams. She calls the work that she does “financial nakedness” as when you’re working with a money coach, they see everything! In the last two posts, I reflected on how Carol refers to “Clarity Sheets” as distinct to budgets and that she talks about how fear of investing is a fear of the unknown. In the second piece, I mused over the points Carol raised that many people think others are more financially literate than they are and that willpower can be more about being kind to oneself and staying true to their values rather than grit and stackability. I wanted to finish this series with the top five tips that Carol offered throughout the session:

- Get clarity on what you owe and what you own.

If you want to use a very helpful tool to bring all your stock market investments into one dynamic place, I suggest you build your own “Portfolio” in the tab of the same name in the program. This will enable you to see your stocks at a glance as well as their respective gains and losses, but also the Recommendation of the stock, the Stop Loss as well as the tailored graph of your progress.

- Observe what you’re spending.

Through building your portfolio, you will also be able to generate reports. It can be quite interesting, or as Carol describes, an “a-ha moment”, when you see the aggregate impact of the costs of your activity. You will see the total costs of your stockbroking charges and this may give you the impetus to shop around and see if you need another provider.

- Make sure that your financial activity links to your values.

As an investor, I know myself very well by now. I like generating income through dividends. I prefer to have sectoral, geographic, and currency diversification. I’m very comfortable selling options on stocks in a sideways market. From that very first time I met VectorVest over a decade now, I remember thinking that VectorVest is one amazing tool for those who know themselves well. I can use the Stock Viewer to screen for dividends (and the YSG indicators look for those that are significant, safe, and growing). I can easily see the business sectors in my Watchlists. I can make delineate between my investments between currencies by opening up different geographical regions of the program.

- Track your progress

Progress isn’t simply about returns and money in the bank. It also refers to how much you’re learning, the self-awareness you’re building into your own investing personality, and enjoying the process along the way.

- Understand your risk profile and take action accordingly.

A stop loss is a feature that your online trading platform offers so that you can put a sell order into the market, triggered by your stock reaching a certain price. It’s a very useful tool to enable you to manage your risk. However, one might wonder what stop price to choose. At the end of the episode, I explain how VectorVest uses a 13-week moving average adjusted for risk. It’s a smart way of incorporating fundamental analysis into informing decisions.

For more insights from this conversation, check out the full episode on our channel on YouTube!

Leave A Comment