This morning, Advanced Auto Parts (AAP) released first-quarter earnings that came in way under expectations. Along with a dismal earnings report, the company weakened its outlook and slashed its quarterly dividend. Safe to say things are tumultuous right now for the North Carolina-based company.

While analysts were expecting an EPS of $2.57/share, the company reported a mere $0.72/share. Revenue narrowly missed the estimate at $3.42 billion compared to $3.43 billion.

While net sales rose 1.4% to $3.4 billion, that’s really the only good news from the report. Profitability dropped, and the company had to cut the dividend dramatically too. Last quarter, Advanced Auto Parts paid out a dividend of $1.50 per share. This quarter, though, that figure dropped to $0.25 per share.

And it doesn’t appear that things are going to get better anytime soon, as the company also slashed the full-year profit and earnings outlook. EPS is expected to fall between $6-$6.50, while the previous assumption was in the range of $10.20-$11.20.

CEO Tom Greco blames these problems on rising costs across the professional sales channel, which have taken a toll on profit. This is coupled with inflationary pressure, supply chain issues, and other challenges – which Greco doesn’t expect to subside in the near future.

However, experts like Oppenheimer analyst Brian Nagel believe these are self-induced problems – not industry issues. Other auto parts providers like AutoZone or O’Reilly are doing just fine, and stand to gain market share here as Advanced Auto Parts flounders.

As a result of all this, shares of AAP have fallen a whopping 33% and counting. This is a continuation of the trend we’ve watched form for the last year, as the company now sits 62% lower than it did last May.

So, if you’ve invested in AAP, what’s your next move – is it time to cut losses and move on? Or, is there any hope that the company can turn things around sooner rather than later? We’ve taken a look at the company through the VectorVest stock analyzing software and have 3 findings to share with you. These will help you make your decision with complete confidence…

Despite Good Upside Potential, AAP Has Poor Safety and Very Poor Timing

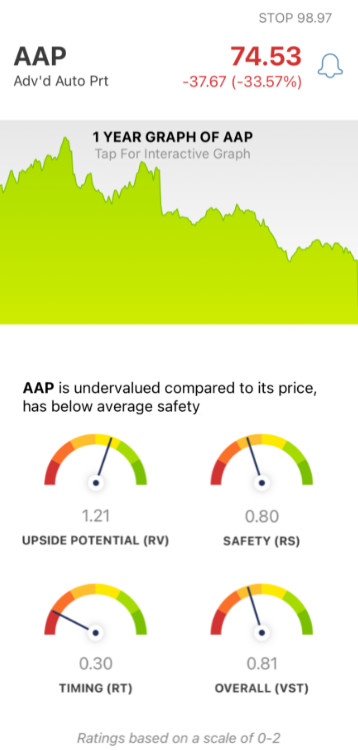

VectorVest is a proprietary stock rating system that simplifies your strategy, helping you win more trades with less work and less stress. It’s all based on 3 easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average. But, it gets even easier - because based on the overall VST rating for a given stock, the system provides a clear buy, sell, or hold recommendation at any given time. As for AAP, here’s what we’ve uncovered…

- Good Upside Potential: This indicator compares a stock’s 3-year price projection to AAA corporate bond rates and risk to offer better insights than a simple comparison of price to value alone. As for AAP, the RV rating of 1.21 is good - suggesting that the stock has solid long-term price appreciation potential. And, it’s undervalued right now - with a current value of $94

- Poor Safety: In terms of risk, AAP has poor safety - as evidenced by the RS rating of 0.80. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: The biggest issue for AAP right now is the strong negative price trend gripping the stock - which has only been strengthened by this latest earnings debacle. The RT rating of 0.30 is very poor. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

In the end, the overall VST rating of 0.81 is poor - but does that mean it’s time to cut losses and move on?

Don’t let emotion or guesswork influence your decision-making. Make a confident, calculated move based on a tried-and-true stock analysis system. Get a clear answer at VectorVest today through a free stock analysis on AAP!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While AAP is currently undervalued and has good upside potential, that’s where the positive news ends. After the latest earnings report, it’s clear the company has serious internal problems - with poor safety and very poor timing weighing it down.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment