Advanced Micro Devices Inc. (AMD) has been informed by US officials that the AI chip they’ve been developing for China will need additional licensing before it can be exported. Shares are down a bit today on this news, but as we’ll explore in just a moment, AMD is still worth buying.

The chip in question has been nerfed to a level that’s dramatically weaker than AMD’s chips here in the US. Still, regulators say it is too strong to sell abroad without getting a license through Commerce’s Bureau of Industry and Security.

This is not the first time we’ve seen this happen recently, either. Nvidia (NVDA) has relentlessly downgraded its own chips in an effort to gain Washington’s approval to export to China. Given this is one of our country’s biggest geopolitical rivals, though, it seems unlikely regulators will budge on the issue.

More specifically, there is concern that China could use the technology we develop here in the States to strengthen its own military forces. This fear initially prompted Joe Biden to lay out new export controls 2 years ago, and those standards were bolstered just a few months ago.

When Nvidia experienced this roadblock, it quickly developed a weaker solution to accommodate. However, AMD has not commented yet, and it’s unclear if they’ll even bother. The company has dramatically less Chinese market share than Nvidia, so it may not be worth the investment.

Back in December AMD unveiled its new MI300 chip lineup, which seeks to contend with those that Nvidia is producing. This series included the MI309, which was specifically tailored to the Chinese market.

Since that release, AMD has surged 71%. It’s up more than double that in the past year. So, do the government’s efforts to stifle AMD exports really pose a threat to the company? Or, is this a non-issue?

We’ve taken a look through the VectorVest stock analysis software and found 3 reasons AMD is still worth buying today.

AMD Has Good Upside Potential With Excellent Safety and Timing

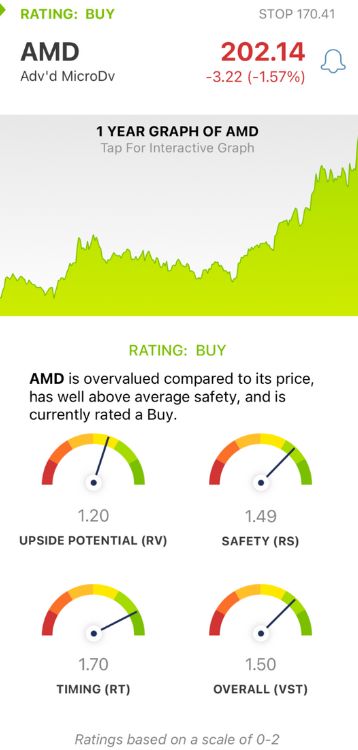

VectorVest is a proprietary trading system that simplifies your strategy by giving you all the insights you need in 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets better, though. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for AMD, here’s the current situation:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insight than a simple comparison of price to value alone. AMD has a good RV rating of 1.20 right now.

- Excellent Safety: The RS rating is a risk indicator. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.49 is excellent for AMD.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. As evidenced by the stock’s performance, AMD has an excellent RT rating of 1.70.

The overall VST rating of 1.50 is excellent, and it’s accompanied by a BUY recommendation in the VectorVest system. Don’t miss this opportunity - get a free stock analysis for AMD today and execute your next trade with confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AMD fell a few percentage points Tuesday on news that US regulators are blocking the export of its China-tailored AI chips. That being said, the stock still has good upside potential with excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment