This morning, Albertsons Companies (ACI) released a statement letting shareholders (and potential investors) know that a common stock dividend has been approved by the board of directors. This dividend is for the 5th quarter of fiscal 2022 and shareholders will receive $0.12/share of common stock.

This comes after impressive Q3 earnings where the company outperformed expectations. EPS of $0.87/share beat out analyst estimates of $0.67/share. Meanwhile, revenue came in over expectations at $18.2B compared to the expected $17.59B. Net income landed around $375 million, which came out to $0.20/share.

This news hasn’t manifested itself in any sort of meaningful activity on the stock market, though. ACI is only up about 1.3% as of 12PM EST.

Taking these two things into account, investors are wondering if now is a good time to buy Albertsons. The stock has slipped over the past three months, from $28.61/share to just $21.16/share. The hype around the acquisition rumors we discussed back in October has faded.

With that said, you’re going to want to see the updated recommendation through the VectorVest stock analysis software below.

ACI Has Good Upside Potential, But Poor Safety & Timing

The VectorVest system transforms the way you uncover and analyze opportunities in the stock market. It tells you exactly what to buy, when to buy it, and when to sell it - all based on a simple, intuitive stock analysis system that has outperformed the S&P 500 by 10x over the past two decades.

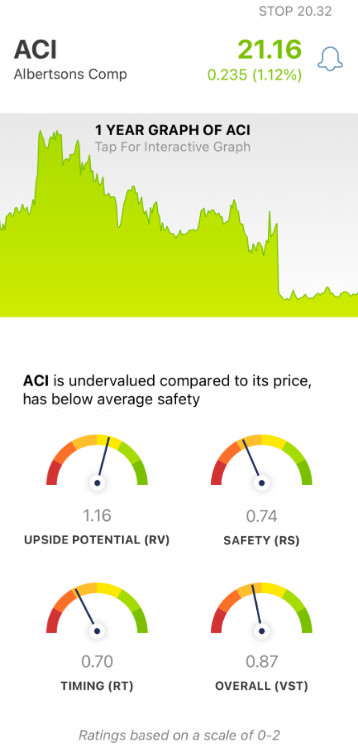

The best part? How straightforward a stock analysis is with VectorVest. You can rely on just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a scale of 0.00-2.00, with 1.00 being the average. Pick stocks over the average and win more trades!

Or, just follow the clear buy, sell, or hold recommendation that VectorVest offers up based on the overall VST rating - for any given stock, at any given time. It’s really that easy. As for Albertsons, here’s the current situation:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (3 years out) to AAA corporate bond rates and risk, giving you a better perspective on a stock’s value. As for ACI, the RV rating of 1.16 is good. And, the stock is currently undervalued at today’s share price of $21.16 - with a current value of $24.28.

- Poor Safety: Taking a look at ACI’s risk, VectorVest deems the stock to be unsafe - with a poor RS rating of 0.74 right now. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: In analyzing ACI’s price trend, we can see that the timing is poor - which is reflected by the RT rating of 0.70. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement - calculated day over day, week over week, quarter over quarter, and year over year.

These three ratings work out to an overall VST rating of 0.87 - which is just fair. Does that mean it’s still time to buy ACI? Or, should you hold off until a more positive price trend has formed? No need to play the guessing game or let emotion influence your decision-making - get a free stock analysis here for a clear buy, sell, or hold recommendation!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ACI, it is undervalued with good upside potential but it does have poor safety and timing right now - despite the positive news the company has released today.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment