As the desktop CPU market plunges, one stock situated within the industry continues to thrive – and that’s AMD. Despite record-low desktop CPU shipments, AMD (Advanced Microdevices) managed to report gains in the last quarter. What makes this particularly interesting is that AMD’s competitors – Intel, Nvidia, and more – are struggling. Yet, through a deep analysis of AMD’s stock, our system has uncovered 3 reasons the stock is rated a buy.

The Current Landscape of the Desktop CPU Market

Mercury Research – a company specializing in PC component market research (microprocessors, graphics components, and more) – released its market share results from the second quarter of 2022. As mentioned above, Mercury Research reported the largest year-over-year decline in microprocessors and graphics components sales since 1984. This plunge has been caused by OEMs reducing their inventory – which led to a drop in demand. Further exacerbating the issue were lockdowns in China, rapidly growing inflation, and overall economic turmoil.

Looking at other players in the industry, Intel reported a loss for the first time in a few decades. Similarly, Nvidia drastically underperformed by about $1.4 billion. So – how is AMD continuing to improve upon its already impressive profitability despite these conditions? What are they doing differently? Its revenue is up 70% year over year and thanks to higher data center and embedded segment revenue (amongst other things) and is preparing to launch new CPUs and GPUs – which will only add to its domination of the desktop and notebook PC market.

3 Reasons AMD is Rated a Buy: Despite a Treacherous PC Market

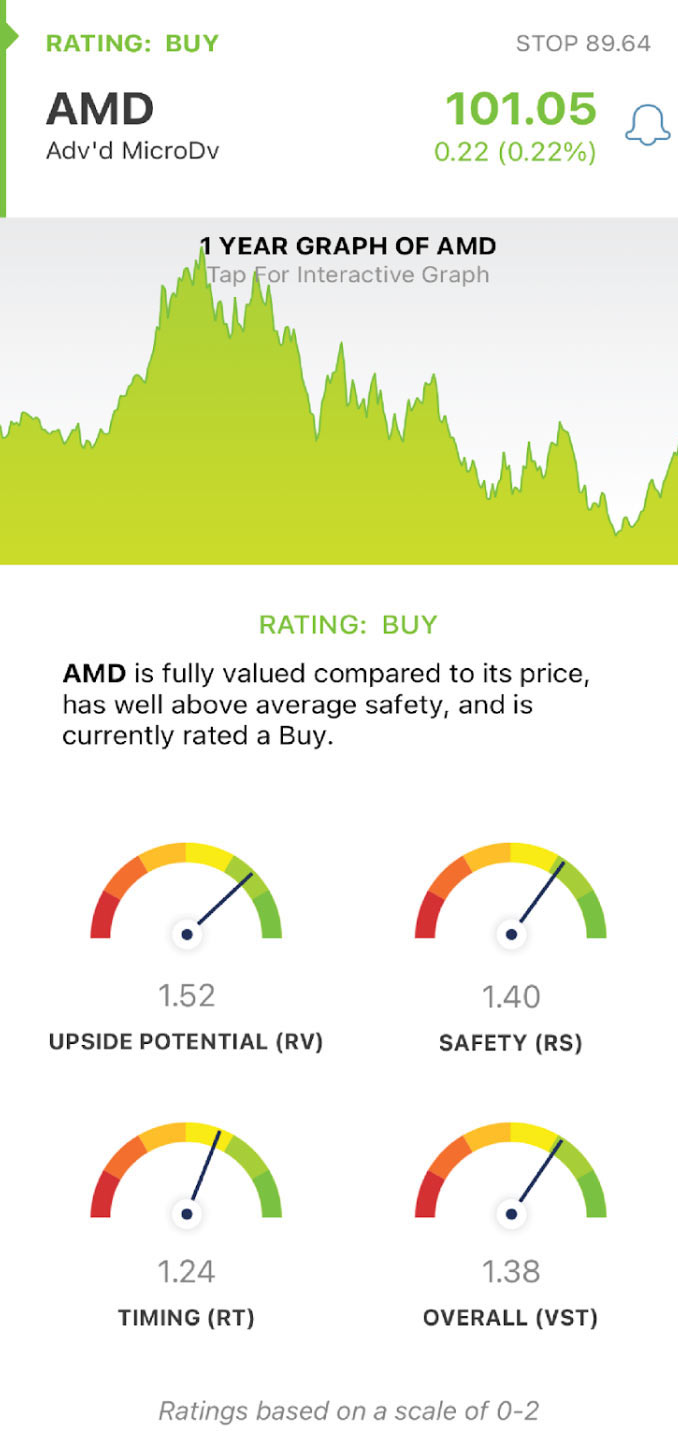

Those who are already invested in AMD have not seen the performance they may have hoped for – as the company stock peaked back in November of 2021 at a price of over $164/share. Since then, there has been a steady fall to earth, with a low point of $75/share back in early July. At the time, our stock forecasting system rated the stock a sell. But fast forward to mid-August and the stock is sitting back in the triple digits at just over $100/share, and is now being rated a buy. Here are three reasons why:

- Excellent Upside Potential: When looking at the relative value (RV) of AMD, you’ll see it’s been given a rating of 1.52 – which is excellent on a scale of 0.00-2.00. This suggests excellent long-term price appreciation potential.

- Very Safe: Investors can enjoy peace of mind entering a position in AMD when taking into account the very low degree of risk associated with this stock. Our system is showing an RS (relative safety) rating of 1.40 – which is far above average on our scale of 0.00-2.00. This is calculated by analyzing the consistency and predictability of AMD’s financial performance and business longevity – along with many other indicators.

- A Strong Trend in the Right Direction: Those who got into AMD early are being rewarded for their patience and commitment – as the RT (relative timing) for the stock is currently 1.24. This suggests a solid trend in the stock’s price movement in the right direction. This is a particularly important indicator for investors to monitor, though – as the RT will gravitate back towards 1.00 as the trend dissipates.

The VectorVest system ranks stocks by averaging the VST (value, safety, timing) together – and AMD boasts an incredible VST rating of 1.38. As such, it’s been rated a buy.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for AMD, it has incredible upside potential, it is safe, and the timing is pretty good at the moment.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment