Shares of American Express Co. (AXP) are up nearly 5% in Friday’s trading session after the company delivered first-quarter earnings that came in well above the analyst consensus.

New card acquisitions were way up for the quarter – more specifically, high-spending, high-credit quality customers that are as valuable as it gets for the company. Amex also saw an uptick in consumer card member spending in the US, up 8% year over year.

All of this led to $15.8 billion in revenue which matched the FactSet consensus. This was an 11% improvement year over year from just $14.3 billion this time last year.

What really has the market excited, though, is the profit side of things. The company delivered a net income of $2.4 billion which worked out to earnings of $3.33 per share. This was well north of the $2.95 analysts were expecting and a massive increase from this time last year when Amex reported just $1.8 billion in net income or $2.40 per share.

Other takeaways from the first quarter included a $1.3 billion consolidated provisions for credit loss, up from $1.1 billion in 2023, as a result of higher net write-offs.

Consolidated expenses climbed to $11.4 billion, a 3% increase contributed by more spending among card members, greater travel benefit use, and more investment in marketing.

Looking ahead to the full year, the company is aiming for earnings per share in the range of $12.65 to $13.15 on revenue growth of 9% to 11%.

AXP has been on a torrent space through 2024 thus far, up more than 25% in the past 3 months. That trend only got stronger today. We took a deeper dive into the stock itself through the VectorVest stock analyzer and found 3 reasons you may want to buy AXP now.

AXP Has Excellent Upside Potential, Good Safety, and Very Good Timing

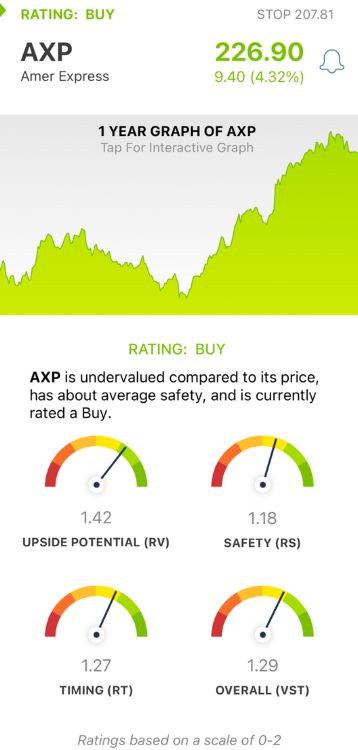

VectorVest helps you win more trades with less work and stress by delivering actionable insights at a glance. You’re given everything you need to know to make calculated decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating is placed on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average, saving you time and eliminating any uncertainty from your trading strategy.

Better yet, you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for AXP:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insight than the typical comparison of price to value alone. AXP has an excellent RV rating of 1.42. Further to that point, the stock is undervalued with a current value as high as $294/share.

- Good Safety: The RS rating is a risk indicator. It’s derived through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. AXP has a good RS rating of 1.18 right now.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. This paints the full picture for investors. As for AXP, its very good RT rating of 1.27 reflects its recent performance.

The overall VST rating of 1.29 is very good for AXP, and enough to earn the stock a BUY recommendation in the VectorVest system. But don’t make that trade just yet - learn more about this opportunity to maximize your profits with a free stock analysis at VectorVest before you do anything else!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AXP matched the analyst consensus on the top line and blew it out of the water on the bottom line, fueled by new cardholder growth and increased cardholder spending. The stock itself has excellent upside potential, good safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment