Apple’s accolades are endless, but its recent legal trouble hurt the stock’s performance despite its far-reaching influence. The company is the first to hit a $3 trillion valuation, it provides endless tech options for consumers, and also owns the title of 2023’s largest company globally. But success didn’t stop the company’s stock (AAPL) from dropping 0.28% on Tuesday, while the rest of the market simultaneously experienced some of the best numbers of the year. What’s causing the tech behemoth to underperform? The Apple Watch was banned from being sold in the US following the medical company Masimo’s claim of technology infringement, and the reactions are the aftermath. Maybe it’s the beginning of cracks in the company, or maybe it’s the perfect time to invest!

It wasn’t just Tuesday that Apple fell; it was the 4th day in a row of a downward turn since the news has been swirling around the widespread impact of the ban. However, Tuesday was the day AAPL filed for an appeal to the International Trade Commission (ITC) and was denied. The ban includes all Apple Watches with the pulse oximeter, which caused Apple to stop the production of the Apple Watch Series 9 and the Ultra 2. The watches infringe on Masimo’s pulse oximeter patent, and the Biden Administration declined to veto the decision, hurting Apple’s plans to appeal the ban.

Will the ban cause AAPL to continue downwards? The company could continue downwards if the issue isn’t resolved quickly, but it won’t be detrimental across the board. The trillion-dollar company has hundreds of other products, primarily focusing on MacBooks and iPhones. Apple’s valuation will not be devastated by the legal issues. In fact, the legal issues provide an opportunity for investors.

The recent performance and legal troubles of AAPL might cause hesitation in investors, but VectorVest’s software sees the potential for a company’s recovery outside of the current legal offsets. The software uses data and financial metrics to determine if AAPL is worth the investment despite the discontinuation of the watches and underperforming stock.

Apple’s Fumble Is Your Opportunity to Buy

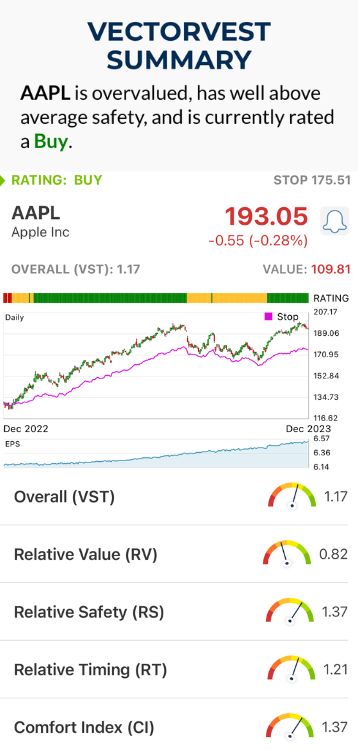

Legal troubles come and go for companies pumping out new and innovative products, but behind each product is the company's financial health. Obviously, Apple is a giant, but investors should examine the varying elements that evaluate AAPL’s health before deciding to invest money in the company. VectorVest software generates three summary ratings: relative value (RV), relative safety (RS), and relative timing (RT), each scored from 0.00 to 2.00, with 1.00 representing the average; then the overall VST (Value-Safety-Timing) rating provides a decisive buy, sell, or hold suggestion for a specific stock. VectorVest’s three summary and overall ratings evaluated AAPL and concluded with a BUY recommendation.

- Poor Upside Potential: The Relative Value score for AAPL is 0.82, making it decently above average on a scale of 0.00 to 2.00. It is overvalued, with a current price of $193.05 but a value of $109.81; because of the surge in tech, the company's watch ban, and the quarter’s recent performance, it is determined as overvalued.

- Very Good Safety: AAPL has a Relative Safety score of 1.37, which is above average on a scale of 0.00 to 2.00, related to its large market cap and ability to recover during financially stressful times.

- Good Relative Timing: The relative timing of AAPL is 1.21, rated as good on a scale of 0.00 to 2.00. The metric considers daily, weekly, quarterly, and yearly stock movements. Historically, Apple has outperformed the market and continually delivered record-breaking years, betting on continued positive performance.

The overall VST rating for AAPL is 1.17, which is considered above average and followed by a BUY recommendation in the VectorVest system. BUY indicates that if you own the stock, you should keep it in your portfolio and consider getting more, and if you’re not already invested, definitely buy in.

VectorVest shows the company's performance as an overview, which shows how it’s still valuable to jump in now during a downturn. You can see the risks associated with the company through the Very Good Safety. You can learn more about how the system works or the current opportunity with any given stock through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying stocks with proper analysis and at the opportune moment, despite the market’s reaction. Apple’s product may be banned, but VectorVest helped investors visualize its financial health. The AAPL stock has poor upside potential, very good safety, and good relative timing, with a recommendation to BUY. Allowing you to see all the necessary components to make an informed decision.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment