Friday morning was brutal for Autolus Therapeutics (AUTL) and its investors as shares plummeted over 35%. This was caused by the announcement executives at the company made yesterday after the market closed. In short, the company is diluting the shares and diminishing stock value.

The company plans to initiate 75 million American depositary shares at a measly price of $2/share. Further, they are granting underwriters of the public offering a 30-day option to buy up to 11.25 million shares at that price of $2.

The reason the stock plummeted is simple – Autolus is going to flood the market with shares of its stock that fall below what the price closed at yesterday (just shy of $3/share). The market quickly corrected as investors sold off their shares at as high a price as possible before this happens. It’s likely investors will buy back in at a lower price when this secondary stock offering goes through.

The stock has performed poorly over the last year and now sits over 70% lower than 365 days ago. However, the positive out of all of this is that Autolus will generate an additional $150 million in proceeds from this move. As the clinical study of Autolus’ obe-cel program progresses and results look to be positive, this will prove helpful in getting the treatment to market.

But from purely a stock analysis standpoint, is there any reason to believe that Autolus will turn things around? Is it even worth buying back at the lower price point? There are three red flags investors need to see in relation to AUTL stock – keep reading to learn more.

Three Major Issues with AUTL Stock Today

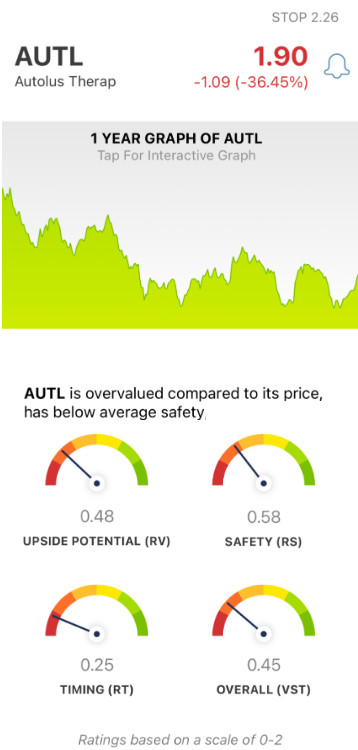

The VectorVest stock forecasting software will change the way you uncover and assess opportunities in the stock market. It tells you everything you need to know about a stock in just three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is easy based on the simple rating system – they sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over 1.00 indicate overperformance and vice versa.

And what really makes this system special is the fact that you’re given a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotional decision-making. Just follow the system and win more trades. As for AUTL stock, here’s the current situation:

- Very Poor Upside Potential: the RT rating looks at the long-term price appreciation potential for a stock three years out – comparing it to AAA corporate bond rates and risk. As for AUTL, the RT rating of 0.48 is very poor. Moreover, the stock is still overvalued even at the low price point of $1.90/share. The current value is just $0.78.

- Poor Safety: an indicator of risk, the RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for AUTL, the RS rating of 0.58 is poor.

- Very Poor Timing: In looking at the price trend for AUTL, it’s clear to see that the timing is very poor – and the RT rating of 0.25 reflects that. This rating analyzes price trend day over day, week over week, quarter over quarter, and year over year. It looks at the direction, dynamics, and magnitude of a stock’s price trend to paint the full picture for investors.

Now, the overall VST rating of 0.45 is very poor on a scale of 0.00-2.00. So if you haven’t already, is it officially time to close out your position and cut losses? Get a clear answer on your next move with our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for AUTL, it is overvalued with very poor upside potential, poor safety, and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment