Johnson & Johnson (JNJ) is known for baby products and the single-shot COVID-19 vaccine, making it a significant booster if you invested before the pandemic. However, following recent lawsuits, JNJ settled to pay $700 million following an investigation over its baby powder, while the COVID-19 vaccine was discontinued in the US, leading to an underwhelming performance in 2023. Is the giant healthcare company still worth buying?

Let’s start with the lawsuits; Johnson & Johnson faces over 50,000 lawsuits alleging its talc-based baby powder contained asbestos, leading to cancer. JNJ has agreed to a tentative deal to pay $700 million to settle with over 40 states evaluating whether powder risks were intentionally hidden. The agreement exceeds JNJ’s $400 million amount set aside for cases such as this. Previously, it has paid $2.1 billion in damages for related ovarian cancer cases. This ongoing legal challenge is a financial risk that raises investors’ red flags, demonstrating uncertainty regarding the company’s future liabilities. On top of the lawsuits, the COVID-19 vaccine was discontinued in May of 2023, hurting the company’s source of revenue and adding to a share price dip of 11% in the fiscal year of 2023.

JNJ’s growth strategy amid bleeding money is the element that makes the company worth investing in! Impactful acquisitions include Ambrx for $2 billion and Abiomed for $16.6 billion, which initially decreased cash, but both acquisitions allowed for new product revenue and enhancements in the medical device business. Executives at JNJ also feel confident in the future, stating at a conference on December 8th that “the company will be able to deliver on its 2023 guidance,” which includes narrowing in on the high end of Adj EPS to $10.07-10.13 and Operational Revenue of $84.4-84.9 billion. The consistent financial outlook aligns with a strong free cash flow over the past year of $15.7 billion. The positive growth will keep growing, making Johnson & Johnson well-positioned to continue a growth trajectory of pursuing further acquisitions, indicating a long-term focus on expansion. Expansion will be crucial for the company as old revenue sources are no longer reliable.

Do the recent lawsuits and difficulties for JNJ bring up red flags? Yes. Is the company with a market cap of $389.06 billion capable of recovering from those downturns? Absolutely! But what should investors do? Use VectorVest! The software, which is geared towards analyzing a company for all of its existing metrics, prior performance, and future potential, can give you a solid recommendation on what to do amidst controversial periods of time for a company.

Buy Johnson & Johnson Stock, Not It’s Baby Powder

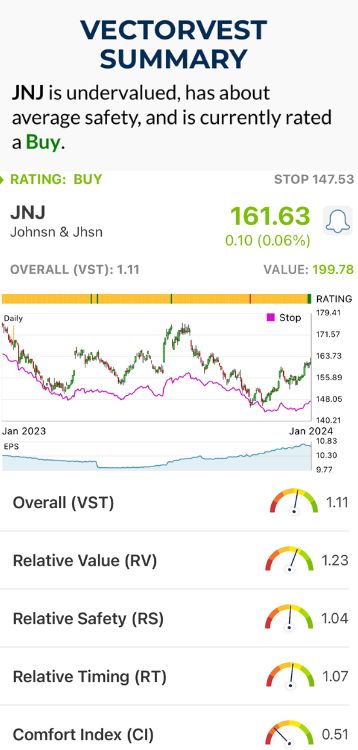

A rocky year has thrown doubt on the stability of Johnson & Johnson, which calls for further investigation of the company’s financial outlook. A legitimate financial analysis considers several components before making a decision, which is why VectorVest software generates three summary ratings: relative value (RV), relative safety (RS), and relative timing (RT), each scored from 0.00 to 2.00, with 1.00 representing the average; then the overall VST (Value-Safety-Timing) rating provides a decisive buy, sell, or hold suggestion for a specific stock. VectorVest’s three summary and overall ratings evaluated JNJ and concluded with a BUY recommendation.

- Good Upside Potential: The Relative Value score for JNJ is 1.23, making it decently above average on a scale of 0.00 to 2.00. It is undervalued, with a current price of $162.62 but a value of $199.78 because of the recent acquisitions and potential for increased product revenue.

- Poor Safety: JNJ has a Relative Safety score of 1.04, which is above average on a scale of 0.00 to 2.00, related to its large market cap and future ability to recover from financial losses.

- Fair Relative Timing: The relative timing of JNJ is 1.07, rated above average on a scale of 0.00 to 2.00. The metric considers the stock movements daily, weekly, quarterly, and yearly, so even with the poor earnings report, the overall timing of Johnson & Johnson is neutral despite the downturns in 2023, showing the company's overall safety.

The overall VST rating for JNJ is 1.11, which is considered above average and followed by a BUY recommendation in the VectorVest system. BUY indicates that if you own the stock, you should keep it in your portfolio and consider getting more, and if you’re not already invested, buy-in.

Although the initial reaction to JNJ’s decline in revenue seems off-putting for investors, VectorVest shows the company's performance as an overview. You can see the trajectory and risks associated with the company through the Good Upside Potential and the Fair Relative Timing metrics. You can learn more about how the system works or the current opportunity with any given stock through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying stocks with proper analysis, not just the market’s movements for that day. Johnson & Johnson had an interesting year with lawsuits and several positive acquisitions, making it challenging to evaluate how to move forward with an investor portfolio. VectorVest helps investors visualize the financial health of a company. The JNJ stock has good upside potential, fair safety, and fair relative timing, with a recommendation to BUY. Allowing you to see all the necessary components to make an informed decision.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment