Block (SQ) shares tanked as much as 20% in Thursday morning’s trading session before bouncing back up to around a 13% loss. This all came as a notorious short seller – Hindenburg Research – finalized its “2-year investigation” into the company and uncovered alarming findings.

Hindenburg claims that Block is complicit in criminal activity, allowing unbanked users to leverage its Cash App service freely. There is a blatant disregard for AML and KYC laws (Anti Money Laundering & Know Your Customer).

This information came from interviewing multiple past employees – who admitted that the company has deficient compliance programs for Cash App that allow this type of activity to go unchecked. In fact, as many as 40-75% of accounts were either fake, involved in fraud, or linked to other accounts held by a single individual.

Beyond acting as a safe haven for criminals to exchange funds, Hindenburg points to a few other reasons why Block is its latest short position. One of these is the fact that those same employees mentioned earlier noted that user concerns are often ignored, as are internal issues. Terms like “Wild West” are used to describe the inner workings at Block.

And, Hindenburg claims that Block is going as far as misrepresenting key financial figures. For example, the company avoids regulatory caps on interchange fees by routing transactions through a small bank.

Now – Hindenburg doesn’t launch these investigations and issue its findings for the sake of morality. They find opportunities to short stocks and then issue their findings to capitalize on market sentiment. Because the group seeks to profit from these investigations, it’s worth wondering how much of this investigation is factual. All of this is to say Hindenburg has an agenda – and questioning the validity of this research early on is justified.

Either way, the damage has been done. If you’re currently invested in Block, you may be wondering if now is the time to get out. Or, perhaps you’re wondering if this steep drop-off presents a good opportunity to buy in at a great value. We’ll help you find a clear answer on your next move through the VectorVest stock analyzer software below:

Despite Fair Upside Potential and Safety, the Timing is Poor for SQ Right Now

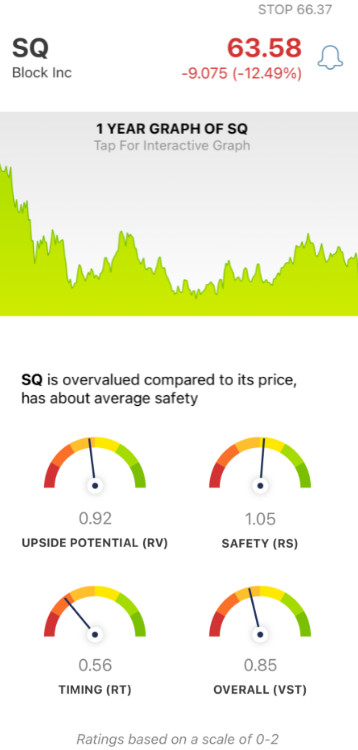

The VectorVest system simplifies your trading strategy by giving you all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

But to make things even easier, VectorVest offers an overall VST rating for any given stock, at any given time, along with a clear buy, sell, or hold recommendation. As for SQ, here’s what’s going on:

- Fair Upside Potential: The RV rating assesses a stock’s price projection 3 years out compared to AAA corporate bond rates and risk. And right now, the RV rating of 0.92 is below the average - but fair nonetheless. With that said, the stock is overvalued as it stands today. The current value is just $30.94.

- Fair Safety: In terms of risk, SQ is fairly safe with an RS rating of 1.05. This is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: As you can imagine, the market has reacted negatively to this news sending shares tanking. Thus, the timing is poor right now - and the RT rating of 0.56 reflects that. It’s calculated by analyzing the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST Rating for SQ is fair at 0.85 - but is a ways below the average. So, what should you do next? Get a clear buy, sell, or hold recommendation for SQ to make your next move with confidence and clarity - analyze the stock free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SQ, it is overvalued right now with fair upside potential and safety - but as a result of Hindenburg’s investigation, the timing is poor as share prices continue to tank.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment