Tools like ChatGPT are transforming the world right before our very eyes. We’re seeing the dismantling of the school system as students are able to write entire essays at the click of a button.

And businesses are seeing the value in AI, too. The latest to buy into the hype is BuzzFeed (BZFD) – a digital media company that has been dwelling toward the bottom of the stock exchange since going public a few years ago.

Today, though, the company’s stock has risen nearly 60%. And in the last week, the stock is up 319%. In the last month, it’s up 445%. All because the company has decided to go all-in on AI content generation.

OpenAI’s ChatGPT software is going to be a key part of the BuzzFeed content creation process. It will allow the company to scale down costs while scaling up output. CEO Jonah Peretti says that this is an imperative step in looking forward and taking steps to recovery, as the stock is still down 65% since going public – even after all the hype in the last month or so.

Why is the idea that BuzzFeed will streamline its content creation process getting investors so excited, though? Beyond the efficiency this will unlock for the company, it is leading to deals with other digital media companies – like the Facebook parent company. META has plans to partner with BuzzFeed to bring more creators to its platforms as a result of this news.

You’re probably wondering if this hype is substantiated – and if it’s truly worth buying BuzzFeed stock as a result of this news. Well, you don’t have to play the guessing game or let emotion influence your decision-making. Get a clear buy, sell, or hold recommendation by reading below – we’ve analyzed the stock through VectorVest’s stock analysis software.

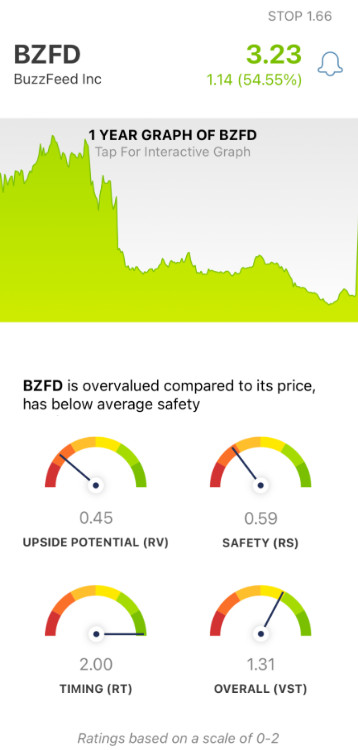

Despite Very Poor Upside Potential & Poor Safety, BZFD Has Excellent Timing

The VectorVest system simplifies your trading process by telling you exactly what to buy, when to buy it, and when to sell it. You’re given all the insights you need in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00, with 1.00 being the average. Figures over the average indicate good performance and vice versa. But the real kicker is that based on these three ratings, VectorVest can provide you with a clear buy, sell, or hold recommendation for any stock, anytime. As for BZFD, here’s what you need to know:

- Very Poor Upside Potential: Looking at the stock’s long-term price appreciation potential three years out compared to AAA corporate bond rates and risk, VectorVest has given a very poor RV rating of 0.45 Moreover, the stock is now considered overvalued – with a current value of just $1.27.

- Poor Safety: The RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. And as of now, the RS rating of 0.59 is poor for BZFD.

- Excellent Timing: The one thing BZFD has going for it is the undeniable price trend that has formed over the past few weeks – and this trend has been solidified with today’s news. The RT rating of 2.00 is excellent, tipping out the scale. It’s calculated based on the direction, dynamics, and magnitude of the stock’s price movement. And, it’s calculated day over day, week over week, quarter over quarter, and year over year.

All things considered, BZFD has a very good overall VST rating of 1.31. But is this rating just skewed by today’s hype? Or, is this stock really worth adding to your portfolio? Get a clear answer on your next move by analyzing the stock free here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, BZFD is overvalued with very poor upside potential and poor safety – but the timing for this stock is excellent.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment