Foot Locker (FL) started Monday morning on the wrong side of the bed falling nearly 5% in pre-market trading. Since the bell sounded though, the stock has recovered those losses and settled around a 1% loss. All this came after Citi Bank downgraded the stock to a sell.

Analyst Paul Lejuez believes the stock is positioned to underperform in the remainder of 2023, and issued his update just 2 days before the company is set to declare earnings. The holiday season won’t offer the same lift as it did in years past for the footwear brand.

The company is suffering from not just a weaker economic climate as consumers are more cautious with their spending, but also a surplus of slow-moving inventory. Lejuez believes Foot Locker will be left with no choice but to heavily discount this excess inventory to make room for next year’s styles, contributing to profitability challenges.

Another challenge for the retailer is that it’s reliant on hype for brands like Nike or Adidas – brands that have seen slowing sales so far this year. Without the hype around these footwear brands Foot Locker will have to rely on discounting even further.

Looking to the upcoming earnings report on Wednesday the 29th, analysts are rethinking their estimates. Lejuez in particular is forecasting a dramatic underperformance, changing his EPS call from 26 cents to just 10 cents per share. He also suspects that Foot Locker will cut its full-year earnings guidance to just $1.

Wednesday’s report will be a big one, as the company has already missed guidance for the past two quarters, and investors are anxious for a win. That being said, FL has been rallying in the right direction leading into the earnings day. The stock has gained 12% in the past month and more than 32% in the past 3 months.

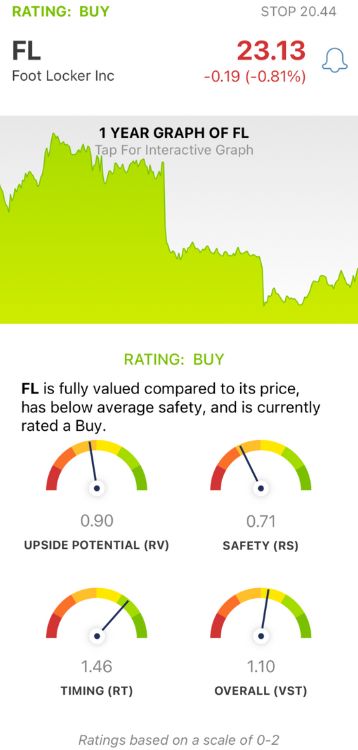

And while Lejuez is warning investors to sell, the VectorVest stock forecasting software paints a very different picture – the system is showing a BUY rating for FL right now. Here’s what you need to see…

Despite Poor Safety, FL Has Fair Upside Potential and Excellent Timing

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 simpler ratings - eliminating guesswork, human error, and emotion. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-interpret scale of 0.00-2.00, with 1.00 being the average. You’re then given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for FL, here’s what we found:

- Fair Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk - offering far superior insights than a simple comparison of price to value alone. FL has an RV rating of 0.90, which is below the average but deemed fair nonetheless.

- Poor Safety: The RS rating is an indicator of risk. It’s derived from a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. FL has a poor RS rating of 0.71.

- Excellent Timing: As you can see from the stock’s performance, the timing is excellent for FL - and the RT rating of 1.46 reflects that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.10 is considered good for FL - and it’s enough to earn the stock a BUY recommendation right now. Get a free stock analysis to learn more about this opportunity and the VectorVest system itself!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. FL is facing a few challenges coming into Wednesday’s earnings report and the remainder of the year, and some analysts believe it’s time to sell. VectorVest does not. Despite poor safety, this stock has fair upside potential and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment