Shares of Coinbase (COIN) are down more than 5% today despite delivering a solid first-quarter earnings performance yesterday. The crypto trading platform beat analyst estimates on both the top and bottom lines thanks to a Bitcoin price surge during the middle of Q1.

Revenue came in at $1.64 billion compared to the $1.34 billion analysts were forecasting. Adjusted earnings per share of $2.15 beat the $1.09 consensus, too.

The quarter showed a very different Coinbase than we saw this time last year, reporting net income of $1.18 billion whereas we witnessed a $78.9 million loss back in 2023. This comes after the exchange reported its first profit in 2 years just a few months back.

Much of the performance for Q1 can be attributed to increased trading volume as crypto prices soared. Consumer transaction revenue was up more than 100% year over year to $935 million, while total transaction revenue saw nearly a 3x jump to $1.08 billion. Subscription and services revenue brought in just $511 million.

Bitcoin hit an all-time high of $73,000 just over a month ago in March, while Ethereum experienced its own surge to over $4,000. These make up the two biggest assets traded on the platform, and when they do well, Coinbase follows suit.

That’s to say that when they underperform – as we’ve seen since the peak in March – COIN comes back down to earth as well. The stock has fallen more than 14% in the past month. To be fair, though, it experienced a massive surge in price amidst the crypto bull run, soaring nearly 120% in just a few months. A correction may have been due.

It’s worth noting that quite a few insiders have been offloading COIN shares, taking profits during the first quarter. 4 members of the company’s C-suite sold a combined $383 million in stock. So, if you currently hold COIN, is this your sign to take profits too?

We’ve taken a look at this opportunity through the VectorVest stocks software and found 3 things you need to see whether you’re currently invested in COIN or looking to trade this stock.

COIN Has Poor Upside Potential Despite Fair Safety and Good Timing

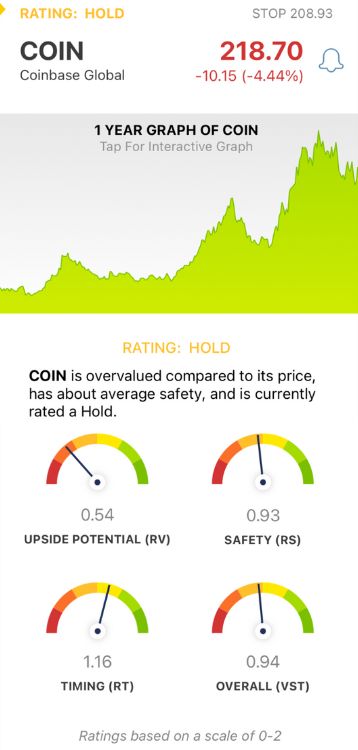

VectorVest empowers you to win more trades with less work by delivering clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. Better yet, the proprietary stock rating system gives you a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time.

Here’s what you need to know about COIN:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. As for COIN, the RV rating of 0.54 is poor. The stock may be overvalued after its recent run with a current value of just $30.66.

- Fair Safety: The RS rating is an intuitive risk indicator. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. COIN has a fair RS rating of 0.93, which is just below the average.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. COIN has a good RT rating of 1.16 reflecting the stock’s performance so far through 2024, as it still sits 27% higher on the year.

The overall VST rating of 0.94 is just below the average but deemed fair nonetheless. COIN is currently rated a HOLD in the VectorVest system - but there are a few other things you’re going to want to see before you make your next move one way or the other.

So, get a free stock analysis today and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. COIN delivered an impressive Q1 performance boosted by the Bitcoin boom, recording a beat on the top and bottom lines. However, the stock has come down since March, experiencing a price correction after soaring more than 100%. It has poor upside potential, fair safety, and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment