Apple (AAPL) always stirs up commotion when a new product release is teased. But this week, news of the Apple Vision Pro sent shock waves throughout the tech world. And with the upcoming iPhone 15 in just a few months, some analysts suspect the company is rapidly approaching a $4 trillion valuation.

Research firm Wedbush’s Dan Ives backs this claim up by pointing to 250 million iPhones that haven’t been upgraded in the past 4 years. And, Ives suspects this is the year consumers will give in and upgrade. In fact, he suspects 2023 could see as high as 235 million total iPhone unit sales.

This is coupled with the upcoming release of the Vision Pro – Apple’s VR headset. While the price reveal of $3,499 led to no shortage of jokes and memes, the product is said to be revolutionary. While it won’t be for everyone at that price point, people are undoubtedly going to buy it.

Now, just how many people are going to buy it remains to be seen. However, Wedbush has set its target for first-year sales at 150,000 units, with second-year sales exceeding 1 million units. Bank of America is taking a stronger stance, expecting a whopping 1.5 million units in the first year.

As a result of all this, Wedbush raised its price target on AAPL from $205 to $220. This would be a 23% increase, and the firm expects this to happen over the next 12 months.

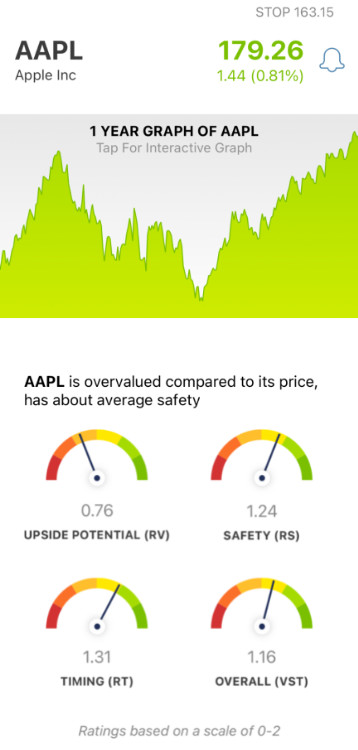

While the stock initially dipped on the news of a $3,500 VR headset, shares have turned around so far in Thursday’s trading session – up nearly 1%. The stock has been rallying hard since January of this year when it sat at just $125/share. It’s climbed more than 43% since then and now sits at $179/share.

Whether you’re currently invested in the company or are wondering if now is the right time to buy, you’re going to want to see the 3 things we’ve uncovered through the VectorVest stock analyzer below.

Despite Poor Upside Potential, AAPL Has Good Safety and Very Good Timing

The VectorVest system simplifies your trading strategy by giving you clear insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these ratings sits on its own scale of 0.00-2.00, with 1.00 being the average.

This allows for quick and easy interpretation, helping you win more trades with less work and stress. But, it gets even easier. VectorVest offers a clear buy, sell, or hold recommendation for any given stock, at any given time, based on these 3 ratings. As for AAPL, here’s what we found:

- Poor Upside Potential: The RV rating is an indicator of a stock’s long-term price appreciation potential in comparison to AAA corporate bond rates and risk. And right now, the RV rating of 0.76 is poor. On top of this, the stock is overvalued. The current value is just $88.

- Good Safety: In terms of risk, AAPL has good safety – as evidenced by the RS rating of 1.24. This rating is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: As you can see by looking at how AAPL stock has trended in the past few months – and really since the year began – the stock has very good timing. The RT rating of 1.31 confirms this. It’s based on the direction, dynamics, and magnitude of the stock’s price movement. The RT rating is calculated day over day, week over week, quarter over quarter, and year over year.

Now, the overall VST rating of 1.16 is good – but is it enough to justify adding AAPL to your portfolio or bolstering your existing position? Or, should you wait to see how the upcoming releases are actually received before making a move?

Don’t play the guessing game or let emotion get in the way of your decision-making. Get a clear buy, sell, or hold recommendation through a free stock analysis today – you’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite the initial reaction to the Apple Vision Pro, analysts suspect it could be the missing piece to a $4 trillion company. This, coupled with a boost to iPhone sales, could send shares as high as $220 in the next 12 months. While the upside potential for AAPL is poor right now, it has good safety and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment