Shares of Crowdstrike (CRWD) are up more than 15% Wednesday morning after the company delivered Q4 earnings that topped analyst expectations on both the bottom and top lines. The company also announced news of an acquisition alongside its guidance for the year ahead.

The cybersecurity company brought in revenue of $845 million, a 33% growth year over year. The consensus called for $839 million. Meanwhile, adjusted earnings came in at 95 cents per share compared to the consensus of 82 cents per share.

The guidance for the current quarter and the full year are also optimistic. Crowdstrike is forecasting adjusted earnings of 89 to 90 cents on revenue of $902 million to $906 million. The consensus is calling for just 82 cents per share and $899 million.

Looking further down the road to the entire 2025 period, the company is aiming for earnings between $3.77 and $3.97 on revenue between $3.925 billion to $3.989 billion. This is relatively in line with analyst estimates at $3.76 per share on sales of $3.938 billion.

A while back, Crowdstrike set forth a goal to generate $10 billion in annual recurring revenue by 2030. The company says it’s on pace to make this vision a reality, although there is a way to go with an annual recurring revenue of just $3.44 billion.

But, the acquisition of Flow Security may help support these efforts. Crowdstrike announced yesterday that it had acquired the company in a cash and stock deal in order to enhance its cloud data security offerings. The company says this move will help protect data in all states – from data to code, to application, to device, and cloud.

All of this news has bolstered what was already a strong positive price trend for CRWD, which is now 40% higher in the last 3 months.

That being said, should you buy this stock today? We’ve taken a look through the VectorVest stock forecasting software and see a few reasons to consider it…

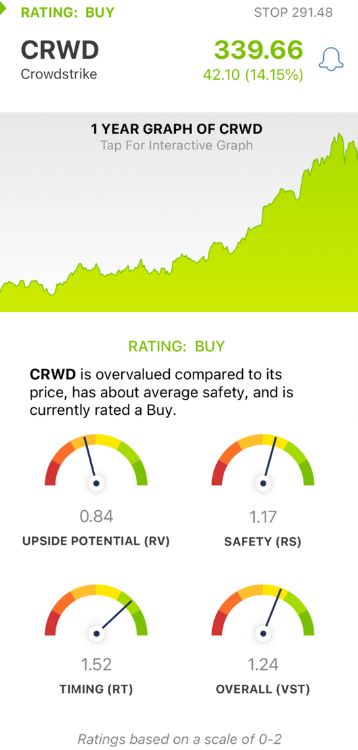

CRWD Has Poor Upside Potential, But Good Safety and Excellent Timing Earn it a Buy

VectorVest helps you save time and stress while winning more trades. This is only possible through a proprietary stock rating system that gives you all the insights you need in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).Each sits on its own scale of 0.00-2.00 with 1.00 being the average,

making interpretation quick and easy. It gets even easier, though. You’re presented with a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we discovered for CRWD:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. CRWD has a poor RV rating of 0.84 right now.

- Good Safety: The RS rating is a risk indicator that’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.17 is good for CRWD.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.52 is excellent, reflecting CRWD’s performance in both the short and long term.

The overall VST rating of 1.24 is very good for CRWD, and it’s enough to earn the stock a BUY recommendation. But before you do anything else, we encourage you to learn more with a free stock analysis at VectorVest.

Don’t miss out on this opportunity to transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CRWD surpassed analyst expectations on both the top and bottom lines while maintaining an optimistic outlook for the road ahead. The company is also reinvesting in itself through acquisitions, showing it is well on its way to reaching its $10b AAR goal. The stock may have poor upside potential, but its safety is good and its timing is excellent.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment