Robinhood (HOOD) has been on a tear through 2024 so far, up more than 43% year-to-date fueled by an uptick in retail trading, particularly for Bitcoin. However, one analyst believes that this trend is poised to reverse and has changed his outlook from neutral to sell as a result.

Citi analyst Christopher Allen says that HOOD has been driven up in tandem with Bitcoin to a point where the stock is now overvalued. His concern is that when Bitcoin comes back down, so too will HOOD.

The stock has a 92% correlation with Bitcoin through the first 4 months of this year, but crypto as a whole makes up just 13% of first-quarter revenue.

With the halving of Bitcoin set to take place later this month, there’s a lot of uncertainty about what this could mean not just for crypto but for companies that rely on it – like Robinhood, Coinbase, and other exchanges.

Historically, Bitcoin prices have soared when a halving takes place, which is when new token issuance is cut in half. Demand spikes as supply plummets, simple economics. However, the new record highs that Bitcoin has found leave analysts like Allen unsure that this will be the case again.

Allen does acknowledge that Robinhood as a company has made an impressive turnaround from a fundamental standpoint amidst healthy trading activity and growth in deposits, but the downside simply outweighs the potential upside.

Along with crypto concerns, he sees risks in slower retail activity or a market pullback as a whole. As a result, his new price target is $16 – which is an uptick from $13 – but still suggests HOOD could fall 13% given today’s price.

That being said, HOOD is up 83% in the last year, and VectorVest actually sees reason to buy this stock still today. We’ve taken a look through the stock forecasting software and found 3 things you need to see before you do anything else with this stock…

HOOD Still Has Fair Upside Potential and Safety With Excellent Timing

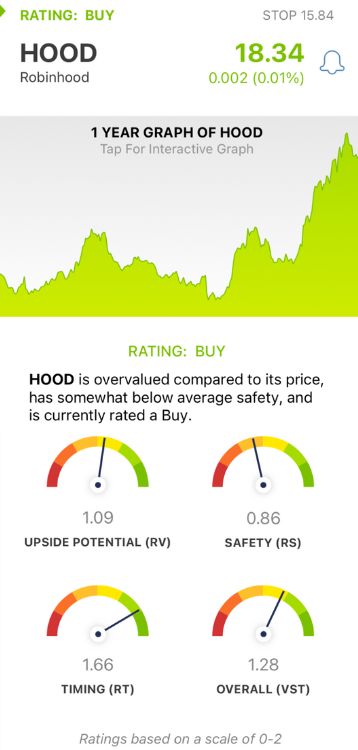

VectorVest is a proprietary stock rating system that delivers clear, actionable insights in just 3 ratings, simplifying your strategy to save you time and stress while empowering you to win more trades. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. Just pick safe, undervalued stocks rising in price to win more trades!

The system even goes as far as presenting you with a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for HOOD, here’s what we’re seeing right now:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers much better insight than the typical comparison of price to value alone. HOOD has a fair RV rating of 1.09.

- Fair Safety: The RS rating is a risk indicator. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.86 is a ways below the average, but deemed fair nonetheless for HOOD.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.66 is excellent for HOOD, reflecting the stock’s performance over the last year or so.

The overall VST rating of 1.28 is very good and earns HOOD a BUY recommendation in the VectorVest system. But before you go make your next move, take advantage of a free stock analysis at VectorVest to get the full scoop. Win more trades with less work and stress by leveraging the VectorVest system today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HOOD got a downgrade amidst concern about what the Bitcoin halving could mean for the trading exchange as the stock appears to be overvalued. Nevertheless, VectorVest still sees fair upside potential and safety for this stock paired with excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment