Walt Disney stock (DIS) is up more than 7% in Thursday morning’s trading session after the media and entertainment company reported fourth-quarter earnings that sparked hope among investors and analysts alike.

The company grew revenue 5.4% year over year to $21.35 billion. This narrowly beat the analyst consensus of $21.33 billion. EPS of 82 cents also outperformed the consensus of 70 cents per share.

There are so many moving parts within the Disney ecosystem, but the main segments under the microscope are streaming, theme parks/resorts/cruises, and ESPN.

Disney’s streaming segment is still losing money, but the losses are becoming narrower and narrower. The $387 million loss for the quarter is a dramatic improvement from this time last year when the company reported a loss of almost $1.5 billion.

This turnaround was bolstered by the addition of 7 million subscribers in the 4th quarter, as the company now boasts 150.2 million total Disney+ subscribers. Analysts were looking to see just 148.15 million.

Meanwhile, Disney Experiences (theme parks, resorts, cruises) picked up the weight to drive profitability. Revenue from the segment grew 13% to $8.16 billion. CEO Bob Iger says that this segment will receive a $60 billion investment to supercharge results.

All eyes are on ESPN, though, as Disney has announced its intention to take the network directly to consumers. Iger is optimistic that Disney can transform ESPN into the premier digital sports platform.

Investors were also delighted to discover that Iger is focusing on restoring the company’s quarterly dividend, which has been suspended since 2020. Iger says that aggressive cost-cutting measures will put more profits back in the hands of shareholders.

That being said, is this your sign to buy DIS if you don’t already own shares? Not so fast. We’ve taken a look through the VectorVest stock forecasting software and see 2 reasons to hold off on this stock for the time being.

Despite Good Timing, DIS Has Poor Upside Potential and Safety

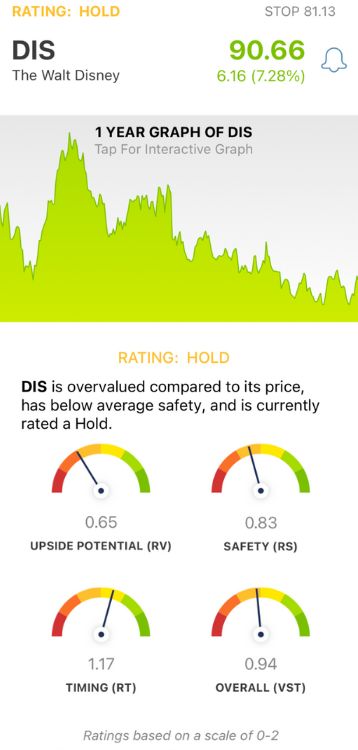

VectorVest simplifies your trading strategy through a proprietary stock rating system that eliminates guesswork, emotion, and human error from your decision-making.

You’re given all the insights you need to make clear, calculated decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy.

But, it gets even easier. You’re presented with a clear buy, sell, or hold recommendation for any given stock at any given time based on the overall VST rating. As for DIS, here’s what we uncovered.

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. It offers far superior insights than a simple comparison of price to value alone. As for DIS, the RV rating of 0.65 is poor.

- Poor Safety: The RS rating is an indicator of risk. It’s derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other risk factors. DIS has a poor RS rating of 0.83.

- Good Timing: The one thing DIS has going for it right now is a good RT rating of 1.17, which reflects its performance in the past few weeks/months. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.94 is slightly below the average for DIS, but considered fair nonetheless. That being said, VectorVest has placed a HOLD recommendation on this stock right now. But, you should get the full scoop firsthand through a free stock analysis today to learn more!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DIS gained 7% after delivering 4th quarter earnings with an array of wins and a number of things to be optimistic about in the road ahead. While the stock does have good timing, upside potential and safety are poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment