Last Tuesday (March 21st) we wrote about the rumors that First Citizens Bank (FCNCA) had thrown its own bid in the mix for the failed Silicon Valley Bank (SVB). And today, those rumors proved true as the US FDIC has announced a deal that will have First Citizens Bank purchase SVB’s deposits and loans at a steep discount.

First Citizens Bank will pay just $16.5 billion for a full valuation of $72 billion in assets. An additional $90 billion in securities and other assets will remain in receivership for disposition by the FDIC. And, the FDIC will also receive equity appreciation right in First Citizens Bank as a result of this deal.

Because many of the commercial loans purchased in this agreement are a loss, the FDIC is also going to help First Citizens Bank absorb some of that loss.

When we wrote about the FCNCA rumors last week, all we had to go on was speculation – but we mentioned how the move made sense, and discussed whether the stock was worth buying before more news came out.

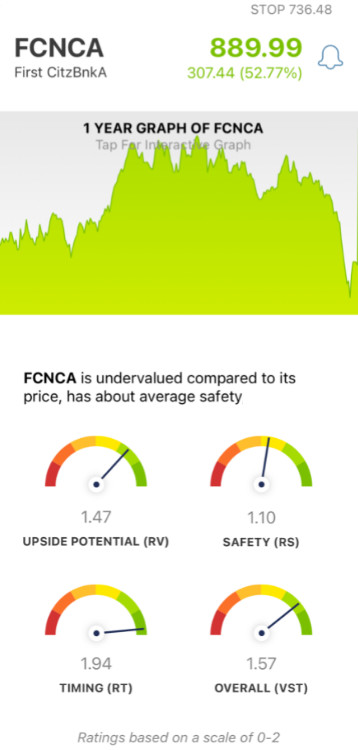

At the time, we noted that despite the negative price trend for FCNCA (that was in the midst of turning around), the stock had excellent upside potential and good safety. If you took a chance and bought into the speculation, you could have added this stock to your portfolio at a huge discount to where it currently sits today. As a result of this news, shares have shot up over $305/share or 52%.

This may have you wondering…is there still any opportunity left to buy into FCNCA? Or, is it too late? While you can’t go back in time and buy FCNCA at a lower price, you can keep reading below as we take another look at the updated circumstances around this stock using the VectorVest stock analyzing tool.

After This Deal, FCNCA Now Has Excellent Upside Potential and Excellent Timing

The VectorVest system helps to simplify your trading strategy by telling you what to buy, when to buy it, and when to sell it. It eliminates guesswork and emotion from your process by giving you all the insights you need in just three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings each sit on their own scale of 0.00-2.00, with 1.00 being the average. And based on the overall rating for a given stock, VectorVest can give you a clear buy, sell, or hold recommendation. So, let’s see how things have changed around FCNCA since we talked last week:

- Excellent Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential in comparison to AAA corporate bond rates and risk. And even after shooting up over 50%, VectorVest still deems FCNCA to have excellent upside potential with an RV rating of 1.47. If you were worried about finding room for growth in this stock, don’t be. The current value for this stock is as high as $1,025/share.

- Good Safety: In terms of risk, nothing has changed for FCNCA - it still has a good RS rating of 1.10. This is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: This is where things get interesting - because last week, the poor RT rating was holding this stock back. But that’s no longer the case - as you may have guessed. Now, the RT rating of 1.94 is excellent - and the price trend we saw starting to form last week has been solidified. This rating is calculated by analyzing the direction, dynamics, and magnitude of the stock’s price movement.

The overall VST rating for FCNCA is excellent at 1.57 - so, does that mean there is still enough opportunity for you to buy this stock right now? With the guidance of a free stock analysis at VectorVest, you’re just a few clicks away from capitalizing on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for FCNCA, it still has excellent upside potential and good safety even after shooting up more than $300/share. But now, the timing is excellent as well - making this a great opportunity for the right investor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment