GameStop (GME) is up more than 64% today, picking up where it left off yesterday for a total gain of more than 200% to start the week. All this comes as a result of the members of the subreddit WallStreetBets deciding to send shares surging once more.

The stock reached more than 1,200 mentions in the past week on Reddit – holding the title of the most mentioned stock in that span, beating out even the likes of Nvidia.

But, it all started with Roaring Kitty, the same user who sparked the initial meme stock craze more than 3 years ago. His real name is Keith Gill, and he posted on Twitter (and Reddit) for the first time since 2021 when he turned the market upside down.

He uploaded a sketch of a gamer sitting upright in his chair, suggesting it was time to focus and take the game seriously. This was enough to rally the troops as the tweet gained more than 120k likes since Sunday night at 5 PM.

Since then, Gill has been consistently tweeting short clips from popular TV shows and movies, indicating the rally is far from finished. He pulled the infamous Breaking Bad clip of Walt saying “We’re done when I say we’re done”.

Yesterday’s volatile trading session featured a few different halts, but that didn’t stop the madness from ensuing. Even fellow meme stock AMC benefited from the hype, surging more than 150% in the past few days.

But, is this another case of “if you’re reading this, it’s too late”? Or, is there still reason to buy GME today and join in on the fun? We’ve taken a deeper look through the VectorVest stock analysis software and found 3 things you need to know before you do anything else.

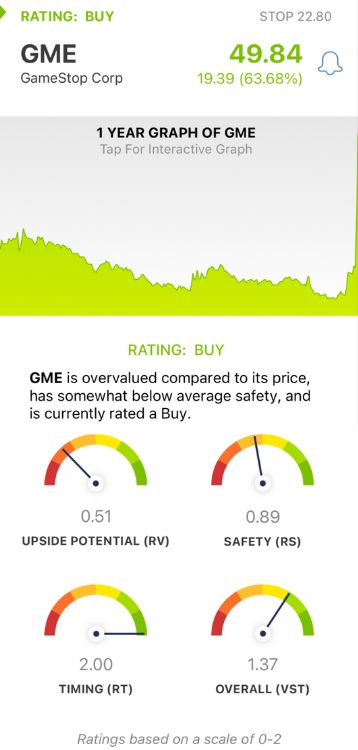

GME May Have Poor Upside Potential and Fair Safety, But Excellent Timing Earns the Stock a BUY Rating

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - eliminating stress, guesswork, and human error from your decision-making.

It’s based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy.

You’re even given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for GME, here’s what you need to see…

- Poor Upside Potential: The RV rating is a far superior indicator to the typical comparison of price to value alone because it compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. GME has a poor RV rating of 0.51. The stock is way overvalued with a current value of just $5/share.

- Fair Safety: The RS rating is a risk indicator. It’s computed from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. GME has an RS rating of 0.89, which is a ways below the average but deemed fair nonetheless.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. This is where things get interesting, as GME is tipping out the scale with an RT rating of 2.00.

The overall VST rating of 1.37 is very good for GME, but is clearly skewed by the meme craze we’ve witnessed over the past two days.

While the stock is rated a BUY, you should approach this opportunity with extreme caution and stay up to date. You can set yourself up for success on this trade with a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. GME is up more than 200% as the meme stock frenzy is back at it again. The stock itself has excellent timing after the past two days of trading, but safety is just fair and upside potential is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment