Tuesday was an exciting day for Alphabet investors – the parent company of Google (GOOGL, GOOG). The company reported first-quarter earnings for the year that beat analyst estimates handily. And, along with this overperformance was the announcement of a $70b stock buyback program.

The company exceeded the revenue consensus of $68.96 billion that had been laid out, reporting a revenue figure of $69.7 billion. Moreover, the company beat EPS estimates of $1.08 with $1.17. Google ad revenue was up, as was Youtube ad revenue.

This was undoubtedly a pleasant surprise for shareholders who have withstood the previous few quarters of underwhelming performance.

But, what will really have investors excited is the fact that the Google Cloud unit was finally profitable. It’s been 3 years of consistent losses for the segment, which has been coming in behind Amazon and Microsoft’s cloud infrastructure market for some time.

Just last quarter, the segment produced a $706 million loss. This quarter, though, the company earned $191 million in operating income on a revenue figure of $7.45 billion. The years of investment have finally paid off – and executives with the company say this is just the beginning as the segment gains momentum.

To top it all off, Google announced an enormous stock buyback program in the $70 billion range. All things considered, it was one of the better earnings reports for Alphabet in some time. But – is all this reason enough to buy GOOGL? Before you do anything else, we’ve uncovered 3 through the VectorVest stock analysis software that you need to see…

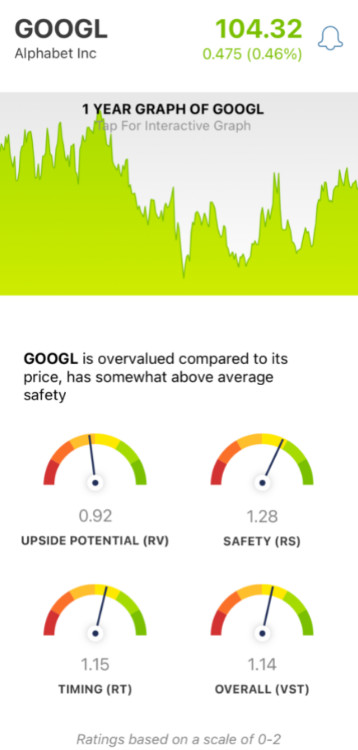

GOOGLE Has Fair Upside Potential, Good Timing, and Very Good Safety

The VectorVest system empowers you to win more trades with less work - telling you exactly what to buy, when to buy it, and when to sell it. It’s all possible through the proprietary stock rating system that gives you clear insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy - but it gets even better. Because based on the overall VST rating for a stock, VectorVest is able to offer a clear buy, sell, or hold recommendation - at any given time. As for GOOGL, here’s what you need to know:

- Fair Upside Potential: The RV rating is an assessment of a stock’s long-term price appreciation potential (projected three years out) in comparison to AAA corporate bond rates and risk. And right now, the RV rating of 0.92 is below the average - but fair nonetheless. With that said, the stock is overvalued right now. The current value is just $83.

- Very Good Safety: But, GOOGL has very good safety - with an RS rating of 1.28. This is calculated from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: And, in terms of price trend, the timing for GOOGL is good right now - as evidenced by the RT rating of 1.15. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.14 is good for GOOGL - but is it enough to justify adding this stock to your portfolio, or bolstering your position by picking up more shares? A clear answer awaits you at VectorVest - get a free stock analysis today to feel confident making your next move!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. And after Tuesday’s earnings report for GOOGL, the company has fair upside potential, good timing, and very good safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment