While much of the sporting retail industry takes steps backward amidst this challenging economic climate, Hibbett Sporting (HIBB) reported second-quarter earnings that outperformed not just the analyst expectations, but industry rivals too.

The company reported sales of $374.9 million, which was just shy of the consensus of $376 million. This was a 4.6% decline over the last year.

But, profit is where the Birmingham, Alabama retailer thrived. Net income of $10.9 million for the quarter translates to 85 cents compared to the FactSet consensus of 73 cents. While this was a fall off from this quarter last year when the company posted $24.7 million ($1.86/share), the conditions are far more challenging for retailers selling discretionary goods right now.

Chief executive of the company Mike Longo said that despite consumers pulling back as a result of inflation, the quarter was relatively strong after a strong start to the busy back-to-school season and a positive reaction to new product releases throughout the quarter.

The retailer also took a renewed look at where they should allocate their focus – dedicated attention to premium footwear brands as their apparel line feels the effects of softer consumer demand.

Even though Hibbett still faces these challenging headwinds, Longo feels they are poised to perform well and uphold the full-year guidance of up to 2% growth in sales and an EPS of $7.00-$7.75.

The news came as a delight for investors who were expecting the worst after rivals reported lackluster earnings earlier this week. Dicks, Foot Locker, and Nike are all struggling with the same economic challenges but also face issues with theft straining their margins.

That being said, HIBB climbed 21% so far in Friday’s trading session on this news. The stock was slipping heading into the earnings report on the concern of bad news, down 15% at one point. But those losses have all been recovered and then some.

So, where does that leave investors or prospective investors now? Is HIBB a buy, or is this a good time to sell your shares for profit? We’ve taken a look through the VectorVest stock forecasting software and have 3 things to share that will help you make your next move one way or the other.

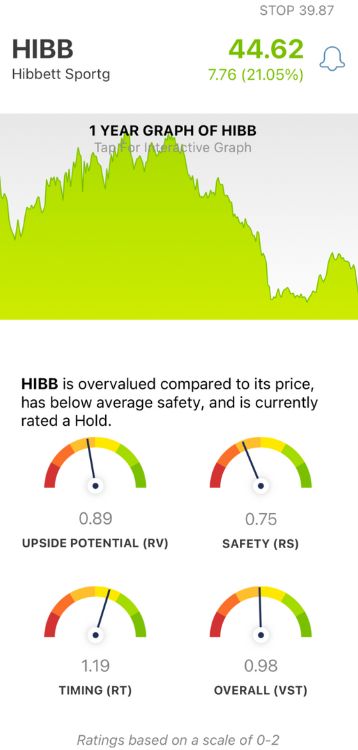

HIBB Has Fair Upside Potential, Poor Safety, and Good Timing

The VectorVest stock forecasting software consolidates everything you need to know into 3 simple ratings, saving you time and stress as you win more trades with less work. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a simple scale of 0.00-2.00, with 1.00 being the average. Ratings above the average indicate overperformance and vice versa. And, making things even easier for you, the system issues a clear buy, sell, or hold recommendation at any given time based on these ratings. As for HIBB, here’s what’s going on right now:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. It offers far superior insights than a simple comparison of price to value alone. Although the RV rating of 0.89 is a ways below the average, it’s still deemed fair. That being said, the stock is overvalued with a current value of just $38.96.

- Poor Safety: The RS rating is an indicator of risk. It’s calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for HIBB, the stock has poor safety with an RS rating of 0.75.

- Good Timing: As you can see by looking at the stock’s performance in both the immediate and longer term, it has good timing - which is validated by the RT rating of 1.19. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating works out to just 0.98, which is slightly below the average but still considered fair. So, what does that mean for you? Should you buy this stock, sell it if you hold shares, or hold off before doing anything?

A clear answer is just a click away. Get a free stock analysis for HIBB and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After reporting higher than expected profits and more favorable results than the rest of its competitors, HIBB has climbed more than 21%. The stock has fair upside potential and good timing, but be aware of its poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment