Over the weekend, Union Pacific (UNP) announced that the current CEO Lance Fritz is on his way out, and a leadership change will come by the end of the year.

While the railroad company just delivered an impressive Q4 profit, a hedge fund that controls a $1.6b stake in the company publicly lambasted Fritz and the direction the company has taken under his leadership over the past 8 years. Sources close to the company say that this hedge fund – Soroban Capital Partners – has privately critiqued Fritz and urged the company to replace him for over a year now.

Eric Mandelblatt, the name behind the letter of criticism that went out, says that Union Pacific is not performing as one would expect of the premier railroad company. He claims that Fritz is to blame for the fact that Union Pacific is lagging behind its peers – pointing to poor rankings in safety, volume growth, revenue growth, cost management, EBIT growth, and total shareholder return.

Fritz has been with the company for over 22 years and served as CEO for the last 8 years. While Mandelblatt has urged Union Pacific to hire Jim Vena – previous COO of the company – the board says they have a leadership consultant helping them identify the best internal and external candidates for the position.

The board also took the time to praise Fritz for helping grow the railroad’s profits through tumultuous times – especially as of late. With the uncertainty of the pandemic and obstacles like union negotiations, he held strong despite the lackluster cards he was dealt. But, as the railroad continues to struggle with keeping up, a change is inevitable.

As a result of this news, Union Pacific shares traded 10% higher in Monday’s session. This morning, the stock slid a bit and sits 1% lower than it opened at. Should investors see this leadership change as a sign of more prosperous times ahead – or will the company have to take a few steps back before progressing ahead?

We’ve got three things you need to see before making your next move with this stock, uncovered through the VectorVest stock analysis system.

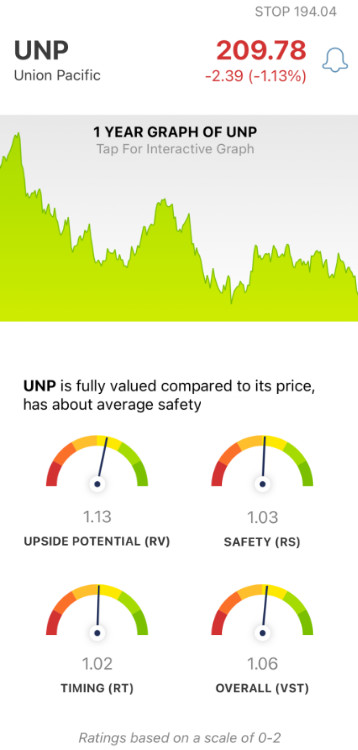

UNP Has Good Upside Potential Along with Fair Safety & Timing

The VectorVest system simplifies your trading strategy, saving you time and eliminating costly errors. It’s all based on a proprietary stock rating system that tells you everything you need to know in just three simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings is placed on a scale of 0.00-2.00, with 1.00 being the average. Based on these ratings, VectorVest is able to provide you with a clear buy, sell, or hold recommendation for any given stock, at any given time. As for UNP, here’s the current breakdown:

- Good Upside Potential: The RV rating assesses a stock’s 3-year price appreciation potential compared to AAA corporate bond rates and risk to give you a better understanding of its true value. As for UNP, the RV rating of 1.13 is good. Moreover, the stock is fully valued as it stands today.

- Fair Safety: In terms of risk, UNP is fairly safe - as evidenced by the RS rating of 1.03. This is derived from a deep analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: While it appeared yesterday that a positive price trend was forming, that quickly dissipated in Tuesday’s session. Right now the RT rating of 1.02 is just fair - and is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.06 - which is fair. Is it enough to earn the stock a buy rating, though? Or, should you wait for a stronger price trend to form before making your stake? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move through our free stock analyzer today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, UNP has good upside potential along with fair safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment