Lululemon (LULU) decided to end the week with a bang as it reported fiscal first-quarter earnings Thursday evening, resulting in a trading frenzy Friday morning.

The athleticwear company beat analyst estimates for both earnings and sales figures. EPS of $2.28 topped the expected $1.98, while revenue of $2 billion outperformed the estimated $1.93 billion analysts were looking for.

Profitability climbed from this time last year as well. Net income for the quarter came in at $290.4 million, a dramatic boost from last year’s $190 million. This can be attributed to lower costs associated with air freight and tighter inventory control.

The boost in sales came as a bit of a surprise, as US inflation continues to mount. It appears the increased cost of living hasn’t deterred the upper-class market that flocks to Lululemon in droves – not yet, at least.

However, one of the biggest contributing factors to a quarter of excellence was the rebound in China. As China’s rigid COVID-19 policies began to relax, revenue in the region climbed nearly 80%. This is compared to a modest 17% jump in North American sales.

The company also boosted guidance for the remainder of the year. The previous revenue outlook of $9.30 billion to $9.41 billion has been raised to a range of $9.44 billion and $9.51 billion. Profit has been raised a notch too, up from $11.50-$11.72 to $11.74-$11.94 per share.

The market reacted as you’d expect, sending shares of LULU trading nearly 13% higher in Friday’s trading session. This couldn’t have come at a better time, as shares were falling dramatically over the past month. Still, the stock is up 26% in the past year.

We’ve taken a look at the company through the VectorVest stock analyzer, and have uncovered 3 more reasons investors and potential investors alike should be excited about LULU. See what we found below…

LULU Has Very Good Upside Potential & Safety, With Good Timing to Boot

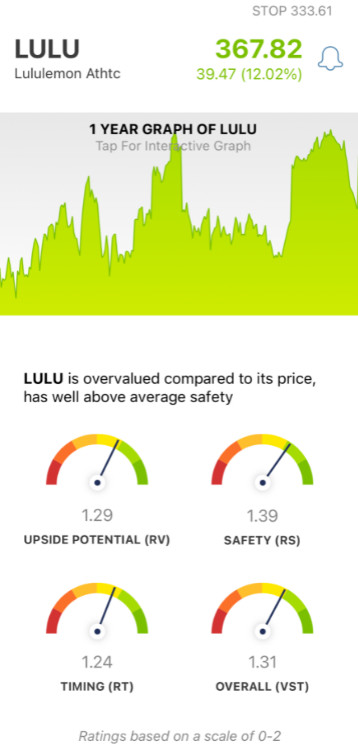

The VectorVest system simplifies your trading strategy by giving you all the insights you need to make confident, calculated investing decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation, saving you time as you win more trades.

But it gets even better, as the system provides a clear buy, sell, or hold recommendation based on these ratings. Here’s what you need to know as it pertains to LULU:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. And right now, LULU has a very good RV rating of 1.29. This is a far superior indicator than a simple comparison of price and value alone as it gives you a better idea of what the value of this stock could look like 3 years from now.

- Very Good Safety: In terms of risk, LULU is a very safe stock - as confirmed by the RS rating of 1.39. This rating is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. M Science analyst Matthew Jacob spoke to this, saying that LULU is one of the only companies to show a track record of very strong growth in comps every quarter.

- Good Timing: While LULU had been trending downward in the past month, it appears that trend has reversed on today’s news - as the RT rating of 1.24 is good. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.31 is very good for LULU. So, is it worth adding to your portfolio if you don’t have it already? Should you bolster your existing position with more shares? Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for LULU, this stock has very good upside potential and safety, coupled with good timing - making it a worthy prospective addition to your portfolio.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment