Lumen Tech (LUMN) is taking its talents to Microsoft and Google with its latest product development. The news of this partnership has sent shares of LUMN more than 3% higher in Monday morning’s trading session – which couldn’t have come at a better time, as the stock has been battered and bruised for much of this year.

Lumen helps companies harness the full power of their data – and their new ExaSwitch network connection is going to aid companies to route their traffic dynamically between networks. What makes ExaSwitch unique though is that it’s specifically engineered for those with high-bandwidth needs, and eliminates the need for 3rd party intervention.

The stock is down a whopping 83% in the last year, and more than 20% in the last month alone. And even with the excitement blooming around the company’s latest product, there is reason to believe it will get worse before things actually get better. While the company’s latest earnings did not disappoint, there is fear that profits will continue shrinking through the remainder of the year.

Nevertheless, some analysts think that the company is set to turn things around. One analyst recently upgraded the stock from underperforming to market perform. That being said, what should you do with LUMN?

Whether you currently own shares of the stock or you’re pondering a potential play here as the company sits at its lowest point since the 1980s, we’ve got something you need to see. After taking a look at this stock through the VectorVest stock analyzing software, there are 3 important takeaways we want to share.

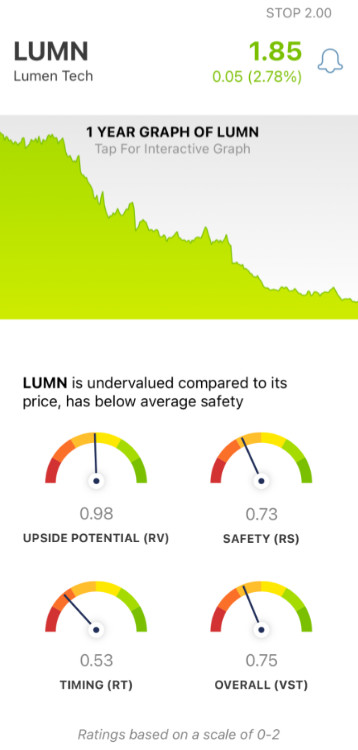

Despite Fair Upside Potential, LUMN Has Poor Safety and Timing

The VectorVest stock analyzing software helps you simplify your trading strategy by consolidating all the information you need into 3 easy-to-understand ratings. This empowers you to win more trades with less work.

The ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a scale of 0.00-2.00, with 1.00 being the average. The best part, though, is that based on these ratings, the system is able to offer you a clear buy, sell, or hold recommendation – for any given stock, at any given time! As for LUMN, here’s the current situation.

- Fair Upside Potential: The RV rating is a comparison of a stock’s 3-year price appreciation potential to AAA corporate bond rates and risk. This offers superior insights than a simple comparison of price to value alone. And right now, LUMN has a fair RV rating of 0.98 – just below the average. What’s more, the stock is undervalued – with a current value of $2.53.

- Poor Safety: In terms of risk, though, LUMN has poor safety – with an RS rating of 0.73. This is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: As you can see through a quick peek at the stock’s trajectory, the timing for LUMN is poor – and the RT rating of 0.53 confirms this. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All things considered, LUMN has a poor overall VST rating of 0.75. That being said, is it time to sell any shares you may have and cut losses here?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer based on a tried-and-true approach to stock analysis today. A free stock analysis is just a few clicks away at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for LUMN, the stock is undervalued right now and has fair upside potential – but the safety and timing are poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment