After reporting Q3 earnings that exceeded expectations, Macy’s (M) stock climbed over 11% as of 11 AM EST Thursday morning. If you’re evaluating the stock and considering whether there’s an opportunity for trading here, we’ve got two things you need to see first. Before we unveil our findings, let’s look at what happened in the past quarter for Macy’s.

The company just beat out revenue expectations on Wall Street – coming in at $5.23 billion vs $5.20 billion. This was a 3.9% decline from the third quarter last year.

What has experts raising their eyebrows, though, is the steep dropoff in profitability. Macy’s operating margin was just 3.7% for the quarter compared to 9.6% last year. Gross margin came in at 38.7%, which is down from 41% this time last year.

But, there is some good news from this earnings report – which has led to the spike we saw this morning. EPS came in way over the anticipated 19 cents/share at a whopping 52 cents/share. Another reason for the climb in share price for M stock was the commentary provided along with the earnings release. Executives at the company have raised earnings forecasts for the remainder of the year – to $4.07 to $4.27 vs. $4 to $4.20.

There is optimism looking ahead to the 4th quarter, as Macy’s has ample inventory in stock that will allow them to maintain prices and keep up with holiday shopping demand. The company is working strategically to bring in a younger crowd through efforts like an added e-commerce presence. They’re also closing down physical storefronts to protect the margin they’ve seen slipping.

Compared to competitors, analysts believe Macy’s is in a favorable position to finish the year strong – and carry that momentum through 2023. Nevertheless, executives at Macy’s and analysts following the company both have concerns over inflation heading into the holiday season. There is a concern that consumers will spend less this season to keep up with the rising cost of living.

As of today, Macy’s is down 30% in the last year. It appears a shift is occurring, though, as the stock has begun rallying back in the past 3 months – and the 12% hike so far today is helping to strengthen that trend.

All this said, is now the time to buy Macy’s stock – or is it still too early? Get a clear answer on what your next move should be with this stock by taking a look at the VectorVest stock analysis tool.

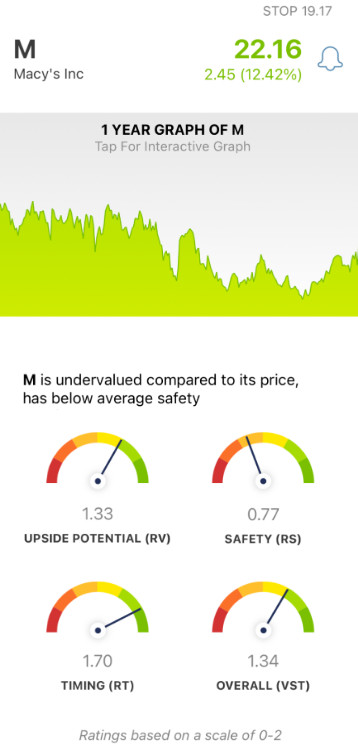

Despite Poor Safety, Macy’s Has Very Good Upside Potential & Excellent Timing

VectorVest changes the way you discover and vet opportunities in the stock market. With just three simple ratings, you’re given all the information you need to make an accurate, emotionless decision based on tried-and-true trading principles. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

All three of these ratings sit on the same scale of 0.00-2.00 – with 1.00 being the average. Anything over the average indicates overperformance in a category and vice versa. But here’s the real kicker: based on these three ratings, VectorVest provides a clear buy, sell, or hold recommendation – for any given stock, at any given time! Here’s the current situation with M:

- Very Good Upside Potential: taking a look at the long-term price appreciation potential for M stock 3 years out, VectorVest finds very good upside potential – and the RV rating of 1.33 reflects that. Moreover, the stock is undervalued at the current price of $22.15/share – the true value is $25.50 according to the VectorVest system.

- Poor Safety: this rating analyzes a stock’s financial consistency and predictability, debt-to-equity ratio, and business longevity. And right now, the RS rating of 0.77 is poor for M.

- Excellent Timing: As you can see looking at Macy’s price movement over the past few weeks, the timing is excellent. This is confirmed by the RT rating of 1.70. This rating looks at price trend day over day, week over week, quarter over quarter, and year over year. It analyzes the direction, dynamics, and magnitude of a stock’s price movement.

In taking all three of these ratings into account, the overall VST rating for Macy’s is very good at 1.34 – so, is now the time to buy? If you want a clear answer on your next move with Macy’s, get a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for M, it is undervalued with very good upside potential and has excellent timing – despite poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment