Recently, Michael Burry – manager of Scion Asset Management – unveiled new stakes in 7 different companies. The famed investor pointed toward a looming economic downturn for the year ahead just a few months ago – and he feels these companies still have the opportunity for growth.

Today, we’re taking a look at one stock addition that now makes up 20% of his portfolio: Black Knight. Scion’s recent purchase included 150,000 shares of the company, which specializes in software solutions and data analytics.

The stock has been steady over the last year, but today it popped 4%. This could be due to the fact that just hours ago, the company announced an agreement with Intercontinental Exchange (ICE) to sell its Empower LOS Business to Constellation Software Inc.

It’s worth noting that this deal is still under review by the FTC – which has already announced that it intends to block the deal over antitrust concerns. With that said, this is undoubtedly a positive sign for investors – like Burry – who would benefit from any sort of deal of this nature.

Does that mean you should add this stock to your portfolio today, too? In looking at Black Knight through the VectorVest stock analysis software, we see 2 major issues that you should be aware of before making your next move.

BKI Has Very Poor Upside Potential and Poor Safety

The VectorVest system tells you what to buy, when to buy it, and when to sell it. The system has outperformed the S&P 500 by 10x over 22 years by relying on a simple, proprietary stock-rating system. In three simple ratings, you’re given all the insights you need to make calculated, emotionless decisions. These are relative value (RV), relative safety (RS), and relative timing (RT).

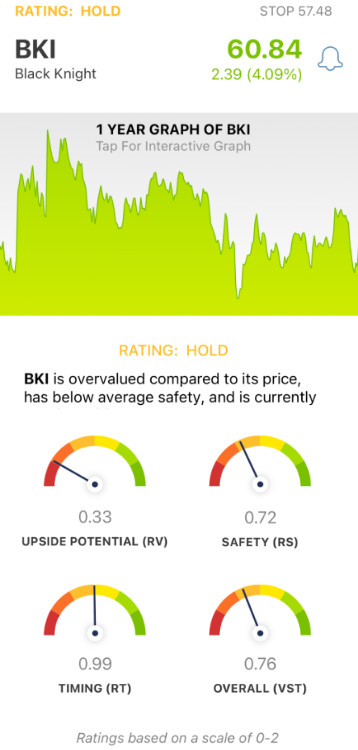

These ratings sit on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy - saving you time and energy in your analysis. Better yet, the culmination of these three ratings results in a clear buy, sell, or hold recommendation for any given stock, at any given time: including Black Knight. Here’s the current breakdown:

- Very Poor Upside Potential: The RV rating assesses the long-term price appreciation potential of a stock (three years out) in comparison to AAA corporate bond rates and risk. And right now, the RV rating of 0.33 is very poor for BKI. Moreover, the stock is overvalued at the current price of $60.87/share - the current value is just $14.29/share.

- Poor Safety: In terms of risk, BKI has a poor RS rating of 0.72. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: Looking at the price trend for BKI, things have remained stagnant for some time - until today, that is. As a result, the RT rating for BKI is 0.99 - just below the average. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. Hopefully for BKI investors, today’s 4% gain manifests into a more meaningful price trend in the right direction.

These three ratings contribute to an overall VST Rating of 0.76 - which is poor. But - does that mean it’s time to sell any shares you may have in BKI, or should you wait to see what happens on the horizon with this new potential Intercontinental Exchange deal? Get a clear answer on your next move with a free stock analysis today. You’re not going to want to miss out on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, BKI has very poor upside potential, poor safety, and fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment