Microsoft (MSFT) issued its fiscal Q3 earnings earlier this week, and as of Friday, the ripples haven’t yet subsided. The company impressed with both a revenue and EPS beat, and has climbed nearly 10% since Tuesday evening when the report went out.

Earnings came in at $2.45 per share compared to the estimate of $2.23 per share. Meanwhile, revenue of $52.86 billion topped the consensus of $51.02 billion – a 7% increase from the same quarter a year ago. Profitability was up in the quarter as well, as the company grew net income to $18.3 billion – a 9% increase from this time last year.

And, Microsoft didn’t stop there. They expect a fiscal 4th quarter of growth as well, which they say will be fueled by AI. The company’s finance chief Amy Hood is expecting revenue of $54.85-$55.85 billion. The current analyst estimate for the quarter is just $54.84 billion – suggesting Microsoft is poised for yet another earnings beat in a few months.

Microsoft was one of the early investors in AI technology back in 2019, and the fruits of this labor are finally starting to come to fruition. Bing – which is now fueled by AI – has reached over 100 million daily active users. And during this fiscal third quarter, Microsoft announced another multi-billion dollar investment in OpenAI.

The company is already off to a solid start in 2023, and this report will bolster that trend. With a 23% gain in the last 3 months, momentum is behind the stock. So – what does that mean for investors? Is this your sign to buy MSFT? Or, is it too late to buy and get good value?

Through the VectorVest stock forecasting software, we’ve discovered 3 things to help you make your next move with complete confidence. Here’s what you need to know…

While Upside Potential is Just Fair, MSFT Has Good Safety and Very Good Timing

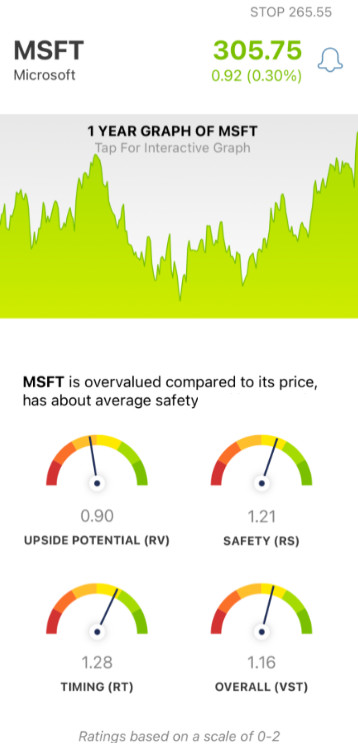

VectorVest helps you win more trades with less work through a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it. The system is comprised of three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. Stocks rising above the average indicate overperformance and vice versa. This makes your approach to analysis quicker and easier than ever before - with less human error or emotion getting in the way.

But, it gets even easier - because based on these three ratings, VectorVest is able to provide a clear buy, sell, or hold recommendation for any given stock at any given time - including MSFT:

- Fair Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. And right now, the RV rating of 0.90 is below the average - but considered fair nonetheless. With that said, the stock is overvalued at its price of $305/share. The current value is just $185.

- Good Safety: In looking at the associated risk of MSFT, VectorVest deems the safety to be good - with an RS rating of 1.21. This is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: After the impressive earnings beat earlier this week, the price trend we’ve witnessed over the past few months has been solidified. The very good RT rating of 1.28 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating of 1.16 is good for MSFT - but is it enough to earn the stock a spot in your portfolio? Or, perhaps justify bolstering your position with more shares?

A clear answer awaits you - just get a free stock analysis at VectorVest today for a buy, sell, or hold recommendation you can count on!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for MSFT, the upside potential is just fair - but the safety for this stock is good, and the timing is very good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment