When we last talked about Nike back in September, the company was experiencing problems with inventory bloat. With $9.6 billion worth of inventory crowding shelves, analysts and investors alike had concerns – and this sentiment manifested itself in a lower price per share of $84.

Today, however, Nike appears to have turned a corner. As the end of the year looms, CEO and President John Donahoe expressed satisfaction with the steps that have been taken in the last 90 days. Donahoe expects the company to be at a healthy inventory level by the end of the year.

After marking down excess inventory the company was able to not only trim the fat off their shelves – but report impressive sales figures, coming in 17% higher than this quarter last year. But it’s not just a result of markdowns on excess inventory growing the top line. It’s also an increase in direct-to-consumer sales – up 16% year over year. This segment will continue to grow as China stores continue to reopen.

While margins are still falling in each consecutive quarter, analysts and executives at Nike alike believe this will be a short-term problem that subsides in the near future. The issue with margins is mainly a result of markdowns on excess inventory, but the economic headwinds at play have factored in as well.

In September, Nike was down over 42%. Today, the stock has rallied to recover some of these losses – just 29% in the past 365-day period. As the stock’s price trend continues to move in the right direction and gain momentum, investors are wondering if now is the time to get back into Nike stock. We’ll take a look at three key things you need to know before executing a decision below…

Poor Upside Potential vs Excellent Timing – Does One Outweigh the Other for NKE Stock?

The VectorVest stock analysis system tells you everything you need to know about a stock based on three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. This makes your decision-making as simple and straightforward as possible. Just pick stocks above the average and win more trades!

Or, better yet, just follow the clear buy, sell, or hold recommendation that VectorVest gives you for any given stock, at any given time. This system transforms the way you invest – eliminating human error and guesswork once and for all. As for NKE, here’s the current situation:

- Poor Upside Potential: The long-term price appreciation potential for NKE (3 years out) doesn’t look too promising – and VectorVest has provided a poor RV rating of 0.57 as a result. Moreover, the stock is overvalued at the current price of $116.86 – with a current value of just $42.63.

- Fair Safety: In terms of risk, NKE appears to be a fairly safe stock – and the RS rating of 1.08 reflects that. This is calculated based on the company’s financial predictability and consistency, debt-to-equity ratio, and business longevity.

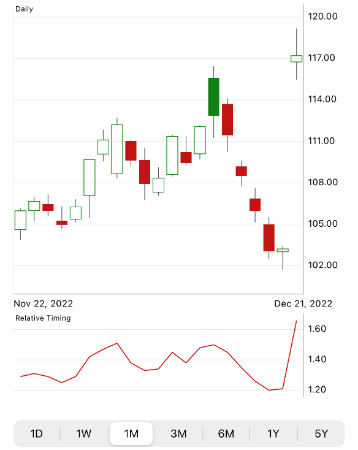

- Excellent Timing: As you can see looking at the price trend that’s formed over the past 3 months for NKE, the timing is excellent right now. The RT rating of 1.65 reflects that – as this rating is calculated from the direction, dynamics, and magnitude of a stock’s price movement.

The overall VST rating for NKE is good at 1.23 – but does it earn the stock a buy rating?

Despite poor upside potential, the timing is excellent – meaning if you decide to trade NKE stock, you’ll want to keep up on the RT rating. As it begins falling back towards 1.00, it will indicate a weakening trend & eventual reversal. To get a clear buy, sell, or hold recommendation for NKE, analyze the stock free here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NKE, it is overvalued with poor upside potential, fair safety, but has excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $9.95 (usually up to $139/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment