Tuesday morning, the market reacted to news that Warren Buffet’s Berkshire Hathaway had offloaded its entire stake in Restoration Hardware (RH). This sent shares down more than 8% – but the road to recovery is well underway.

Berkshire Hathaway has been a key shareholder in RH since 2019. This was right around the beginning of the pandemic – which was also right around the time the stock began its steep climb to an all-time high of $722 per share in 2021.

Upon reaching that point, the downward trajectory began – and the stock has slid nearly 67% since then. Nevertheless, the $575 million stake Berkshire Hathaway held in RH likely still earned a substantial profit.

So far in Wednesday morning’s trading session, though, the stock has rebounded 3%. Restoration Hardware was rallying over the past month leading up to this news and was up nearly 13% in the past 30 days.

While investors can breathe a temporary sigh of relief knowing the stock is headed back in the right direction, we’ve taken a look at RH through the VectorVest stock analyzing software. In doing so, we’ve uncovered 2 major issues that investors (or prospective investors) need to see…

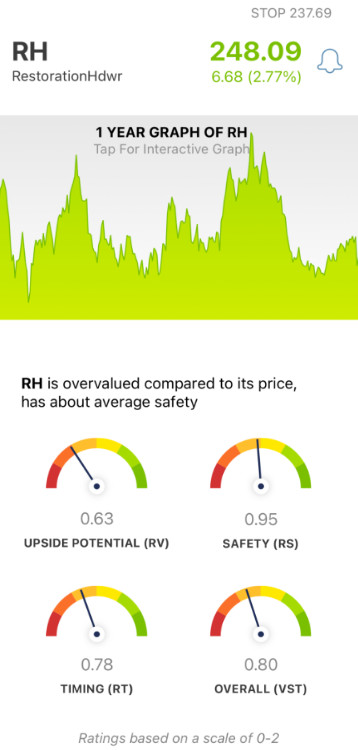

While RH Has Fair Safety, the Stock Has Poor Upside Potential and Timing

The VectorVest system helps you simplify your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on its own scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation - helping you win more trades with less work.

But, it gets even better. Because based on the overall VST rating for a given stock, the system is able to offer you a clear buy, sell, or hold recommendation - at any given time. As for RH, here is the current situation:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (projected 3 years out) and AAA corporate bond rates & risk. Right now, the company has a poor RV rating of 0.63. Plus, the stock is overvalued at today’s price. The current value is just $142.

- Fair Safety: In terms of risk, RH is a fairly safe stock - as evidenced by the RS rating of 0.95. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. While this rating is slightly below the average, it’s deemed fair nonetheless.

- Poor Timing: The news of Berkshire Hathaway dumping RH sent negative signals throughout the market - resulting in downward pressure on the stock’s price. As a result, the stock has a poor RT rating of 0.78. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.80 is poor for RH - so does that mean it’s time to follow Berkshire Hathaway’s lead and sell off your stake? Or, is there any reason to hold onto the hope that the company will turn things around in the near term?

Don’t play the guessing game or let emotion influence your next move - execute with confidence by getting a clear buy, sell, or hold recommendation through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RH has already rebounded a bit after yesterday’s downfall - but we still see issues with the stock. While it has fair safety, the upside potential and timing are poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment