Salesforce (CRM) board of directors has recently approved a $10 billion stock buyback program – the first in the software firm’s history. This news comes on the heels of a good quarter for earnings and revenue. And yet, the company’s executives are skeptical about the future – and have trimmed back their 2023 fiscal projections. This led to a drop in CRM stock of 10% overnight. In looking at the financials of Salesforce, investors may assume that now is a great time to buy low – but, VectorVest’s stock forecasting appstill rates CRM a hold at this time. We’ll explain why later. First – let’s dig into what’s caused Salesforce to lower its targets for the next fiscal year.

While the enterprise software market originally put its 2023 revenue outlook in the $31.7-$31.8 billion range, it’s been lowered to $30.9-$30 billion. This is the result of a more measured buying environment with longer sales cycles. Buyers are being a bit more strategic and calculated in their purchase decisions. Looking closer ahead in the future, the 3rd quarter of 2022 is expected to be down as well. The company forecasts earnings per share of $1.20 vs the originally forecasted $1.28 per share. Furthermore, revenue is expected to come in at $220 million shy of expectations. Now – a big question that remains to be answered is whether or not these projections will pan out, or if Salesforce executives are just being prudent in an uncertain economic environment.

In digging into the projected $10 billion stock buyback program, what can investors expect? Typically, reducing the number of shares on the market is a good thing for existing shareholders. It increases the value of their shares while also increasing earnings per share. This has investors wondering if the time is right to buy CRM – however, the VectorVest stock analysis system suggests it is not. Currently, Salesforce is rated a Hold – here’s why.

Poor Timing Earns Salesforce a “Hold” Recommendation in the VectorVest System

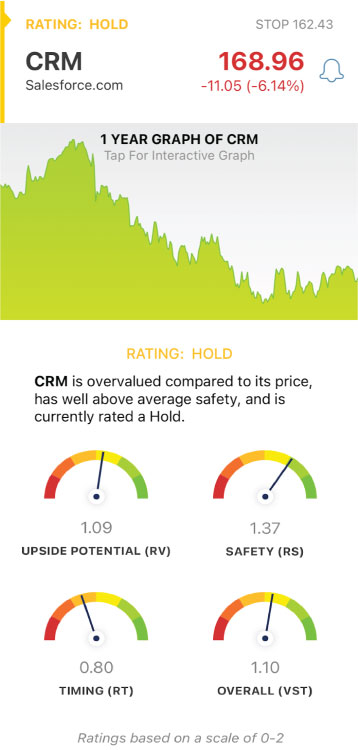

There are three primary ratings our system uses to rank stocks: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). These are ranked on a scale of 0.00-2.00 – with 1.00 being the average. Together, these three ratings make up the overall VST rating a stock is given. In looking at the Relative Value of Salesforce, you see fair upside potential with a rating of 1.09. This is coupled with a very good forecasted earnings growth rate of 18%. From a risk standpoint, CRM has very good Relative Safety with a rating of 1.37. This is computed from the consistency and predictability of CRM’s financial performance and business longevity.

But – the one thing holding this stock back right now is timing. Our RT rating analyzes the price trend – calculated from the direction, dynamics, and magnitude of price movement. And right now, CRM has a poor RT rating of 0.80. As such, our system has rated the stock a hold. As this RT rating starts to gravitate towards 1.00 and crosses over to signaling a positive trend forming and growing in strength, the stock will likely earn a buy rating.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Salesforce, it is safe and has fair upside potential – but it’s not rising in price, so investors should wait for the trend to turn around..

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment