Tesla (TSLA) was climbing higher yesterday after its best week in a while as Elon Musk shared a pleasant surprise update with investors.

He visited China to meet with Li Qiang and gained approval to move forward with its Full Self-Driving (FSD) software for the country’s electric vehicles. Musk also gained the go-ahead to transfer data overseas.

This is a landmark announcement given Tesla’s desire to compete with other EV manufacturers in China, such as Nio, BYD, Xpeng, and more. It’s important to mention that many of these other companies also gained approval alongside Tesla for their own data security rules.

Still, this is the largest market in the world for Tesla and one they’ve been anxiously awaiting to tap into. It’s a reason to celebrate for shareholders who have been uncertain of the automaker’s ability to expand outside of the US.

Now, there’s still a way to go before a Tesla is actually approved to hit the road without driver supervision. But, the goal for the company has always been to completely automate the driving experience, with Musk himself admitting the real value in Tesla lies in a fleet of robotaxis. This end goal is baked into the stock’s current share price.

While shares gained as much as 12.3% yesterday, they have corrected a bit today with a 5% reversal. They’re still up more than 30% in the past week, and there is optimism that this trend will hold its momentum.

That being said, is all of this reason enough to buy TSLA today? Not so fast. We’ve taken a look at the VectorVest stock analysis software and found 3 reasons you may want to hold off.

TSLA Still Has Very Poor Upside Potential Despite Good Safety and Timing

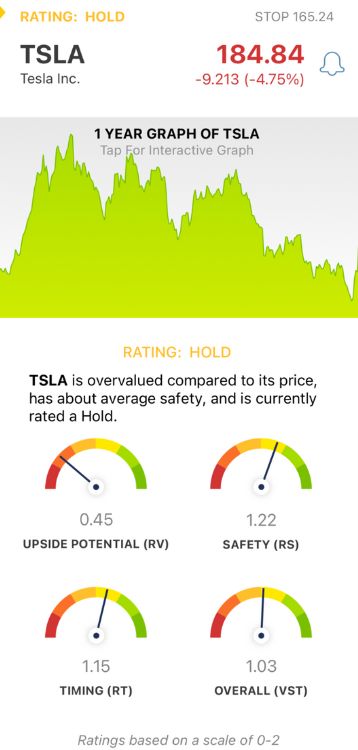

VectorVest is a proprietary stock rating system that saves you time and stress by telling you what to buy, when to buy it, and when to sell it. It does all this through 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy - just pick safe, undervalued stocks rising in price to win more trades with less work!

Or, better yet, follow the clear buy, sell, or hold recommendation the system offers for any given stock at any given time based on its overall VST rating. As for TSLA, here’s what you need to see:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This offers much better insight than the typical comparison of price to value alone. The problem for TSLA right now is its very poor RV rating of 0.45. The stock is way overvalued with a current value of just $52.22.

- Good Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.22 is good for TSLA.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. TSLA has a good RT rating of 1.15 right now after last week’s performance.

The overall VST rating of 1.03 is just above the average and deemed fair for TSLA, but the stock is currently rated a HOLD.

We encourage you to take a deeper look whether you’re a current shareholder or are looking for an opportunity to trade TSLA - get a free stock analysis today and simplify your trading strategy!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TSLA finally gained approval to move forward with its full-self driving technology in China along with permission to transfer data overseas. While the stock does have good safety and timing, its upside potential is very poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment