The Children’s Place (PLCE) is up more than 78% Thursday morning after news broke that an investment group came together to build a majority stake in the company.

Snowball Compounding Ltd. and groups associated with Mithaq Capital (a Saudi Investment firm) teamed up to claim a 54% stake and will nominate 11 people for the board at the 2024 annual shareholder meeting.

There has been mixed response to this news, as some are concerned that this takeover could have negative implications. Triggering a Change of Control clause puts The Children’s Place in default on its credit agreement, which has already been amended and restated.

That being said, the company already announced that it was working with lenders to waive this issue. A spokesperson also noted that Mithaq Capital has offered assistance for financing the company’s liquidity needs – for which the company intends to welcome with open arms.

It’s been a tumultuous few days for the company and its shareholders after profitability issues were disclosed in its Q4 earnings call earlier this week. At the time, it was said that The Children’s Place was looking for new financing options and wasn’t opposed to strategic options if those efforts fell short.

Margin pressure from discounts, higher shipping costs, and overall economic and geopolitical challenges have proved to be a burden for the company, which operates brands like Gymboree, Sugar & Jade and PJ Place. With over 500 stores throughout North America and a worldwide reach, there is a lot of opportunity for the company with the right leadership and ample financing.

Analysts had recently downgraded the stock, citing the concerns we referenced above. The company declined to offer guidance for the year, but the expectation is that Children’s Place will be unprofitable for the first half of the year. The goal is to work towards a solid back-to-school season in Fall 24.

Whether you’re currently invested in PLCE or are considering trading this stock, you’re going to want to see what we found below through the VectorVest stock forecasting software. There are 3 interesting takeaways…

PLCE Has Poor Upside Potential and Safety, But Excellent Timing Pushing the Stock Higher

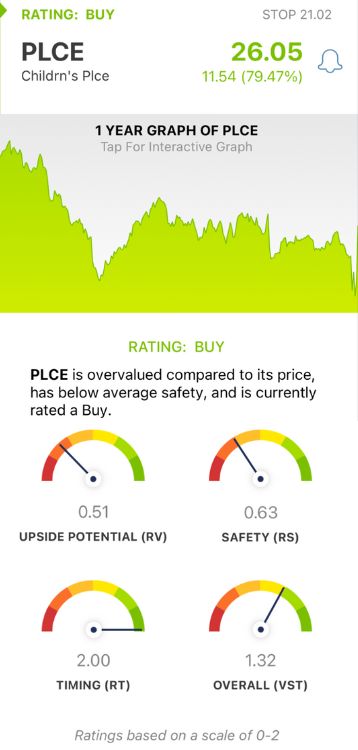

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - all in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. Taking things a step further, you’re offered a clear buy, sell, or hold recommendation for any given stock at any given time. As for PLCE, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. PLCE has a poor RV rating of 0.51.

- Poor Safety: The RS rating is a risk indicator calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The stock has a poor RS rating of 0.63.

- Excellent Timing: This is where things get interesting, as PLCE has skyrocketed today on this news. The RT rating of 2.00 is tipping out the scale. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.32 is very good for PLCE. While this may be skewed by the stocks’ excellent timing, it’s currently rated a BUY in the VectorVest system. Learn more about this opportunity with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLCE is up more than 88% in Thursday’s trading session after news of an investment group claiming a majority stake in the company, addressing its financial woes. The stock has poor upside potential and safety, but excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment