Oatly (OTLY) – the plant-based food brand – was upgraded to a buy rating by analysts at Mizuho Thursday morning. This Japanese bank claims the bear run is over for Oatly, and they’re poised to make a run. And a serious run at that – with a price target set at $6. This is 123% higher than the stock that closed yesterday.

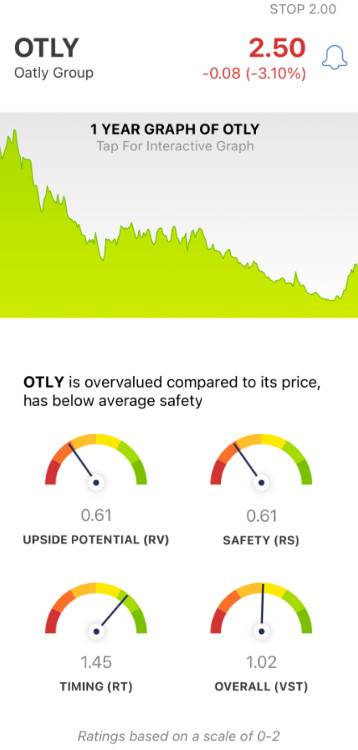

This company IPO’d just under 2 years ago at a price/share of $22. It’s been a race to the bottom ever since with the company down 88% over that period. Today, it sits at a measly $2.50/share. So – what exactly have these analysts so excited about Oatly?

Mizuho Senior Consumer Equity Research Analyst John Baumgartner claims that much of the damage to Oatly was done in 2022. He’s right, as the stock lost 65% last year. This was the result of supply chain constraints, commodity inflation, and COVID lockdowns in China. All of these problems should dissipate in 2023 – at least, that’s Baumgartner’s stance.

The other reason he is high on Oatly is the category itself. While competitors like Beyond Meat have floundered, Oatly is different in that it’s a beverage. The category saw a 10% climb last year, and he expects that trend to continue in 2023 and beyond.

Along with these, Baumgartner points to Oatly’s partnership with Yaya Foods here in North America as a reason to get into the stock early. But – looking at Oatly purely based on tried-and-true stock analysis, we’re not sold on the stock just yet.

In fact, we see two reasons to exercise caution with OTLY through the VectorVest stock forecasting software. You’re going to want to see this…

Despite Excellent Timing, OTLY Has Poor Upside Potential and Safety

The VectorVest system transforms the way you uncover and assess opportunities in the stock market. It saves you time, maximizes profits, and minimizes losses by helping you eliminate guesswork and emotion from your strategy.

It’s all based on three proprietary ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on an easy-to-understand scale of 0.00-2.00 - with 1.00 being the average. Pick stocks with ratings above the average to win more trades.

And, making things even easier, VectorVest gives you a clear buy, sell, or hold recommendation based on these ratings. You’re told exactly what to buy, when to buy, and when to sell it. It’s really that easy. And as for OTLY, here’s why we’re skeptical:

- Poor Upside Potential: The RV rating analyzes a stock’s long-term price appreciation potential (3 years out) compared to AAA corporate bond rates and risk. As for OTLY, the RV rating of 0.61 is poor. And while analysts have set a price target of $6, this stock is overvalued as is - with a current value of just $1.29.

- Poor Safety: Taking a look at OTLY’s risk level, VectorVest’s RS rating of 0.61 is poor as well. This is based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The only thing OTLY has going for it right now is timing. After reaching a low point of $1.33/share, it’s rebounded over 80% in the last month. The excellent RT rating of 1.45 indicates that this positive price trend has taken hold. This rating is calculated based on a stock price’s direction, dynamics, and magnitude. It’s taken day over day, week over week, quarter over quarter, and year over year.

These three ratings work out to an overall VST rating of 1.02 - which is fair. But is it really time to buy OTLY - or should you hold the line a bit longer and wait for this trend to strengthen? Get a clear answer on your next move through a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for OTLY, it is overvalued with poor upside potential and safety, but it does have excellent timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action

Leave A Comment