Shares of United Airlines (UAL) are cruising higher after a solid first-quarter performance in which the airliner had to overcome a myriad of adversities. The stock is up 13% so far today after delivering a better-than-expected top and bottom line.

Revenue of $12.54 billion represented a nearly 10% growth year over year and narrowly outpaced the $12.43 billion analysts had forecasted.

Earnings per share came in at a loss of 15 cents per share, which is an exciting turnaround from this time last year when the company lost 63 cents per share. This also outpaced the consensus for a loss of 53 cents per share.

United Airlines followed this up by issuing upbeat guidance for the second quarter as well. It is expecting earnings to come in between $3.75 to $4.25 a share, well above the current Wall Street consensus. All eyes are on this as the company delivered record EPS during the second quarter in 2023

The company stood by its full-year outlook of adjusted earnings in the range of $9 to $11. Analysts are still not quite sold, maintaining a consensus at the low end of that range at $9.41.

Looking back to the first quarter, the company took on a pretax loss of $164 million, which accounts for a $200 million hit as a result of Boeing’s problematic planes being grounded. However, the strong demand for travel helped the company find calm skies amidst the chaos, leading to an impressive quarter all things considered.

United is also taking steps to improve its fleet in the year ahead, already converting some of its Boeing MAX 10 aircraft orders to Boeing MAX 9 to make up for the drop in plane availability.

It’s believed that United is better positioned in the current landscape than its peers since it has a stronger market share in large corporate and international travel. One analyst with Raymond James, Savanthi Syth, sees as much as a 61% upside in the stock.

That being said, should you focus on the fundamentals and tune out the negative noise associated with United’s Boeing mishaps?

Whether you’re considering buying UAL or are currently invested, we have 3 things you need to see that we’ve uncovered through the VectorVest stock analysis software…

UAL Has Excellent Upside Potential and Very Good Timing Despite Poor Safety

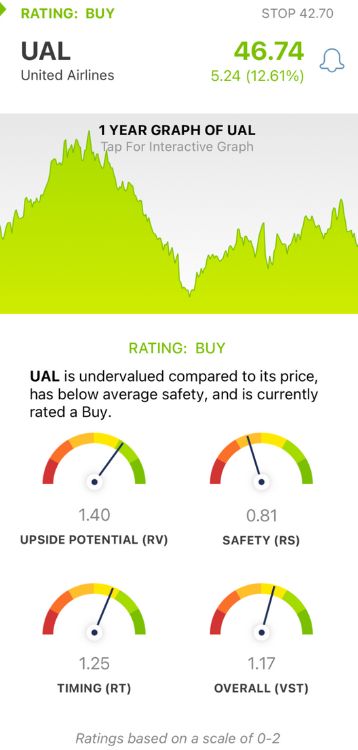

VectorVest simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

Better yet, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on the overall VST rating. This saves you time and stress while helping you win more trades with less work. As for UAL, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. UAL has an excellent RV rating of 1.40 right now. The stock is undervalued with a current value of $63.60.

- Poor Safety: The RS rating is a risk indicator computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.81 is poor for UAL.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. UAL has a very good RT rating of 1.25, reflecting its 22% rally over the past few months.

The overall VST rating of 1.17 is good, and it’s enough to earn UAL a buy recommendation in the VectorVest system.

But, we suggest taking a closer look at this opportunity with a free stock analysis today before you do anything else so you can make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UAL delivered a solid first quarter performance amidst a number of challenges related to Boeing’s planes, and it expects to maintain its momentum through the next quarter and the remainder of the year. The stock itself has excellent upside potential and very good timing despite poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment