VectorVest issued a sell warning for Carvana, before the stock collapsed, saving investors from this devastating loss.

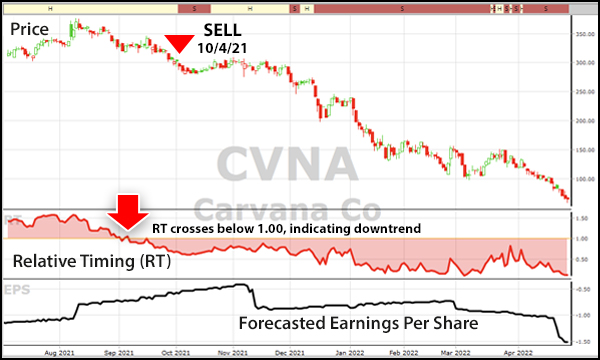

Only VectorVest issued a SELL rating for Carvana on 10/4/21 at $294.07. VectorVest calculated the value of the stock at just $37.29, alerting investors that it was extremely overvalued

Since 10/4/21, Carvana (CVNA) has plummeted to $59.75, as of April 28, 2022. That’s a 79% loss!

With earnings and value continuing to fall, Carvana may still be a major risk to investors.

Since VectorVest’s Sell Rating for Carvana, the stock has plummeted 79%.

Nobody Analyzes Stocks Like VectorVest.

VectorVest is the only stock analysis and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety and timing. It gives a clear buy, sell, or hold rating on every stock, every day.

VectorVest calculates an exclusive Stop-Price for each stock, every day. It’s your line in the sand for knowing when to sell.

NO HUNCHES, NO OPINIONS.

VectorVest calculates the value of every stock, every day. When price is significantly higher than value, there is an increased likelihood that the stock could crash during a market correction.

In the case with Carvana, VectorVest’s calculated value was $37.29 on 10/4/21. Remember, CVNA closed at $294.07 that day, so it was extremely overvalued. Value is computed from forecasted earnings per share, forecasted earnings growth, profitability, interest, and inflation rates.

VectorVest gives you ANSWERS, not just data. What to buy. What to sell. Most importantly, WHEN to buy or sell. Unbiased, independent answers.

Is it time to buy Carvana?

No. We don’t recommend buying stocks that are trending down, because you don’t know how far down is. In this case, the downside risk is still very strong. The stock price continues to fall, the earnings forecast is dropping, and the valuation has fallen to $10.84. Don’t try to catch a falling knife!

So, when would you consider buying? Wait for the stock to reverse course. We want to see the price to stop moving down and begin trending higher. Look at VectorVest’s exclusive Relative Timing (RT) indicator. This measures the price trend of the stock. If it’s above 1.00 the stock is in an uptrend, and below 1.00 it’s in a downtrend. As you can see from the chart below, the RT for Carvana is well below 1.00, indicating CVNA remains in a downtrend.

VectorVest’s Proprietary Relative Timing and Forecasted Earnings Per Share are headed lower. Note EPS is negative—the company is losing money. VectorVest favors companies that are making money, and lots of it.

Seeing is believing, so try VectorVest Risk-Free for 30 days, only $9.95!

Or call 1-888-658-7638

Large losses can be devastating…

With VectorVest, you can avoid losses like these. The Carvana Sell Rating and sell-off that followed was not a fluke… this happens over and over again.

VectorVest issued a sell rating before these stocks dropped. This type of guidance allows you to lock in profits and minimize losses, so you have more money to invest when the market turns back up.

| Stock | Date of Selling | Initial Price | Price on 2/23/2022 | % Gain/Loss |

|---|---|---|---|---|

| DoorDash (DASH) | 11/23/2021 | $184.31 | $90.55 | -50.87% |

| Block formerly Square (SQ) | 11/10/2021 | $227.21 | $88.72 | -60.95% |

| Palantir Tech (PLTR) | 11/10/2021 | $22.52 | $10.43 | -53.69% |

| Upstart Holdings (UPST) | 11/10/2021 | $256.59 | $112.43 | -56.18% |

| Draft Kings (DKNG) | 9/30/2021 | $48.16 | $19.63 | -59.24% |

| DocuSign (DOCU) | 9/27/2021 | $263.82 | $106.35 | -59.69% |

| Twilio (TWLO) | 9/23/2021 | $336.01 | $157.15 | -53.23% |

| Pinterest (PINS) | 7/30/2021 | $58.90 | $23.39 | -60.29% |

| Robinhood (HOOD) | 8/19/2021 | $44.69 | $10.86 | -75.70% |

| Roku (ROKU) | 8/18/2021 | $344.72 | $118.35 | -65.67% |

| Beyond Meat (BYND) | 3/8/2021 | $135.30 | $47.40 | -64.97% |

Taking the emotion out of investing.

With VectorVest, you’ll always know at a glance whether to buy, sell, or hold any investment. VectorVest takes the guesswork out of investing!

Seeing is believing, so try VectorVest Risk-Free for 30 days, only $9.95!

With this Special Trial Offer, you’ll get this Double Bonus:

- A FREE copy of the classic book – Strategies & Common Sense, 2022 edition— a $24.95 value

- Chapter 13 is all about stop-prices. It details how they help you control losses and protect profits.

- Successful Investor Quick Start Video Course – a $95 value

You will also receive:

- 30 days of full access to VectorVest 7

- The 4.6 star-rated VectorVest Mobile App — a $19.99 value

- Hot Stock Picks in our Daily Color Guard Video

- FREE, friendly support from our NC staff

- Convenient on-demand learning center — VectorVest University

- FREE Getting Started Coaching Session — a $95 value

- 100% Money-Back Guarantee

Or call 1-888-658-7638

Leave A Comment