Walmart (WMT) shared the results from its fourth quarter alongside the announcement that it would be purchasing TV manufacturer Vizio while simultaneously boosting the quarterly dividend. All this news sent shares 4% higher Tuesday morning, adding to what has been a strong trend over the past few weeks.

The worldwide retailer is benefiting from a tightening of the global economy, as consumers look to more affordable choices for household goods and groceries. Sales jumped 5.7% to $173.4 billion, outperforming the FactSet consensus of 4% growth and $170.9 billion in sales. Adjusted earnings of $1.80 also beat the expectation of $1.64.

Solid performance over the past few quarters has allowed the company to give back to shareholders in the form of a 9% increase to its dividend – the largest raise in company history. This will work out to $2.49 a share, or 83 cents a share post-split.

Walmart isn’t just returning profits to shareholders, though. It’s also reinvesting them, as the company announced it would be purchasing Vizio for $2.3 billion, which lends to a valuation of $11.50 a share.

The smart TV manufacturer will serve as an integral part of Walmart Connect – the retailer’s ad business. This segment grew 30% year over year to contribute $3.4 billion in revenue, which is a drop in the bucket for Walmart – but the potential is tremendous, and the Vizio deal is a strategic step in the right direction.

Looking at the road ahead, Walmart delivered a forecast for net sales growth of 3-4% – a modest bump YoY. Meanwhile, adjusted earnings will fall in the range of $6.70 to $7.12 prior to the pending stock split (scheduled for later this week). Post-split, this figure will be $2.23 to $2.37.

CFO David Rainey cautioned about economic uncertainty playing a role in where exactly the company falls on that spectrum of guidance but admitted it could be a help or a hindrance – only time will tell. Still, Rainy is optimistic about the year ahead – and so are analysts, with 85% of those polled maintaining a “buy” stance on WMT.

The stock has now climbed nearly 13% through 2024 thus far. So, is it still time for you to buy in WMT though? We’ve found 3 compelling reasons to consider it through the VectorVest stock analysis software – you’re not going to want to miss these insights…

WMT Has Good Upside Potential, Safety, and Timing

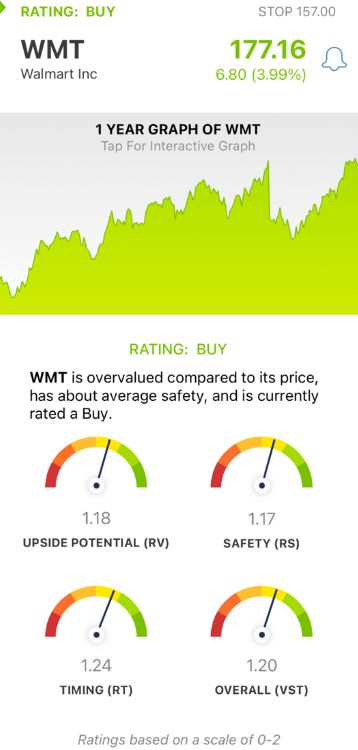

VectorVest simplifies your investment strategy, empowering you to win more trades with less work. It’s all based on a proprietary stock rating system comprised of 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy. It gets even easier, though, as you’re presented with a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we’ve uncovered for WMT:

- Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (projected three years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. The RV rating of 1.18 is good for WMT.

- Good Safety: The RS rating is a risk indicator that’s derived from a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. WMT has a good RS rating of 1.17.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.24 is good for WMT.

All of this contributed to a good overall VST rating of 1.20 - alongside a BUY recommendation in the VectorVest system. Learn more through a free stock analysis today and execute your next trade with confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WMT outperformed expectations in the fourth quarter, raised its dividend, and announced the acquisition of Vizio - leading to a 4% gain Tuesday morning. The stock has good upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment