Yesterday, Mark Zuckerberg and the Meta (META) team unveiled their latest product – Threads. While the release was slated for Thursday morning, the team started the party early. And as you can imagine, the app is already making waves.

If you haven’t gotten the chance to see it yourself, it’s essentially Twitter in a different package. Instagram users can create an account with their existing credentials. Zuckerberg says the goal is to take what Instagram does well and offer it in a text-based format rather than an image-based one. Users can post up to 500 characters with web links, photos, and videos – the exact posting format on Twitter.

As such, the app is already being referred to as a “Twitter killer”, as Elon Musk’s microblogging company is in turmoil and poised to lose market share. Some analysts believe Threads could add billions in revenue for Meta. Just yesterday alone, the app earned more than 30 million sign-ups. But, is all the hype substantiated?

Tigress Financial Partners analyst Ivan Feinseth certainly thinks so. He moved his 12-month price target from $285 to a whopping $380. Not only does Threads present yet another means of raising engagement, but it creates a potential growth catalyst as well.

While other analysts have raised their price targets as well, they point to Meta’s core advertising products – saying Threads won’t offer much upside for the near term. That being said, Meta stock is up on the news, bolstering what was already a positive price trend. The stock has gained more than 3% this week, 8% in the past month, and an astounding 40% in the past 3 months.

That being said, should you hop aboard the Threads hype train and ride this wave higher? Or, is this a temporary blip that will reverse once the noise around Zuck’s latest move fades? We’ve taken a look at META through the VectorVest stock analysis software to focus on what matters most to investors. That being said, you’ll want to see three things we discovered below…

While META Has Poor Upside Potential, the Stock’s Safety and Timing are Excellent

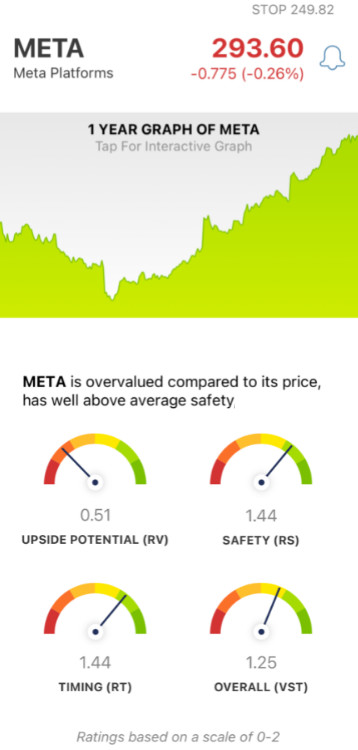

The VectorVest system helps you simplify your trading strategy by consolidating your analysts into just 3 ratings. You can gain all the insights you need at a glance, through the relative value (RV), relative safety (RS), and relative timing (RT) ratings.

Each of these sits on a scale of 0.00-2.00 for quick and easy interpretation. Pick undervalued stocks with ratings rising above the average to win more trades with less work! Or, better yet, just follow the clear buy, sell, or hold recommendation the system issues for any given stock, at any given time. As for META, here’s what we’re seeing right now:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. This offers far superior insights than a simple comparison of price to value alone. That being said, the stock has a poor RV rating of 0.55 right now. It’s also overvalued, with a current value of just $125.

- Excellent Safety: In terms of risk, though, META has excellent safety - with an RS rating of 1.44. This rating is calculated through a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: As you can see by looking at how the stock’s price has trended over the past few months, META has excellent timing - with an RT rating of 1.44 as well. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All of this contributes to an overall VST rating of 1.25. That being said, do the excellent safety and timing outweigh the poor upside potential to earn this stock a buy rating? Or, should you wait to see an increase in upside potential before making a move?

Don’t let emotion or guesswork interfere with your decision-making. Follow a tried-and-true system that has outperformed the S&P 500 by 10x over the last two decades. A free stock analysis is waiting for you at VectorVest, where you can gain a clear buy, sell, or hold recommendation on META!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. There’s no denying the hype around META right now after the Threads roll-out. While the stock still has poor upside potential, it does have excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment