This morning, Vince McMahon shocked the wrestling world and sent the stock market in a frenzy all at once. The company he founded – World Wrestling Entertainment, or WWE as it’s more commonly known – is going through an internal shakeup that has wrestling fans and investors alike excited.

As the controlling shareholder, McMahon removed 3 board members from their roles, and 2 others left on their own accord. He will be stepping back in, and he is bringing two more former executives with him – former co-presidents Michelle Wilson and George Barrios.

According to McMahon, this is the only way for WWE to fully capitalize on the growth in demand for live entertainment & content. After growing the company for 4 decades, he retired last July. But that hiatus was short-lived.

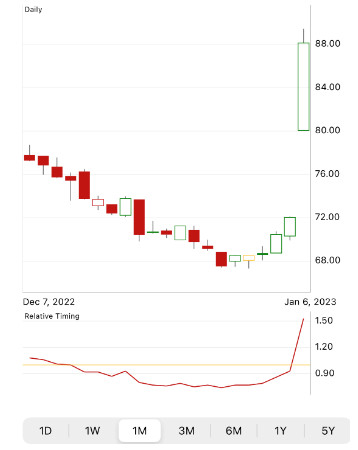

The goal of this is to maximize shareholder value in the short term. However, McMahon also said the company would be exploring strategic alternatives – seeking a sale. This news was initially reported yesterday but was made official today. While there’s no concrete evidence that a sale is on the horizon, the speculation alone has sent shares trading over 22% higher so far Friday morning.

This begs the question – is WWE a buy at this point in time? The company’s stock clearly has momentum behind it, but as the stock reaches its highest point since 2019, you may be wondering if there is any more room left for you.

We can help you make your next move based on tried-and-true investment principles that have outperformed the S&P 500 by 10x for two decades and counting. Keep reading to see what the VectorVest stock analysis system is showing for WWE right now.

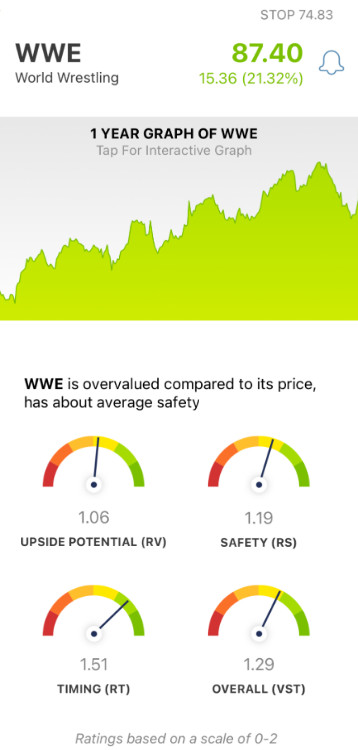

WWE Has Fair Upside Potential, Good Safety, and Excellent Timing

The VectorVest system simplifies trading for you by telling you what to buy, when to buy it, and when to sell it. No guesswork, no emotion – just follow the system and you’ll save time and win more trades. It’s all based on 3 easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00 – with 1.00 being the average. Ratings over the average indicate good performance and vice versa. And based on these three ratings, VectorVest is able to give you a clear buy, sell, or hold recommendation for any given stock, at any given time. As for WWE, here’s the current situation:

- Fair Upside Potential: In comparing the price appreciation potential for WWE 3 years out compared to AAA corporate bond rates and risk, VectorVest deems the upside potential to be fair with an RV rating of 1.06. With that said, the stock is overvalued at its current price today. The current value is just $49.80.

- Good Safety: In terms of risk, WWE is a safe stock – and the good RS rating of 1.19 reflects that. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: As you can see by watching how the stock price has moved this morning, WWE has excellent timing. This is confirmed by the excellent RT rating of 1.51 – which is calculated based on the direction, dynamics, and magnitude of a stock’s price movement.

These three ratings work out to an overall VST rating of 1.29 – which is very good. But is it enough to earn WWE a buy? Or, should you wait for the next dip to get better value? A clear answer on your next move is waiting for you – just get a free stock analysis to discover what you should do with WWE!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for WWE, it is overvalued but has fair upside potential, good safety, and excellent timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment