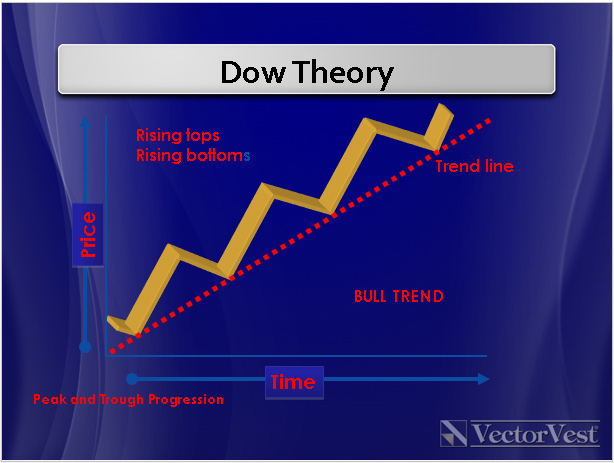

Stocks rarely proceed upwards in price linearly but rather in a series of steps. Old hands refer to these steps as “Peak and trough” progression. The swing trader wishes to benefit from the fast move upwards and be well out of the market while the stock falls back to long-term support. This ebb and flow of shares and financial instruments was first noted by Charles Dow around 1880.

The chart above shows diagrammatically the rise and fall of the stock price. In theory, the swing trader should have taken three trades during this period. They should have been accumulating positions at the support offered by the trendline and then exiting those positions prior to the next retracement to the same trendline.

Swing trading is my preferred method of trading using an end of day chart only. Below is an actual chart of the US listed stock Square, Inc. (SQ), where the swings have been marked with a blue line study.

For a successful campaign of swing trades, the following should be in place.

- Swing trade only in the very best stocks. These stocks are undervalued by the market and growing earnings strongly and reasonably safely. On the chart above, the green line above the price shows that Square is undervalued. Also, the blue study in the window below the price shows earnings per share (EPS) rising strongly. VectorVest finds these stocks in seconds using the UNISEARCH tool in the program.

- The stock should be trending upwards strongly. On the VectorVest program, we have a metric known as the Comfort Index (CI) which finds these stocks effortlessly. The Comfort Index is totally unique, and, in my essays, I refer to the CI as the VectorVest secret weapon. Adding CI to the UNISEARCH mentioned in 1 automatically finds those stocks with outstanding fundamentals that are trending strongly. That adds enormously to the chances of success in our swing trading operations.

- The overall market should be positive and trending upwards. At VectorVest, we have five totally objective Market Timing methods that tell us that it’s safe to be in the stock market. On the front page of VectorVest, there is a feature known as the Color Guard which visually informs the trader that it’s OK to buy stocks. This short-term Market Timing system is referred to as a “Green Light” buy.

- Money Management and position sizing are critical to success. How to manage the trade in the event of a successful or poor outcome needs to be decided upon well before the trade is placed.

Swing trading expertise can be used in three main ways within your individual trading plan.

- Classic swing trading is buying in at support or shortly after the stock starts to move upwards and then exit the position at a profit target or as the stock turns downward. This is probably the option to be used if the leverage of a cfd or spread bet is contemplated. Leverage is cool when the stock is going your way but not so cool when the position is going against you.

- Some traders use swing trading knowledge to quantify and pinpoint an elegant entry into a share at a very good level. This feels good as the position should move into the black quickly. They then manage the trade as a position trade and ignore the pullbacks and subsequent swings. This is a solid plan for an unleveraged position.

- Some traders use their swing trading expertise to add to winning positions at elegant levels. That’s what I have done in Griffin Mining above. In this stock I have used my swing trading knowledge to add to the share on three occasions after the initial entry. The last entry was a few days ago as I write on the 7th April 2018. Again, this is best with unleveraged positions as handling the retracements with leverage most (including myself) find very difficult.

Swing trading can be easily managed in a few minutes a day without causing any work or family issues. No long periods of chart watching as is the case for day trading are required. If you wish to build wealth relatively quickly and are prepared to roll up your sleeves for a few weeks to master the techniques, then swing trading could be for you.

David Paul

Interested, presently using Direxion ETFs &Contras to do this.

Thanks for sharing.

Regards,

https://FinancialStockPrice.com