A while back we discussed what Disney surpassing Netflix in subscribers meant for both streaming services. At the time, analysts and investors alike were down on Netflix. And it wasn’t just because their content was lacking. It was because of their ad department business model – or lack thereof.

But, it appears that things could be changing in the streaming industry as Netflix prepares to roll out its new ad-supported tier. In a week where the stock market as a whole was down 5%, Netflix stock saw a bit of a hike – a welcome site among investors who have patiently waited for some good news.

Netflix’s subscription plans have already increased in cost, and this has users ready to cancel their subscriptions – especially considering the lack of quality content being added to the platform. But, the rollout of the ad-supported tier could keep users around longer – and could bring new users into the ecosystem. While the current plans will remain ad-free, you can subscribe to a cheaper plan with ads to save some money.

This news alone sent positive ripples through Netflix’s stock price. But, this was exacerbated by one noteworthy analyst (Oppenheimer) changing the stock’s rating from “perform” to “outperform”. While the ad tier won’t release until early next year according to many analysts and Netflix executives, there have been rumblings that it could come sooner than anticipated.

There’s no question that a cheaper streaming plan will increase subscriber retention while simultaneously increasing new subscriber growth. But, does this mean now is the time to buy Netflix stock? Or, if you’re currently invested in the company, could this temporary price hike be a good time to sell? Let’s take a look at the stock based purely on tried-and-true analysis in the VectorVest stock analysis tool.

Good Upside Potential, Safety, and Timing for Netflix – But Does it Earn the Stock a “Buy” Recommendation?

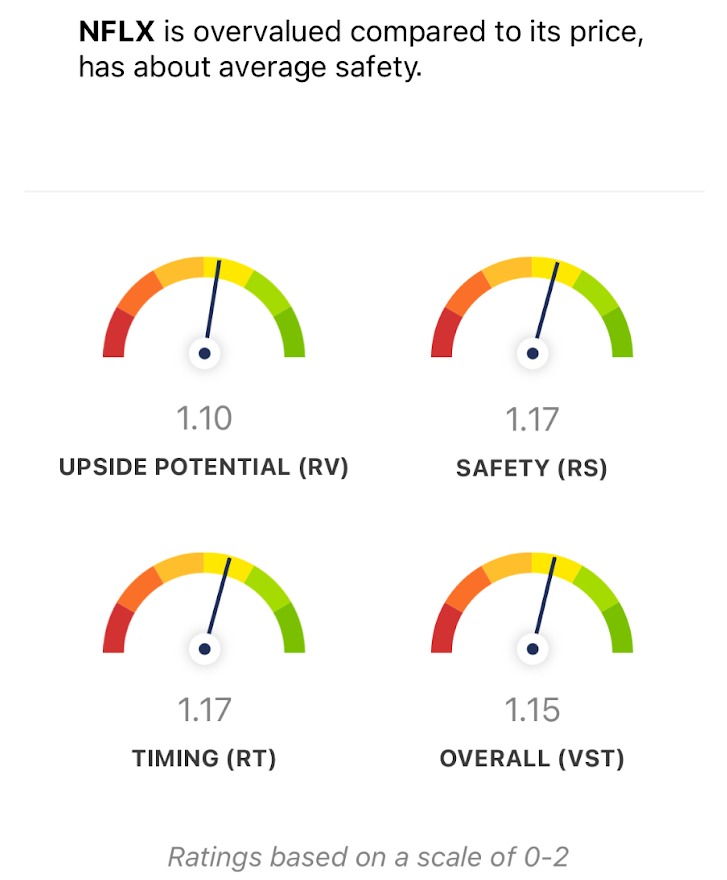

The Vectorvest system compiles all analyses into three simple ratings: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). These are put on a scale of 0.00-2.00, and tell investors everything they need to know about a stock to make accurate, emotionless decisions with their investments. Based on the overall VST rating of a stock, you’re given a clear buy, sell, or hold rating. Here’s the current situation with Netflix:

- Good Upside Potential: the RV rating of 1.10 is good – and indicates positive long-term price appreciation potential for Netflix. The stock also has a forecasted earnings growth rate of 15%, which VectorVest considers to be very good.

- Good Safety: an indicator of risk, the RS rating for Netflix sits at 1.17 right now – which is good on a scale of 0.00-2.00. This is calculated based on an in-depth analysis of the consistency and predictability of a stock’s financial performance, debt-to-equity ratio, business longevity, and more.

- Good Timing: when it comes to swing trading – or any other investment strategy – timing is everything. And right now, the timing is good for Netflix with an RT rating of 1.18. This reflects a positive price trend that has pushed the stock up 40% in the last 3 months.

Altogether Netflix has a current VST rating of 1.15 – which is good. But does it make the stock a buy? Get a free stock analysis here to determine your next move – with no emotion, no guesswork.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NFLX, it has good upside potential, safety, and timing. But to determine whether or not it’s actually rated as a buy, you’ll have to analyze the stock through VectorVest’s system yourself.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Updated: 9/19/2022

Leave A Comment